[ad_1]

- BTC’s 26% drawdown might be a mid-bull correction or the beginning of a bigger correction.

- Glassnode projected {that a} doubtless backside might be hit above $70K.

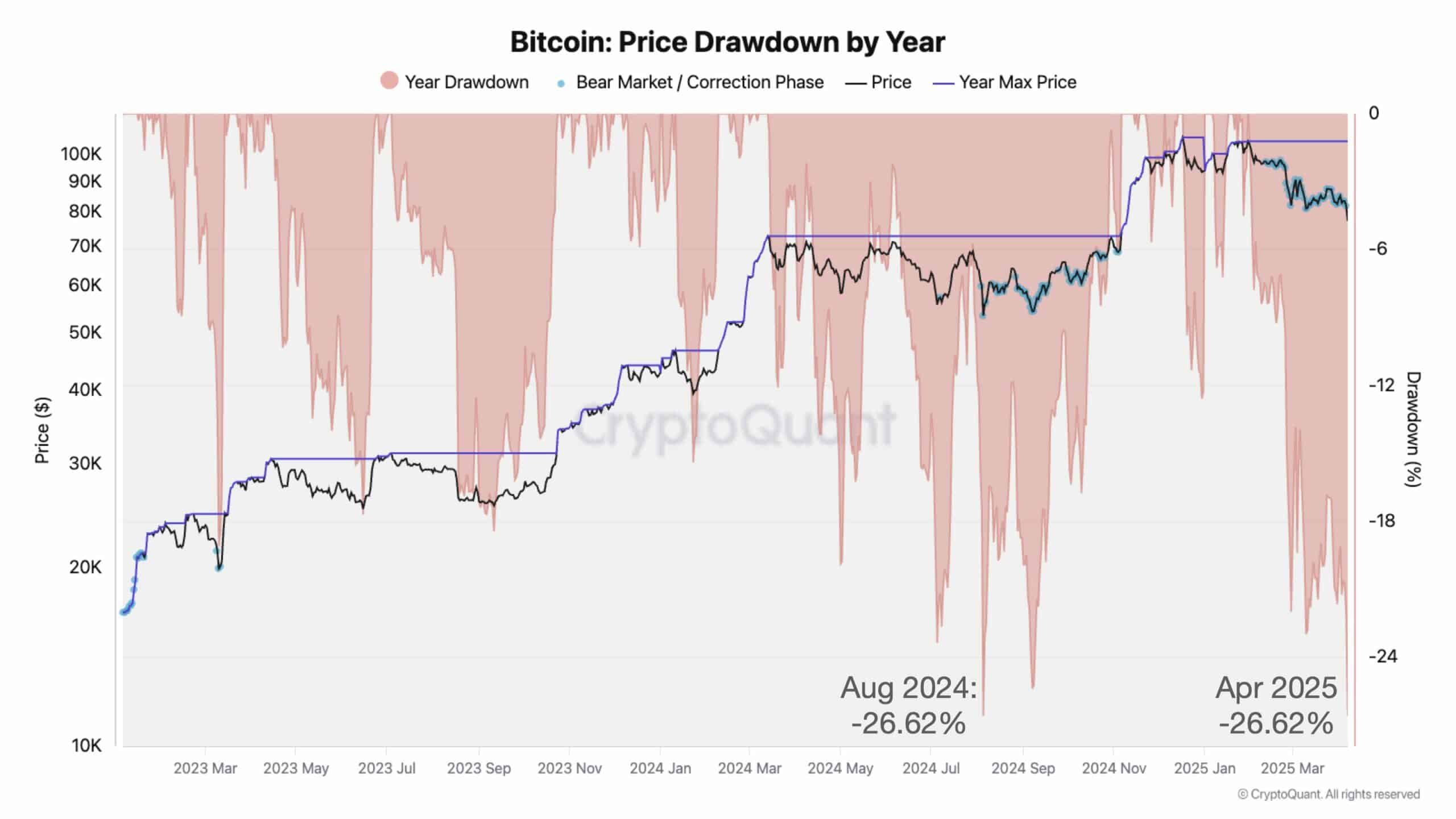

Bitcoin’s [BTC] 26% drawdown in 2025 might turn into the most important on this present cycle if the decline extends.

In line with Julio Moreno, Head of Analysis at CryptoQuant, the 2025 plunge was at the moment equal to the August 2024 pullback.

After peaking at $109K in January, BTC retraced to $74K this week amid macro uncertainty — That’s over 30% correction. It has since recovered to $79K. Final yr, it dropped from $73K to $49K, marking a 33% decline.

