[ad_1]

- Bitcoin’s 90-Day energetic provide is falling, signaling decrease short-term buying and selling exercise and demand.

- The decline in energetic provide could point out a possible worth consolidation or additional dip.

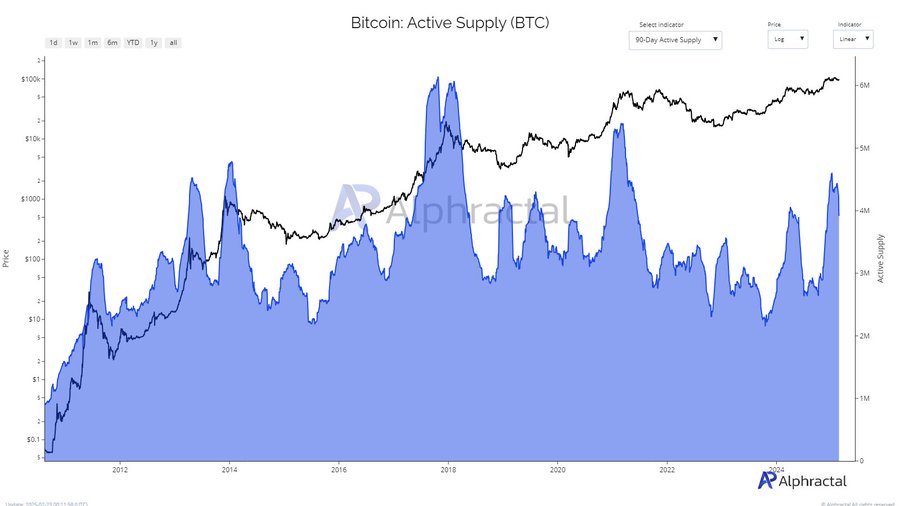

In latest weeks, Bitcoin’s [BTC] 90-Day energetic provide has been on a noticeable decline, elevating questions concerning the present state of market demand and investor sentiment.

This has lengthy been used to evaluate each the extent of recent market curiosity and the general temper of merchants.

Because the metric continues to fall, it’s essential to grasp what this shift may imply for Bitcoin’s worth motion and what tendencies traders ought to look ahead to within the coming months.

Lively provide, market demand, and sentiment

The 90-Day Lively Provide helps to learn into each market demand and sentiment by monitoring the Bitcoin that has been transacted not less than as soon as inside a 90-day interval.

A excessive energetic provide usually indicators elevated market participation, typically reflecting rising demand from new or short-term merchants.

Conversely, a decline in energetic provide could point out lowered curiosity or a shift in sentiment, as long-term holders are much less more likely to promote during times of decrease market exercise.

Traditionally, important shifts in energetic provide have correlated with adjustments in market temper, typically signaling potential worth fluctuations and tendencies.

Components behind the shift in market habits

The recent decline in Bitcoin’s 90-Day Lively Provide pointed to a reduction in short-term trading activity, signaling much less curiosity from new market individuals.

If this development continues, it means that Bitcoin’s worth could both consolidate sideways for an prolonged interval or expertise a slight dip.

A number of elements contribute to this shift.

After Bitcoin’s surge previous the $100,000 mark following President Donald Trump’s election, the market has confronted heightened volatility, pushed by coverage uncertainties and inflation considerations.

This has led to extra cautious buying and selling habits.

Moreover, the SEC’s choice to drop its case towards Coinbase has created a extra favorable regulatory atmosphere, encouraging long-term holding over energetic buying and selling.

As institutional curiosity grows, market individuals appear to be adopting a wait-and-see method, which may additional impression the energetic provide metric transferring ahead.

Historic tendencies and patterns in Bitcoin’s energetic provide

A evaluate of historic Bitcoin cycles reveals that the energetic provide tends to rise throughout bull market peaks and contract in early-stage rallies or post-halving consolidation durations.

The chart signifies earlier spikes in energetic provide throughout Bitcoin’s main worth surges in 2013, 2017, and 2021, adopted by steep declines throughout corrective phases.

Notably, the latest downturn in energetic provide mirrors tendencies noticed earlier than main breakouts, suggesting that present market individuals are holding onto their property in anticipation of a better worth leg.

If this sample holds, Bitcoin could possibly be in a consolidation part earlier than one other upward transfer.

Has this impacted BTC’s worth?

