[ad_1]

Coinspeaker

Ethereum (ETH) Price at $2,700: Final Dip before Parabolic Run to $8K?

With Bitcoin

BTC

$98 244

24h volatility:

1.8%

Market cap:

$1.95 T

Vol. 24h:

$54.89 B

crashing below the $97,000 mark, Ethereum

ETH

$2 699

24h volatility:

0.2%

Market cap:

$325.53 B

Vol. 24h:

$29.53 B

struggles to take care of its help at $2,700. With a 24-hour drop of 4.26%, ETH is at present buying and selling at a market worth of $2,720.

As Bitcoin’s dominance stays at 60.86%, Ethereum’s dominance has slipped to 10.36%. Will the fixed bullish failures delay Ether’s downfall, or is that this the final alternative to purchase Ethereum below $3,000?

Ethereum Weekly Chart Evaluation: Broadening Wedge Eyes a New ATH

On the weekly entrance, the Titan of Crypto, a preferred analyst on X with 198.3K followers, displays a bullish alternative for Ethereum. The present weekly candle is forming the third greater low from a vital help trendline, signaling a bullish reversal.

#Ethereum Most Hated Rally Incoming 🚀#ETH continues to print greater lows, reinforcing its bullish pattern regardless of prevailing skepticism. pic.twitter.com/FXzmBYwCIp

— Titan of Crypto (@Washigorira) February 6, 2025

Supporting the upside potential, the huge tail formation within the weekly candle reveals sturdy help at decrease ranges. The help trendline is a part of a broadening wedge sample, with the higher trendline projecting the primary goal stage of $5,338.

This coincides with the 100% Fibonacci stage, hinting at a brand new all-time excessive.

Extending the bull run, the 161.80% and 200% Fibonacci ranges at $7,321 and $8,546 develop into the first and tertiary goal ranges. The idea of this extremely optimistic projection lies within the steady high-low formation on the weekly chart, ongoing since late 2022.

Historic Ethereum Developments: A Sample of 90-100% Surges

Including bullish hope for Ethereum merchants, crypto analyst Ted Pillows presents one other bullish state of affairs for ETH. Over the previous 12 months, the ETH worth pattern has fashioned three long-tailed weekly candles, marking a backside close to the $2,000 psychological stage.

Ethereum had one capitulation candle in Q1 2024, Q3 2024 and Q1 2025.

Final two occasions, it resulted in a backside, and $ETH pumped 90%-100% within the subsequent 8-12 weeks.

This time, I feel one thing comparable will occur once more. Ethereum will soften faces 🔥 pic.twitter.com/qKnZen8Gcz

— Ted (@TedPillows) February 6, 2025

These occurrences occurred in Q1 2024, Q3 2024, and Q1 2025.

Traditionally, Ethereum pumped practically 90-100% over 8-12 weeks after forming such patterns. If this historic worth pattern continues, Ethereum is more likely to break previous the $4,000 psychological resistance.

Based mostly on Ted Pillows’ evaluation, the breakout rally might prolong to $8,000.

Ethereum Evaluation: Triangle Sample Resembling 2021 Bull Run

Taking a better take a look at the day by day timeframe, crypto analyst Crypto Rover shares an fascinating statement. Highlighting a triangle sample, Rover attracts parallels with Ethereum’s historic worth motion.

That was the ultimate $ETH deviation.

This rally would be the most hated one but. pic.twitter.com/jNdlRCgHq0

— Crypto Rover (@rovercrc) February 6, 2025

In 2020 and 2021, Ethereum faked a breakout from a damaged entrance line, solely to retest the help stage of a triangle sample. Following the retest, Ethereum exploded into the 2021 bull rally.

The 2024-25 worth pattern appears to reflect this sample, suggesting a possible breakout rally. With latest cheaper price rejections signaling a bullish comeback, Ethereum might be on the verge of repeating the 2021 bull run.

Institutional Accumulation: BlackRock Leads the Cost

Amid extremely optimistic worth motion, establishments proceed to purchase Ethereum aggressively, fueling hypothesis a few huge rally. In a latest X post, Michael van de Poppe highlighted that establishments have bought over $500 million price of Ethereum by ETFs.

