[ad_1]

- Bitcoin’s bull rating index dropped to its 2023 ranges as momentum weakened

- In keeping with Coinbase, April’s U.S tariffs and earnings studies could possibly be components to be careful for

In Q1 of 2025, Bitcoin [BTC] misplaced momentum and dropped by 23% to $84k from $109k. In keeping with CryptoQuant analysts’ projections, this might imply a probable longer bearish development.

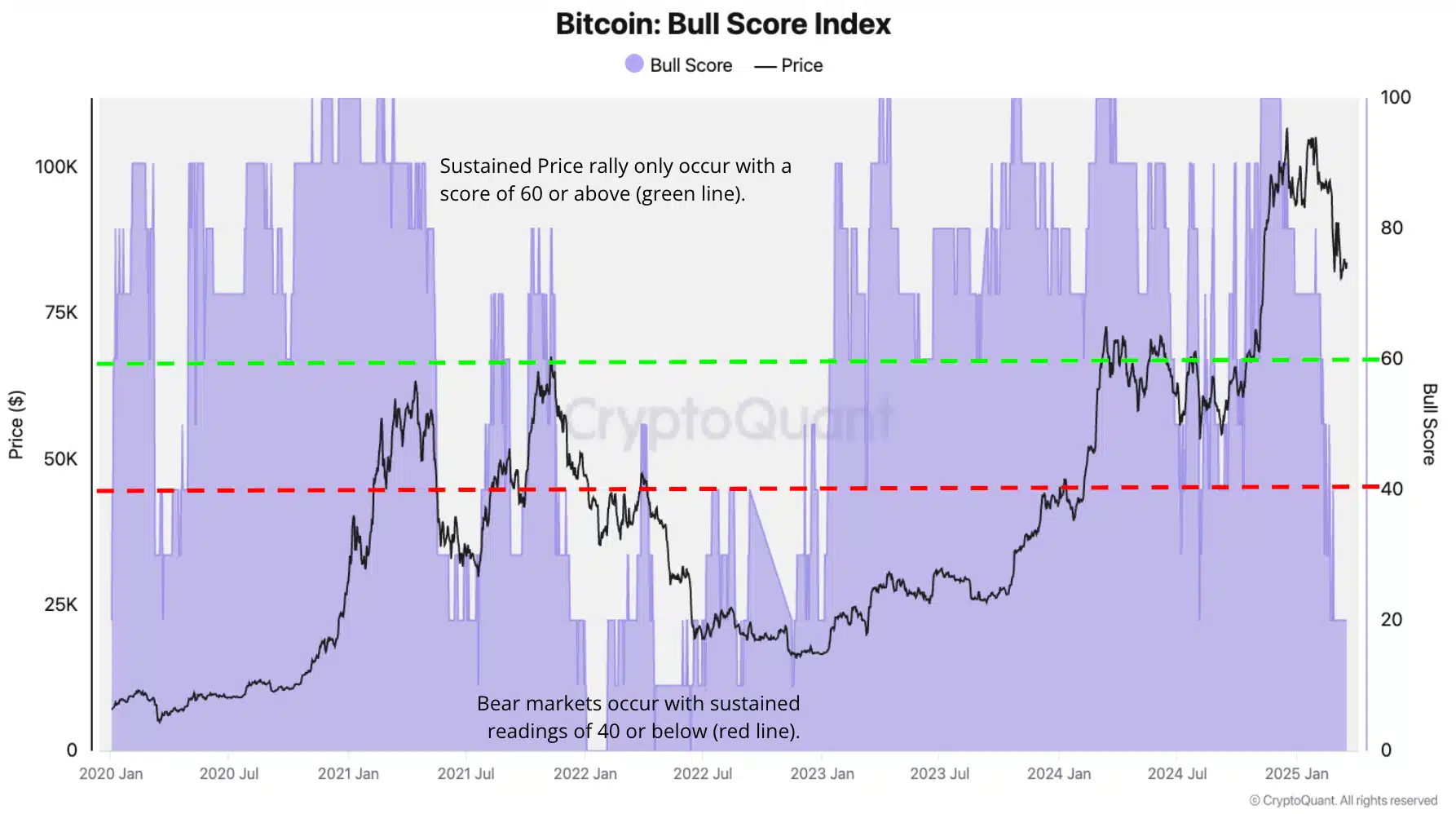

In its weekly report, the analysts famous that the Bitcoin bull rating index (BBSI) fell to a 2-year low. This highlighted weak market momentum throughout the board.

“At the moment, the index stands at 20—the bottom since January 2023—market circumstances are weak, elevating considerations that the current worth drop could possibly be a part of a broader bearish development fairly than a short-term correction.”