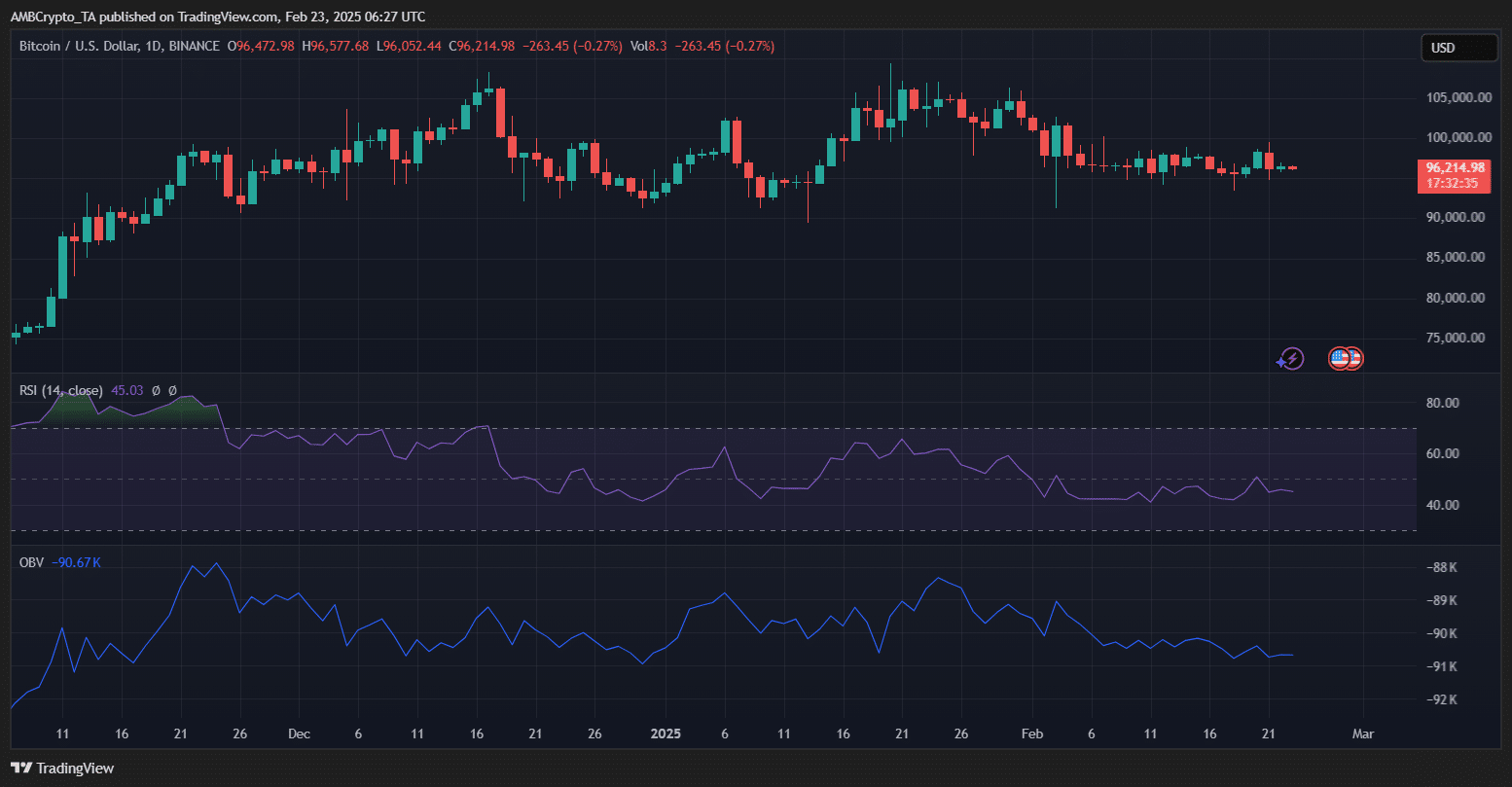

Bitcoin was buying and selling at $96,214 at press time, displaying a 0.27% decline within the final 24 hours. The RSI at 45.03 indicated that BTC is in impartial territory, neither oversold nor overbought.

The OBV was trending downward, indicating weakening shopping for strain, which aligned with the decline in 90-Day energetic provide.

BTC has been consolidating beneath the $100,000 mark after failing to determine a transparent breakout.

The diminishing short-term buying and selling exercise signifies that traders are cautious, doubtless ready for stronger catalysts. If BTC fails to reclaim momentum, a pullback towards $90,000 stays doable.

Nonetheless, if demand picks up, BTC may try one other push towards psychological resistance at $100,000.

[ad_2]

Source link