[ad_1]

- SEC’s stance on PoW mining removes regulatory uncertainty, benefiting miners and fostering trade development.

- Altcoins outperformed main PoW property, signaling a shift in funding traits post-SEC clarification.

The U.S. Securities and Change Fee (SEC) not too long ago confirmed that Proof-of-Work (PoW) mining actions don’t fall underneath securities rules.

This clarification, particularly for cryptocurrencies like Bitcoin [BTC], Litecoin [LTC], and Bitcoin Cash [BCH], gives miners with much-needed authorized certainty. Consequently, miners can now function with out the concern of being regulated as securities, which has lengthy been a priority within the trade.

This determination is important for miners, because it eliminates uncertainty in regards to the authorized standing of PoW mining. It establishes a clearer regulatory framework, permitting miners to develop operations with out concern of authorized challenges underneath securities legal guidelines.

Moreover, it reassures traders, boosting their confidence in PoW mining initiatives and fostering better belief within the sector.

How are market individuals reacting to those developments?

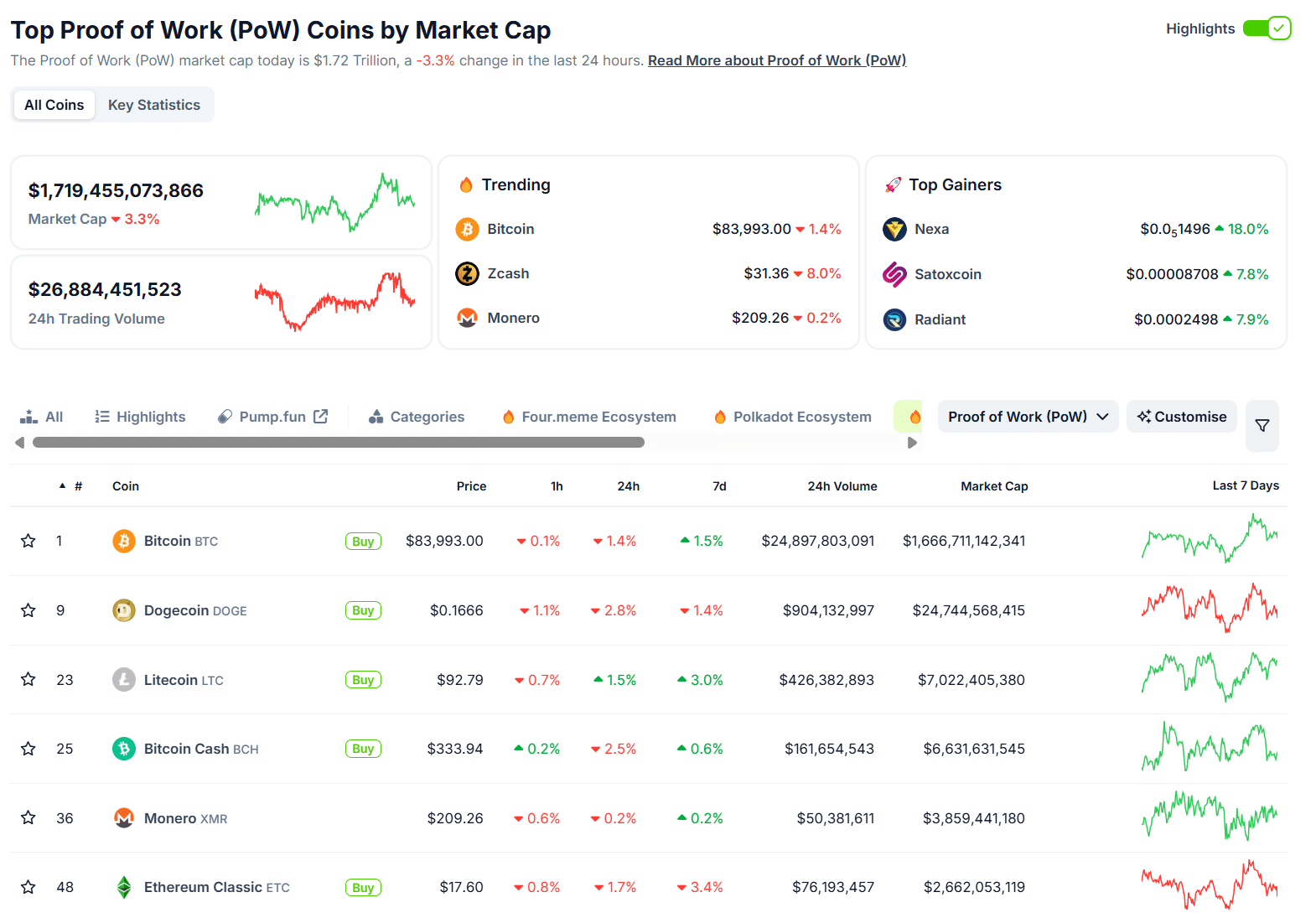

The market confirmed noticeable shifts in response to the SEC’s determination. Main PoW property like Bitcoin and Dogecoin recorded losses, with Bitcoin declining 1.4% to $83,993 and Dogecoin dropping 2.8% to $0.1666. Bitcoin Money additionally fell by 2.5%, reaching $333.94.

In distinction, smaller PoW altcoins outperformed, with Nexa surging 18% to $0.0051496, whereas SatoXcoin and Radiant gained 7.8% and seven.9%, respectively.

This development signifies traders are shifting funds from bigger property to smaller PoW altcoins. The SEC’s clarification strengthened Bitcoin’s standing as a commodity.

Whereas sentiment for bigger property remained regular, curiosity in rising PoW cash elevated considerably.

What does this imply for the way forward for cryptocurrency rules?

This SEC clarification ties into the broader development of extra outlined, clear cryptocurrency rules. The SEC has additionally clarified its stance on meme cash, confirming they don’t represent securities.

Moreover, the top of the authorized battle with Ripple gives further certainty. These developments level to a future the place the regulatory panorama for cryptocurrencies is extra structured, with much less reliance on enforcement actions.

Is the SEC’s determination a bullish sign for crypto?

The latest SEC clarification on PoW mining presents a constructive outlook for the crypto trade. Miners can now function with confidence, whereas traders can discover rising PoW cash with clearer tips.

Whereas Bitcoin and different large-cap PoW property noticed losses, the expansion in altcoins indicators that traders are positioning for long-term positive aspects.

[ad_2]

Source link