The index ranges from 0 to 100. It tracks bullish indicators like community exercise, demand, and liquidity.

Larger values can be deemed bullish, whereas decrease readings would present bearish circumstances. The BBSI studying of 20 mirrored the weak circumstances seen in 2022 and early 2023.

What’s subsequent for Bitcoin?

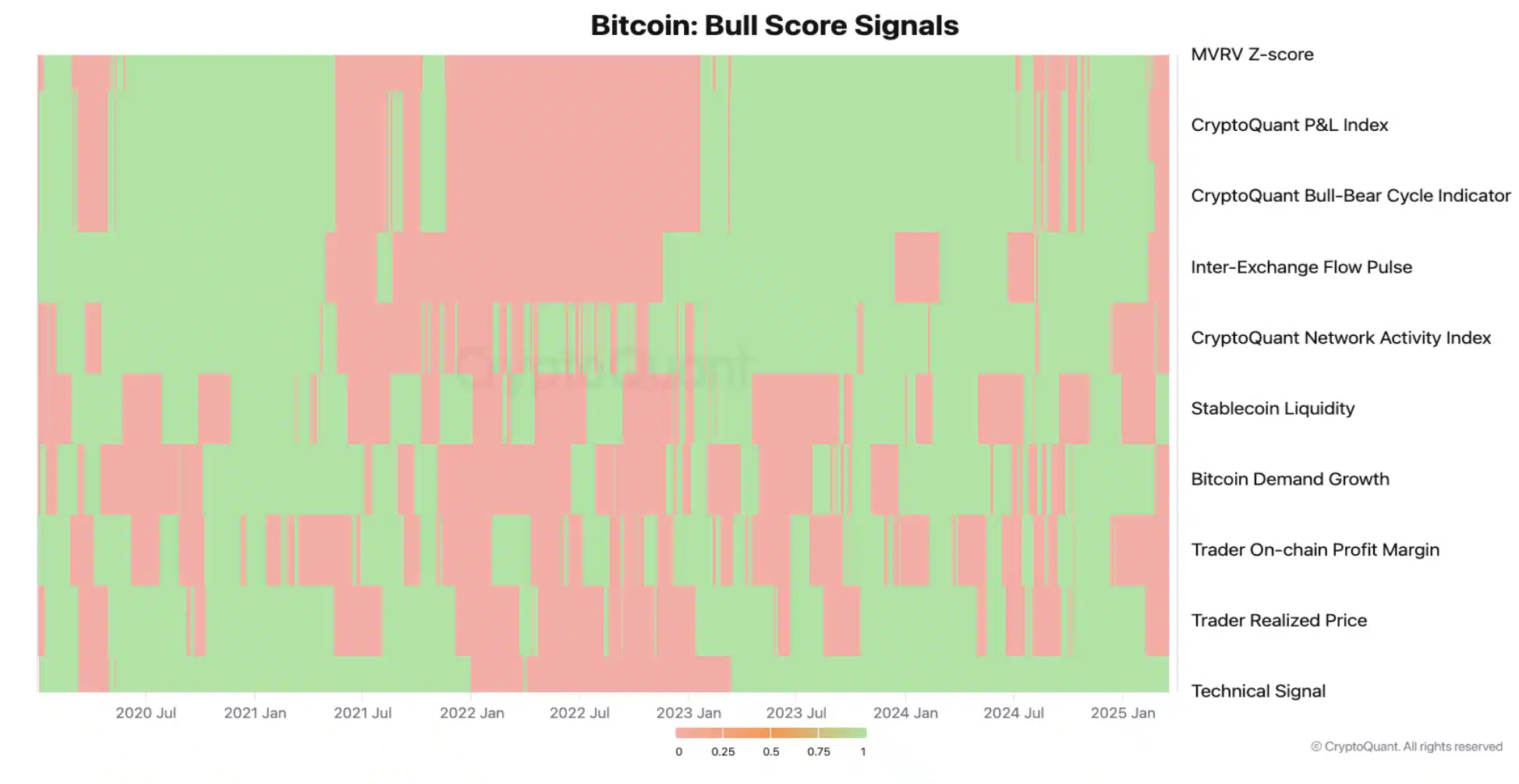

Moreover, the analysts added that different key on-chain indicators, other than stablecoin liquidity, have been bearish since mid-February.

