[ad_1]

Purpose to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business specialists and meticulously reviewed

The very best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Ethereum (ETH) is buying and selling at its lowest ranges since late 2023, struggling to regain momentum after an prolonged interval of promoting strain. Since December 2024, ETH has misplaced over 57% of its worth, failing to reclaim key resistance ranges. With the broader crypto market going through macroeconomic uncertainty and protracted volatility, Ethereum’s downtrend seems removed from over.

Associated Studying

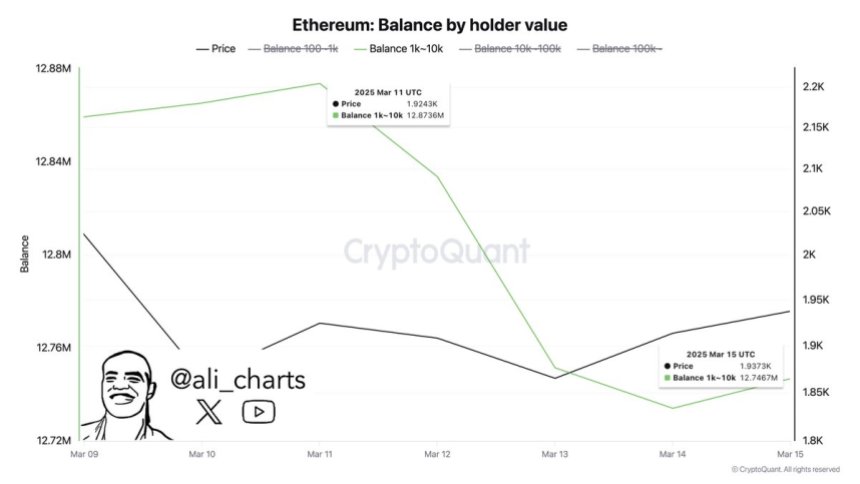

Regardless of the continued decline, on-chain information suggests that enormous traders could also be positioning for a restoration. In response to CryptoQuant, whales have moved over 130,000 ETH off exchanges previously week, signaling a rising accumulation development. This sample has been growing since Ethereum began trending downward, suggesting that institutional gamers and long-term holders are shopping for the dip in anticipation of future value appreciation.

Whereas short-term sentiment remains bearish, historic information reveals that enormous whale accumulations typically precede robust rebounds as soon as promoting strain fades. Nonetheless, ETH nonetheless faces vital resistance, and bulls should reclaim key ranges to substantiate a possible development reversal. With market uncertainty nonetheless looming, the following few weeks can be vital in figuring out Ethereum’s subsequent main transfer.

Ethereum Whale Exercise Hints At Optimism

Ethereum has been below huge promoting strain, struggling amid macroeconomic uncertainty and commerce struggle fears which have shaken each the crypto market and the U.S. inventory market. ETH is now buying and selling beneath a multi-year help stage, which may act as a robust resistance within the coming weeks. If bulls fail to reclaim key value ranges, the stage could possibly be set for a deeper correction.

Nonetheless, not all indicators are bearish. Regardless of the continued downtrend, some analysts stay optimistic about Ethereum’s long-term prospects. High analyst Ali Martinez shared insights on X, revealing that whales have moved over 130,000 ETH off exchanges previously week.

That is vital as a result of giant traders sometimes transfer their holdings off exchanges after they plan to carry for the long run reasonably than promoting. When whales switch ETH into non-public wallets, it typically alerts accumulation reasonably than rapid promoting strain. Traditionally, such developments have preceded market rebounds, as diminished alternate provide can contribute to cost stability and future upside potential.

Associated Studying

Whereas Ethereum nonetheless faces main hurdles, whale exercise means that good cash is positioning itself for the following transfer. The subsequent few weeks can be essential in figuring out whether or not ETH can reverse its downward development or if additional declines are forward.

[ad_2]

Source link