However in comparison with historic drawdowns, is BTC out of the woods, or is the worst but to return?

BTC — A rebound or extra ache?

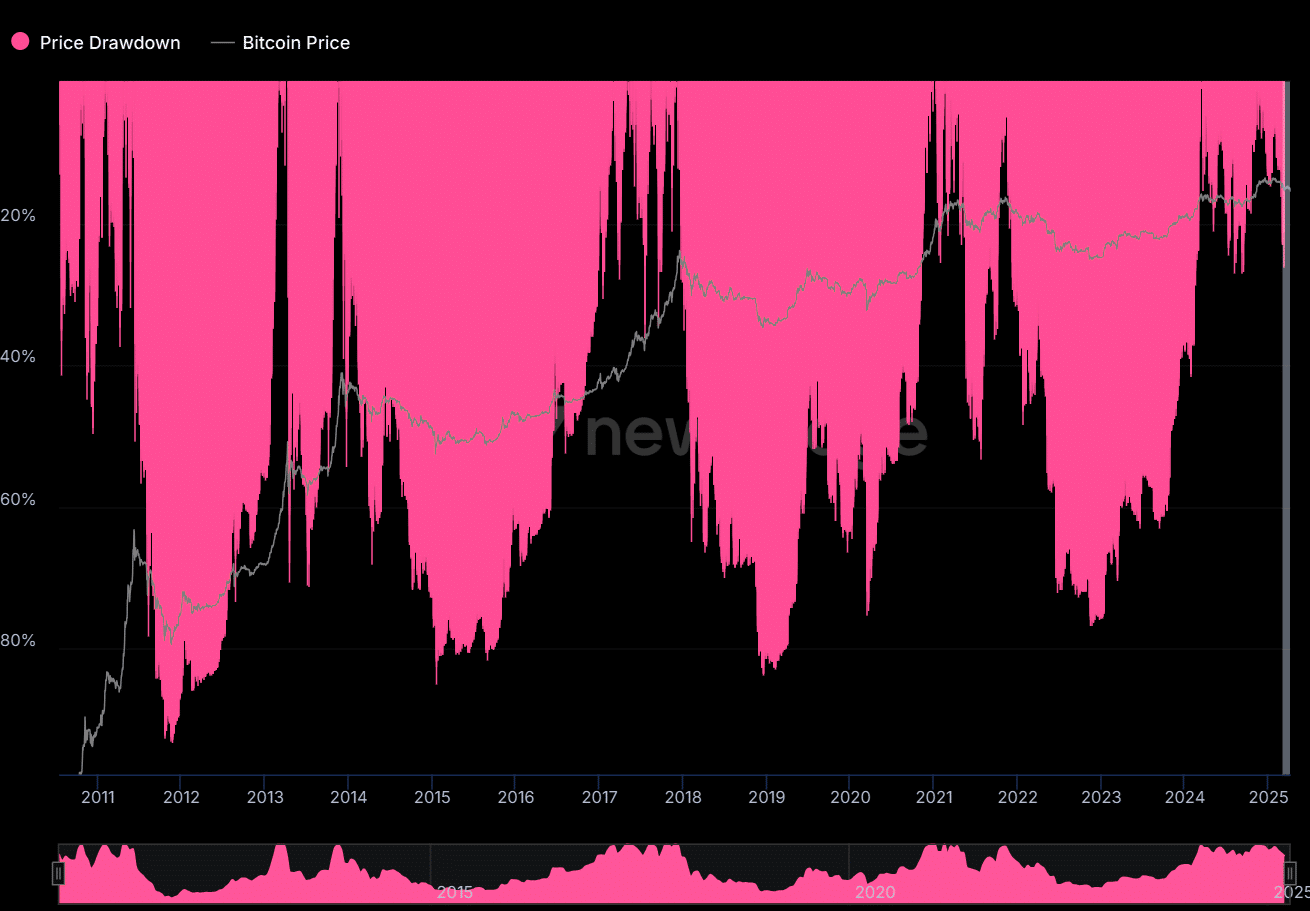

Previous BTC drawdowns, particularly in the course of the bear market section, have been comparatively extra extreme than the present 36%-30% decline. In 2012, 2025 and 2019, for instance, BTC dropped over 80% and lasted 6–12 months after it hit a value peak.

Presently, BTC has declined about 30% over the previous 3 months. As such, if previous traits play out, this is perhaps only the start of a bigger correction for the following 3-9 months.

