[ad_1]

- Ethereum’s long-term holder NUPL confirmed anxiousness amongst buyers however breaking above $3K might restore confidence.

- The approval of a submitting on the CBOE to permit 21Shares to stake the ETH might be the brand new catalyst for an uptrend.

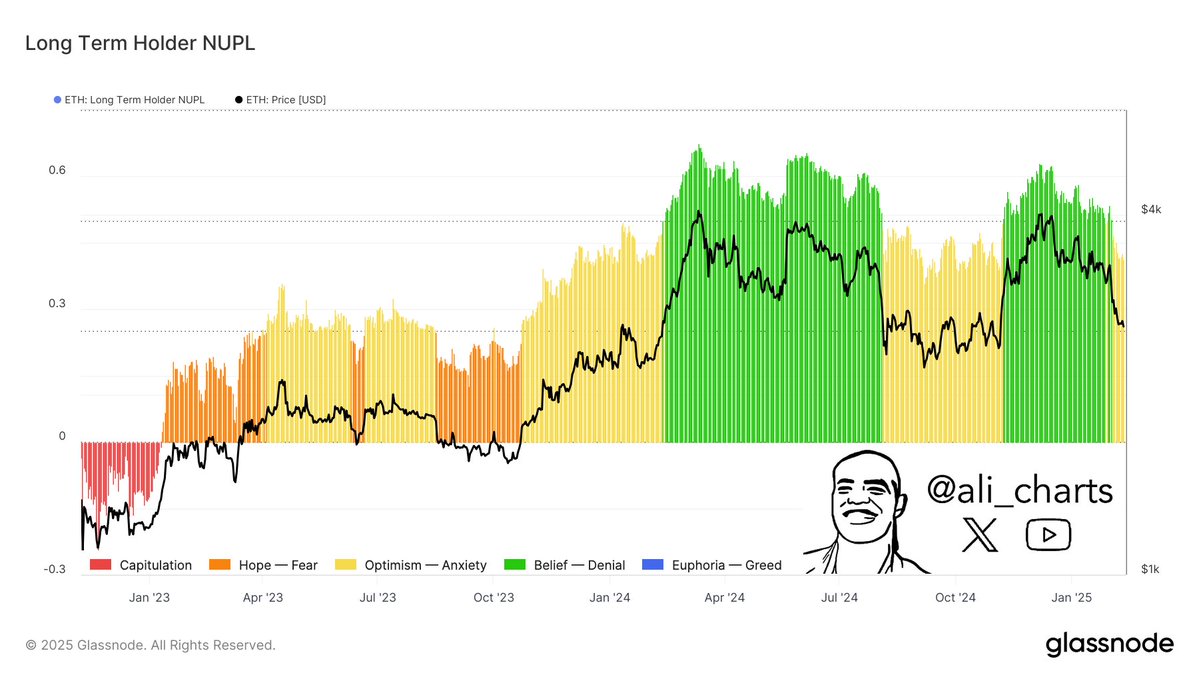

Investor sentiment as per Ethereum’s [ETH] Lengthy-Time period Holder Web Unrealized Revenue/Loss (NUPL) revealed rising anxiousness as the value hovers under the $3,000 mark.

On the time of writing, the NUPL confirmed a pattern in the direction of anxiousness. This means many long-term buyers are seeing their unrealized positive aspects diminish, pressuring their confidence.

A decisive push above $3,000 might shift sentiment from anxiousness to perception or optimism. This sample was seen in mid-2023 when Ethereum approached these ranges and noticed substantial rallies.

A possible transfer might set off renewed investor confidence, encouraging holding and attracting new patrons, driving ETH up. If ETH fails to surpass the $3K threshold, long-term holders may proceed or enhance sell-offs, fearing additional losses.

This might drive the value down additional, deepening market anxiousness and pushing the NUPL into decrease zones, much like capitulation in early 2023.

This situation would probably exacerbate the downward stress on Ethereum’s market worth.

Cboe recordsdata for Ethereum ETF to allow staking

Regardless of the anxiousness, ETH buyers might be hopeful because the CBOE filed a proposal to permit 21Shares to introduce staking inside its Ethereum Spot ETF

This resolution, authorised by the Trade’s President on the twelfth of February 2025, is a pivotal second for ETH. It might function a brand new catalyst for the cryptocurrency’s development.

Staking ETH entails holding the cryptocurrency to assist blockchain operations, in return for rewards.

This approval allows the ETF to have interaction in staking, doubtlessly growing the worth of holding ETH by means of the ETF by providing further yield from staking rewards.

This growth is anticipated to rejuvenate investor confidence in Ethereum, particularly after a interval of market volatility.

By integrating staking, the ETF supplies a twin good thing about publicity to ETH’s value actions and the extra revenue from staking.

