[ad_1]

- Ethereum is mirroring its 2023-style breakout cycle, with sensible cash additional supporting this risk.

- Main headwinds stay to be confronted.

Ethereum [ETH] is exhibiting aggressive dip-buying from deep-pocket traders.

On-chain data confirmed that top-tier ETH wallets amassed 130,000+ ETH as worth depraved to $1,781, indicating sensible cash absorption at a important demand zone.

Nonetheless, with extreme provide nonetheless current out there, uncertainty stays. Is the present worth motion a real breakout, or is ETH merely establishing a backside at a key assist degree earlier than its subsequent transfer?

Good cash circulation — Signal of a possible dip

A month in the past, Ethereum opened at $2,147. At press time, it was down 15%, breaching the important $2k assist for the primary time in two years.

In 2023, ETH underwent a six-month consolidation section earlier than initiating a breakout, with two vital accumulation phases in This autumn, in the end reaching a peak at $4,012.

Some analysts are forecasting a potential repeat rally, drawing parallels to Ethereum’s poor Q1 efficiency as a precedent for a bull cycle. Contemplating each micro and macro elements, this speculation appears believable.

Firstly, the high-risk-off sentiment pushed by Trump’s financial dump might shift market consideration away from Bitcoin, doubtlessly positioning Ethereum for upward momentum.

Moreover, massive inflows at key assist ranges instructed the onset of an accumulation section, reinforcing the bullish case for ETH.

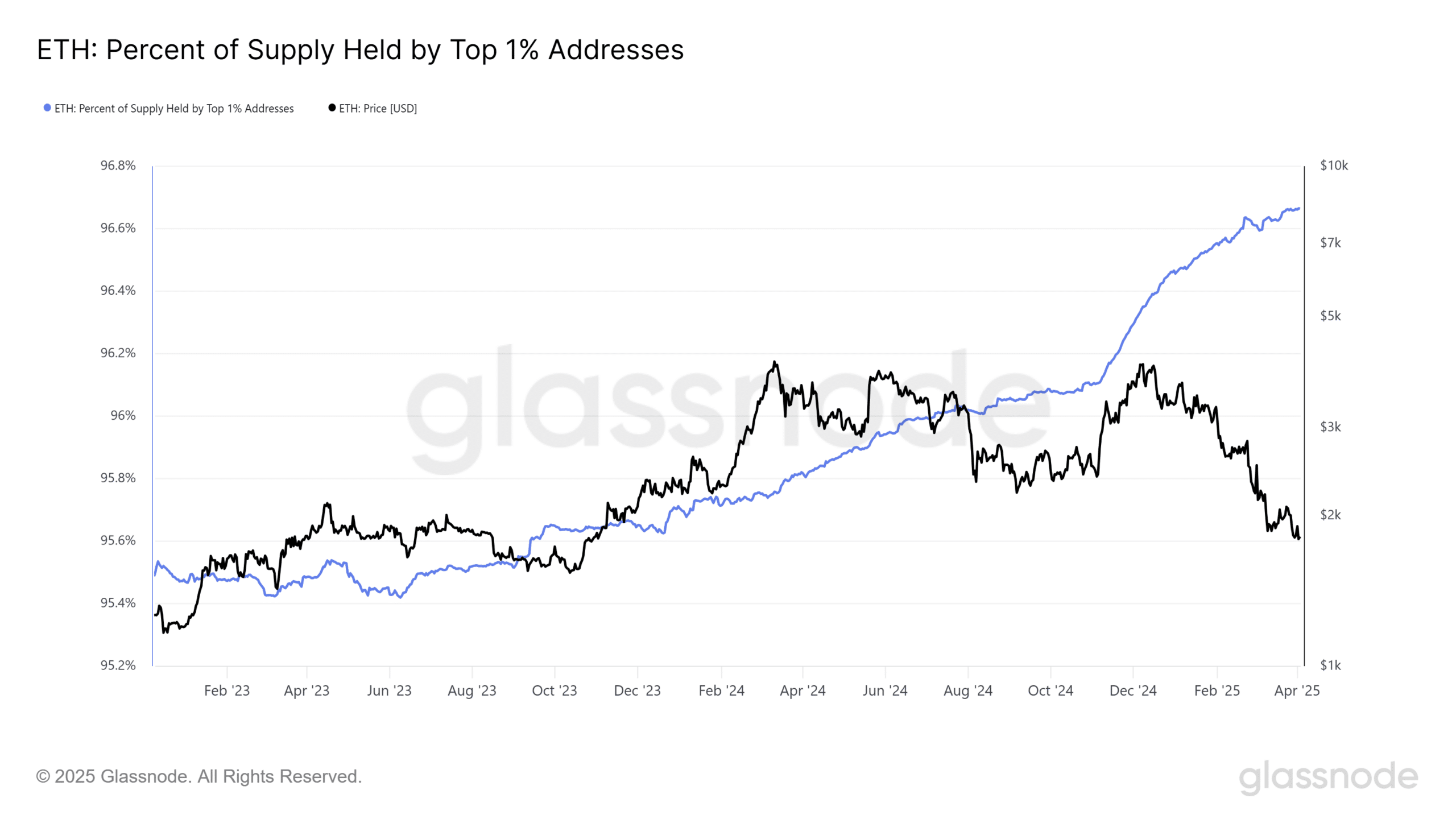

Notably, Ethereum’s % of Provide Held by High 1% Addresses has surged to an all-time excessive, with a considerable 96.66% of the entire provide concentrated throughout the fingers of whale-tier holders.

This focus peaked in mid-This autumn final 12 months, coinciding with a marked enhance in whale accumulation, which helped gasoline ETH’s 71% quarterly rally – Outperforming Bitcoin’s [BTC] 61% throughout the identical interval.

As whale accumulation resumes with ETH dipping to $1,780 and displaying a 2% bounce to $1,830 at press time, these historic patterns and accumulation tendencies strengthen the case for this as a possible market backside.

Might Ethereum be positioning itself for a possible market takeover as Q2 unfolds?

Ethereum’s odds for a repeat rally

In contrast to two years in the past, market situations have change into extra unstable. That is exemplified by the ETH/BTC pair, which has dipped to a five-year low.

Bitcoin’s resilience amid market turbulence has exerted downward stress on Ethereum, contributing to its weak Q1 efficiency.

Ethereum’s dominance, which held regular in double digits all through 2023 and into Q1 2025, has now sharply declined to a document low of simply 8%.

Whereas whale exercise performed a pivotal position in ETH’s breakout to $4k beforehand, the concurrent peak within the ETH/BTC pair highlights capital rotation as a key issue.

Buyers, shifting away from Bitcoin’s high-risk/high-reward profile, funneled capital into Ethereum, including bullish momentum to its rally.

Nonetheless, this dynamic has dramatically shifted. Bitcoin’s dominance has surged to a four-year excessive, breaking 61%, stifling Ethereum’s relative outperformance.

Until this shift reverses, the probability of a repeat rally akin to 2023 stays diminished.

[ad_2]

Source link