[ad_1]

Coinspeaker

Ethereum Eyes Bullish Breakout amid Record ETH ETF Inflows

With the crypto whole market cap, excluding Bitcoin

BTC

$97 739

24h volatility:

1.0%

Market cap:

$1.94 T

Vol. 24h:

$38.65 B

, recovering to $1.23 trillion, Ethereum

ETH

$2 649

24h volatility:

0.5%

Market cap:

$319.32 B

Vol. 24h:

$20.85 B

is on the verge of beginning a restoration rally. At present, Ethereum trades at a market worth of $2,764, marking a restoration of 0.99% over the previous 24 hours.

Regardless of the short-term worth pattern highlighting the next worth rejection, the gradual shift in market sentiment hints at an prolonged rally. Will this restoration run in Ethereum drive a profitable bull run in Ethereum? Let’s discover out.

Is Ethereum Prepared for a V-shaped Reversal?

Within the each day chart, the Ethereum worth pattern data an intraday achieve of 1.15% after a 5% drop final night time. This marks a V-shaped reversal to retest the damaged resistance trendline of the falling wedge sample.

With the intraday restoration, the stochastic RSI indicator alerts a optimistic crossover within the oversold territory. This will increase the opportunity of a bullish restoration in ETH costs.

Moreover, the intraday achieve close to the decrease Bollinger band alerts a slim likelihood of a restoration run, because the bulls maintain dominance close to the $2,750 assist stage.

Ethereum ETF Inflows Hit File Excessive in 2025

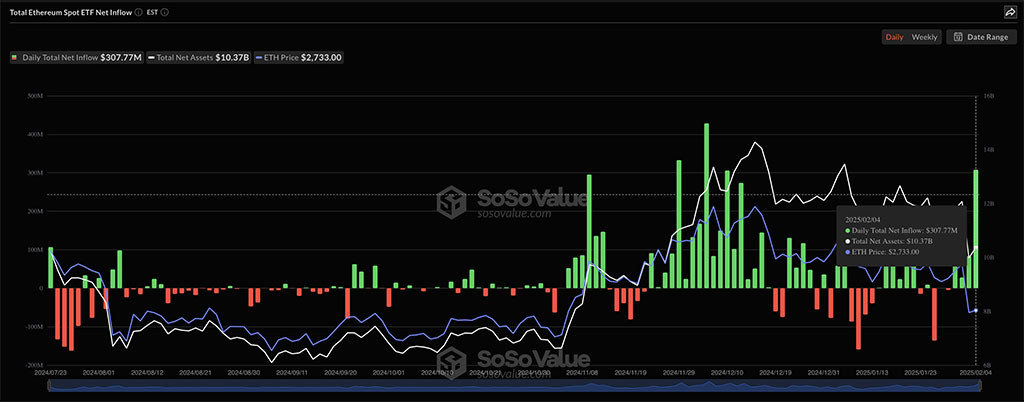

Amid the rising risk of a bullish restoration, the institutional assist from Ethereum’s spot ETFs continues to surge. On February 4, the each day whole internet influx stood at $307.77 million.

Out of the overall, BlackRock acquired probably the most ETH, with an influx of $276.16 million, adopted by Constancy, buying $27.47 million. The one different purchaser, Bitwise, acquired $4.14 million value of Ethereum, whereas the remainder of the ETFs maintained a internet zero move.

This marks the best influx of 2025 for Ethereum ETFs and rising assist for the largest altcoin available in the market.

Hypothesis Fuels Ethereum’s Bullish Momentum

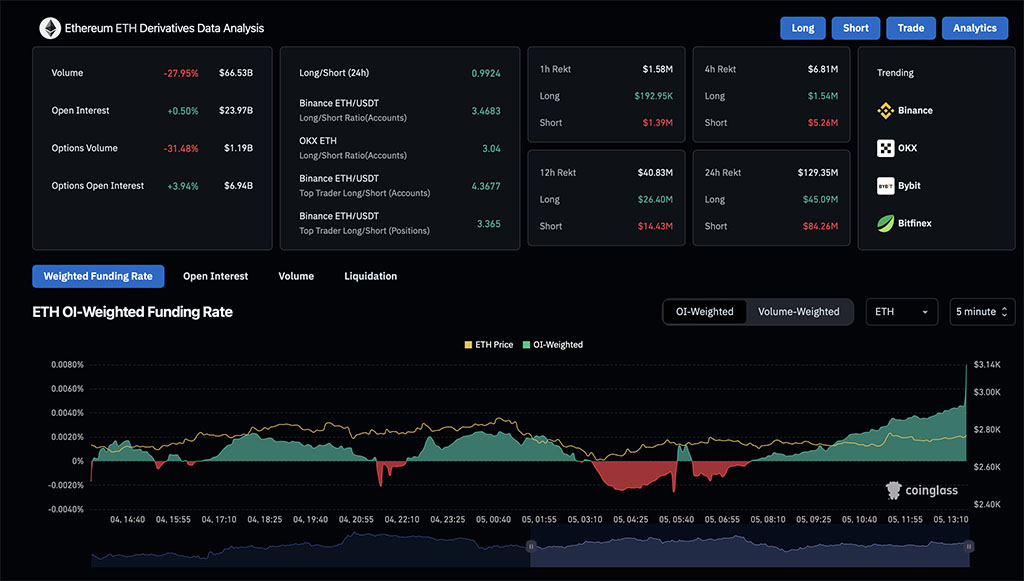

With the rising influx, the speculations within the derivatives marketplace for Ethereum have considerably elevated. With a 0.5% surge in open curiosity to hit $23.97 billion, the long-to-short ratio is lastly equalizing. This displays a surge within the resurgence of bullish gamers.

Moreover, the funding charge has seen a big restoration after the market crash. With a surge from adverse 0.0013% to peaking at 0.0080%, the bulls are extraordinarily keen to carry on to their lengthy positions by paying the additional premiums.

Therefore, the speculations of Ethereum restarting a bullish rally have considerably elevated.

ETH Worth Targets

Based mostly on the ETH worth motion evaluation, a reversal rally will possible problem the $3,000 psychological mark. This important zone is now a support-turned-resistance stage, changing into a important impediment for Ethereum.

A breakout above this can possible sign a profitable bullish restoration in Ethereum, crossing above the $4,000 psychological stage. On the flip aspect, the essential assist stays at $2,500 and $2,400.

Ethereum Eyes Bullish Breakout amid Record ETH ETF Inflows

[ad_2]

Source link