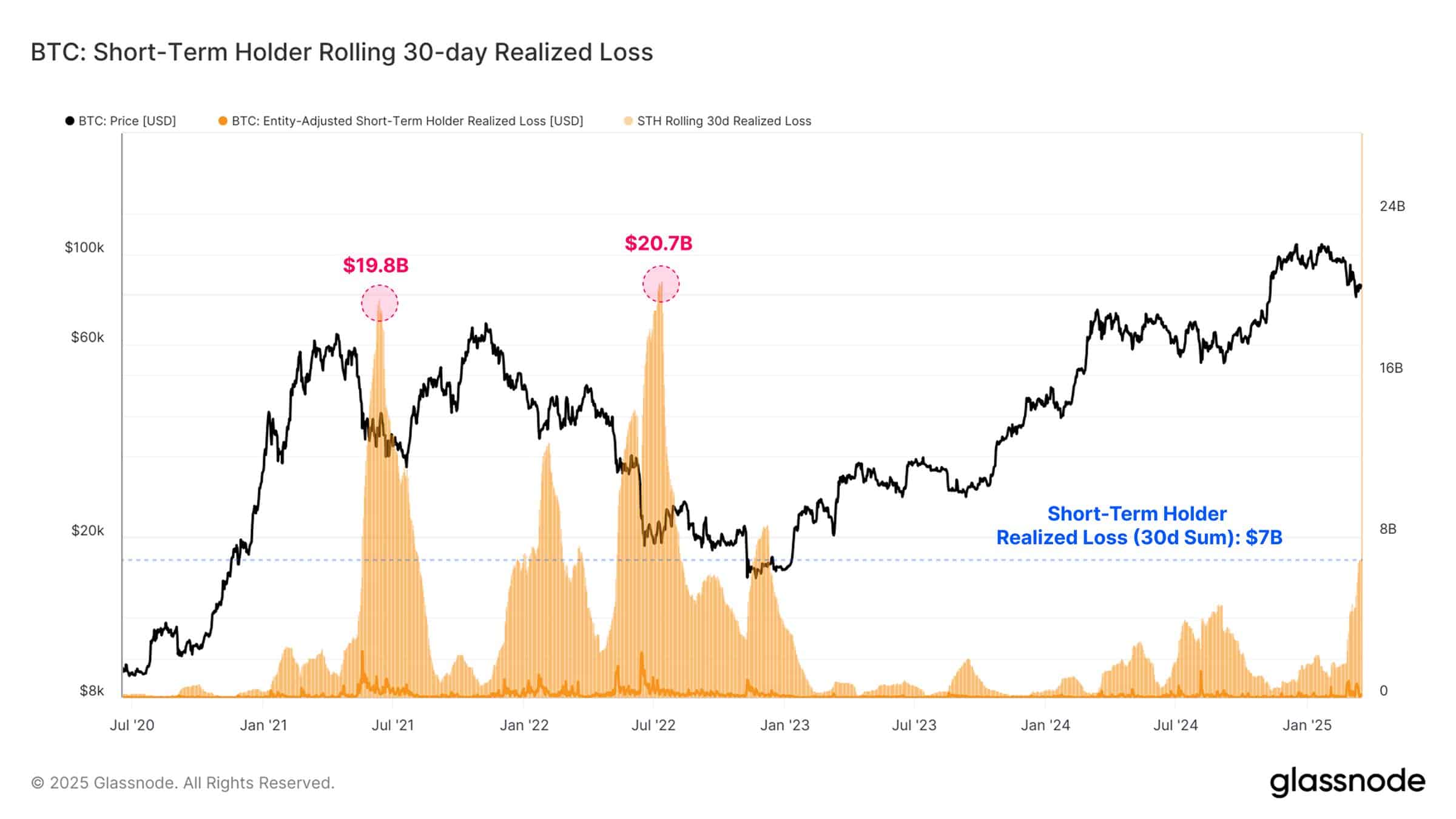

Probably the most distressed group of buyers embrace STH (short-term holders), who’ve held BTC for six months or much less. The group noticed a document lack of $7 billion within the final 30 days, in accordance with Glassnode. Nevertheless, the analytics agency noted that losses remained inside the historic ranges seen throughout earlier BTC bull runs.

“The rolling 30-day realized loss for #Bitcoin’s STHs has reached $7B, marking the most important sustained loss occasion of this cycle. Nevertheless, this stays nicely under prior capitulation occasions, such because the $19.8B and $20.7B losses in 2021-22.”

Nevertheless, Coinbase analysts didn’t share this optimistic outlook. Macro uncertainty and Trump tariffs worsened the risk-off sentiment for BTC in Q1. In truth, Coinbase analysts warned that new tariff wars in early April could possibly be a key issue to observe.

“We imagine tariffs and 1Q25 incomes studies (ahead steerage) symbolize an important components for market gamers to observe within the weeks forward.”

[ad_2]

Source link