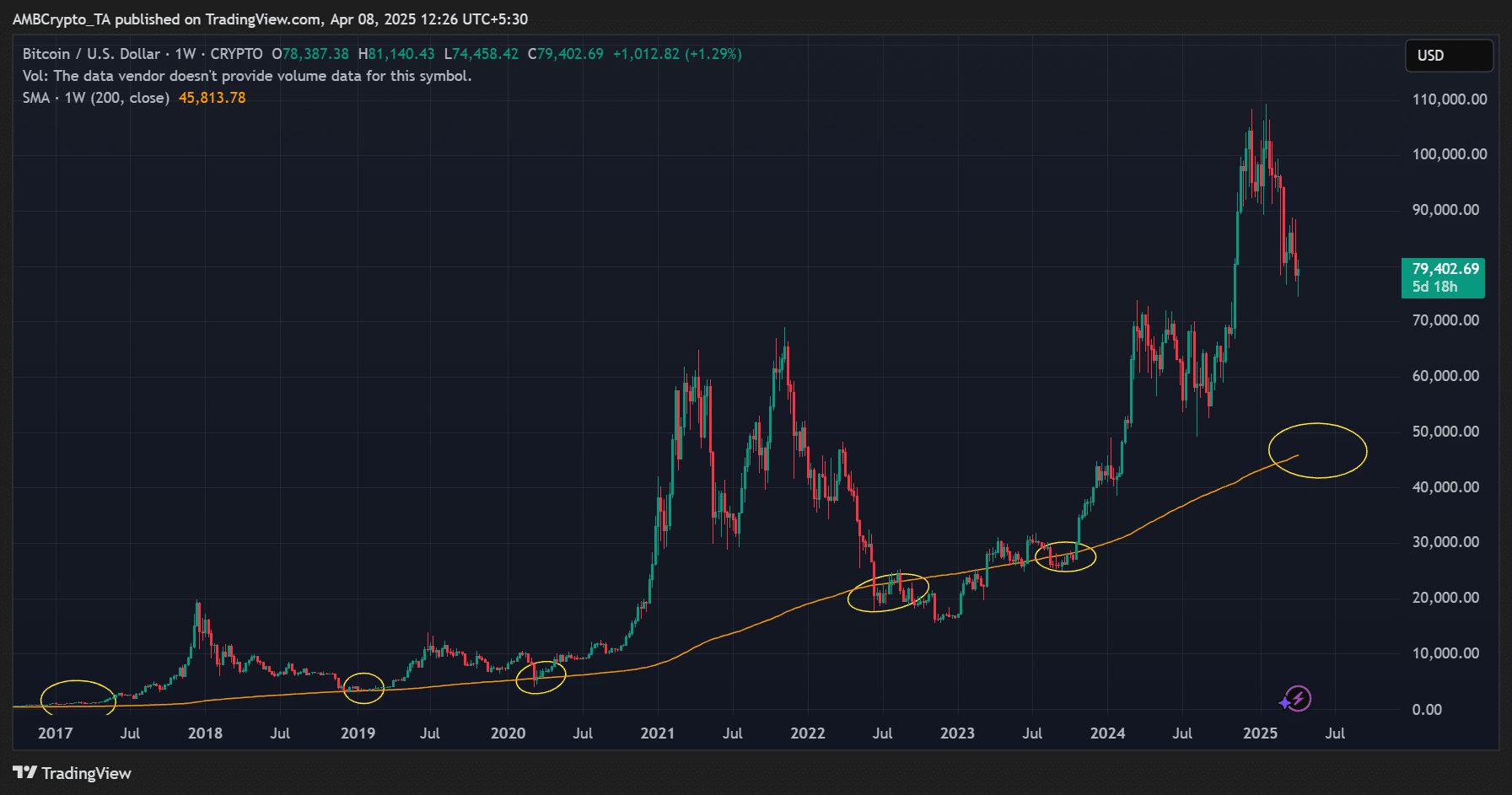

Nonetheless, an 80% drop (to $21K) is perhaps unlikely provided that the important thing bull market help, the 200-weekly Shifting Common, has risen to $45K.

Alternatively, some analysts consider that the present cycle drawdown is perhaps much less extreme due to market maturation. In truth, Glassnode expected a possible backside across the $ 74K-$ 70K space.

“The draw back could decelerate a bit from right here – between $74k and $70k, there’s a complete of ~175k $BTC in price foundation clusters. The one largest stage inside this vary is $71.6k, holding ~41k $BTC.”