On February sixth, the day by day complete web influx for US Ethereum spot ETFs stood at $10.65 million. Whereas eight ETFs remained on the sidelines, BlackRock was the one ETF with an influx of $10.65 million.

This marks the sixth consecutive optimistic day for Ethereum ETFs, though it’s the lowest influx over the previous week.

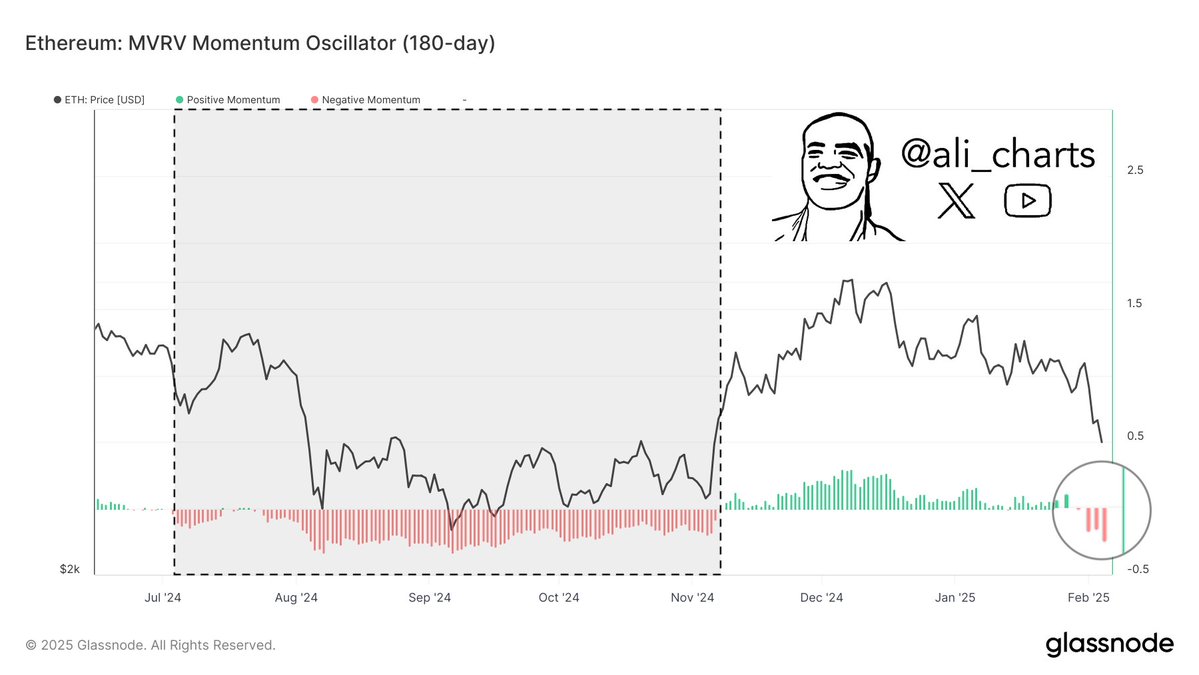

Bearish Warning: MVRV Momentum Oscillator Turns Detrimental

Nevertheless, the bullish outlook will not be with out dangers. In a latest X post, unbiased crypto analyst Ali Martinez identified a bearish sign within the market-value-to-real-value (MVRV) momentum oscillator.

In February 2025, the MVRV momentum oscillator turned unfavorable — a transfer that beforehand led to Ethereum’s hunch in August 2024. This indicator suggests short-term draw back dangers, regardless of the bigger bullish pattern.

Conclusion: Ethereum at a Vital Turning Level

Ethereum’s worth motion presents an important alternative, as analysts spotlight sturdy bullish setups throughout weekly and day by day timeframes. The broadening wedge sample, historic pump cycles, and triangle formation counsel that ETH is on the verge of a breakout, with targets starting from $4,000 to $8,546.

Institutional accumulation, led by BlackRock’s continued ETF inflows, reinforces the long-term bullish outlook. Nevertheless, bearish indicators from the MVRV momentum oscillator trace at potential short-term dangers.

Finally, Ethereum’s capacity to carry above $2,700 will decide if that is the final probability to purchase below $3,000 or if additional correction awaits earlier than the following leg up.

Ethereum (ETH) Price at $2,700: Final Dip before Parabolic Run to $8K?

[ad_2]

Source link