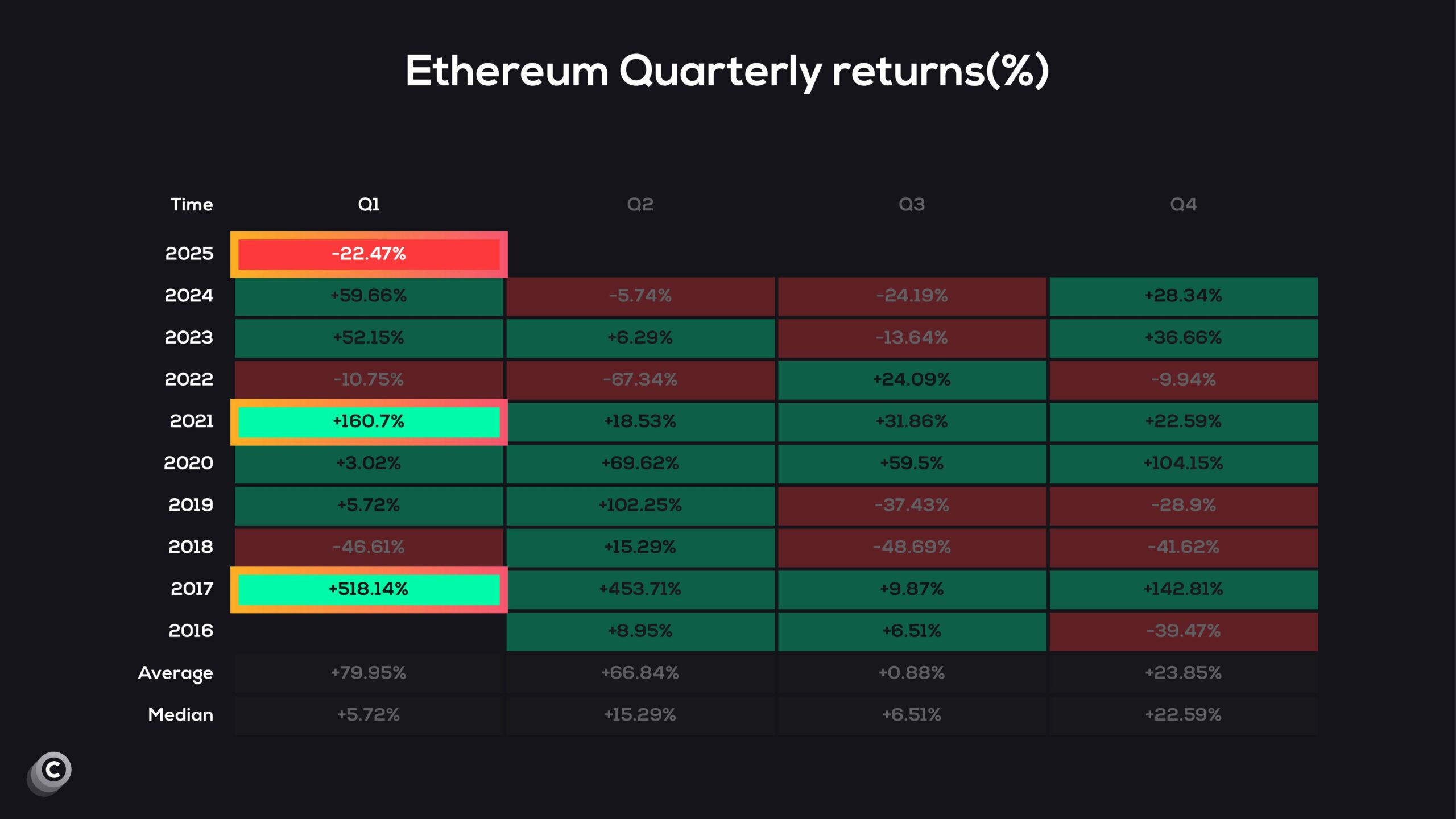

Historic share quarterly returns

Winding up, it’s key to notice that Ethereum has carried out nicely in Q1 traditionally, but it surely’s at present dealing with a downturn, buying and selling at a 22% low cost.

This drop might replicate typical early-year volatility or broader market traits impacting crypto belongings.

Traditionally, Q1 has seen common positive aspects of about 80% for Ethereum, aside from 2018 and 2022. This means a attainable rebound or upward correction because the quarter progresses.

If market sentiment improves or influential crypto occasions happen, ETH might get better from its present lows. It’d intention for positive aspects much like previous first quarters.

Conversely, if the market stays bearish or exterior financial components crush, the low cost might persist or deepen. This is able to result in a subdued Q1 efficiency for Ethereum.

[ad_2]

Source link