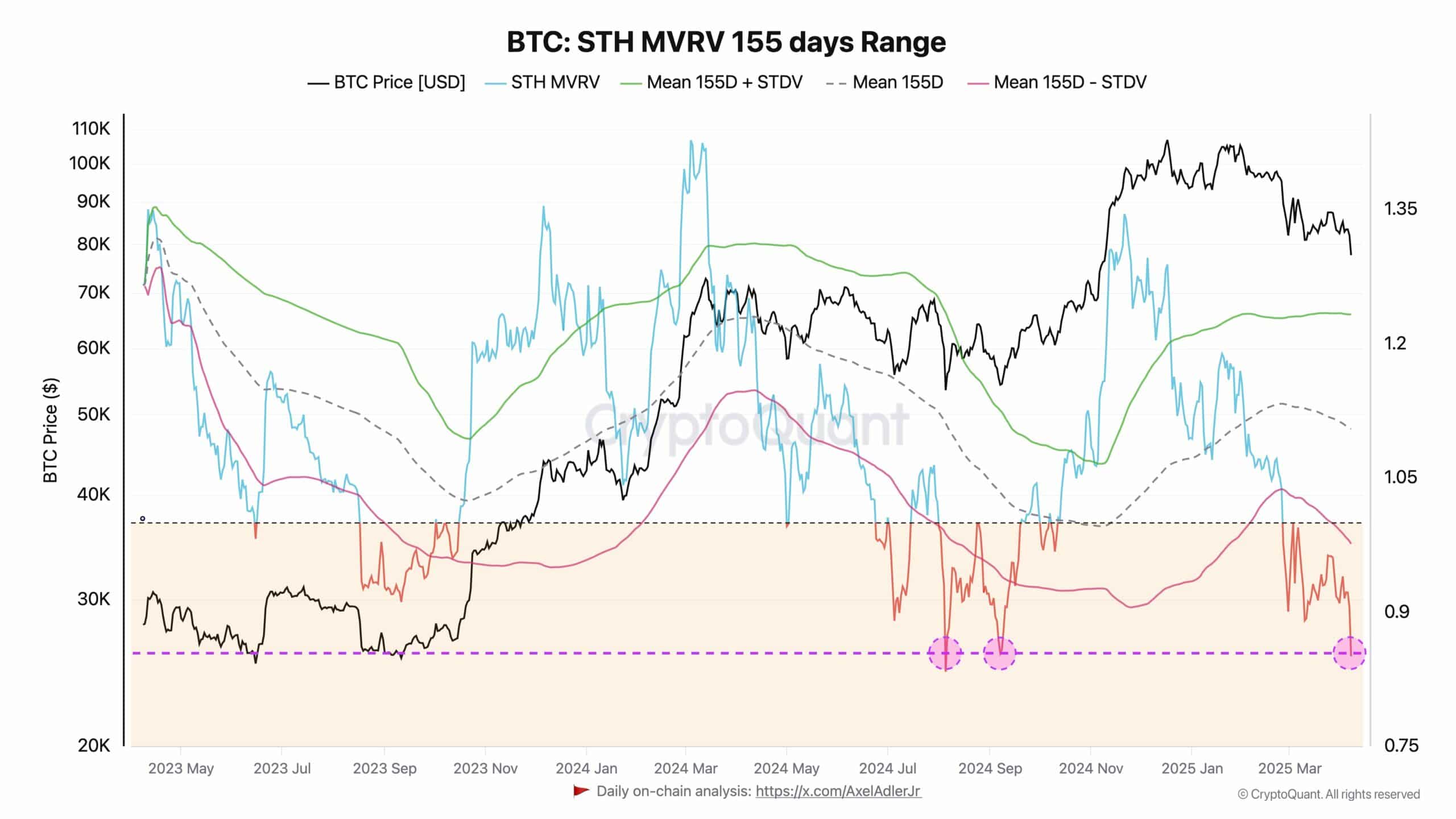

On-chain analyst Axel Adler, echoed an identical stance, noting that BTC had bottomed out and was in an accumulation section, citing the STH (short-term holder) MVRV indicator, which mirrored the native backside seen final August.

“In essence, these circumstances sometimes sign the top of a correction section and the beginning of accumulation.”

Certainly, different savvy buyers, like Philip Swift and Stockmoney Lizards, have been confidently bidding at these ranges.

Nonetheless, Moreno warned that the underside wasn’t totally marked, as a number of bullish indicators have been but to indicate enchancment for BTC.

In conclusion, the present 30% drawdown was nothing in comparison with the previous cycle’s bear phases, which averaged an 80% value drop. Therefore, the present pullback is perhaps a mid-bull correction earlier than one other leg up.

Observe, nonetheless, that it is also the beginning of a bigger correction if bullish circumstances don’t enhance.

[ad_2]

Source link