[ad_1]

Dogecoin (DOGE) holders have been placed on alert by crypto analyst Ali Martinez (@ali_charts), who shared a chart on Monday highlighting a noteworthy technical setup. In accordance with Martinez, the Market Worth to Realized Worth (MVRV) ratio for DOGE simply shaped a “dying cross” with its personal 200-day transferring common (MA)—an occasion that beforehand correlated with main worth declines.

Dogecoin MVRV Dying Cross Warning

Martinez’s chart, sourced from Santiment, plots three key knowledge factors: DOGE/USD Value (black line), DOGE’s MVRV Ratio (orange line) and DOGE’s 200-day MVRV Ratio MA (crimson line). He commented: “DOGE simply noticed a dying cross between the MVRV Ratio and its 200-day MA. The final two occasions this occurred, costs dropped 26% and 44%.”

The newly printed “dying cross” happens the place the orange MVRV ratio line falls under the crimson 200-day MA line. Traditionally, the analyst notes, DOGE’s worth skilled two important corrections after this similar crossover: A 26% drop between early September and late October 2023 and a 44% plunge from mid-June to late September 2024.

Associated Studying

Each downturns seem in shaded areas on the chart, labeled accordingly. After every of those drawdowns, Dogecoin’s worth finally rebounded, however solely after reaching notably lower cost ranges. Trying nearer on the chart, Dogecoin’s worth is proven buying and selling round $0.268. The MVRV ratio (orange line) has climbed close to 91%, whereas the 200-day MVRV Ratio MA (crimson line) hovers round 78.36%.

The MVRV ratio compares Dogecoin’s present market worth to its realized worth (the aggregated price foundation of DOGE final moved on-chain). An MVRV of 91% signifies that market individuals, on common, could possibly be up considerably relative to their buy worth—if the ratio stays above 1. Though the precise interpretation is dependent upon how an analyst applies the MVRV scale, a better MVRV ratio usually implies elevated unrealized positive aspects amongst holders.

Associated Studying

The 200-day MVRV MA is the straightforward transferring common of the MVRV ratio over the previous 200 days. It offers a longer-term baseline to gauge how far Dogecoin’s present MVRV stands above or under its historical trend. A “dying cross” on this context seems when the short-term MVRV ratio (orange line) strikes beneath the 200-day MVRV ratio MA (crimson line), usually signaling a possible shift in sentiment or impending promote stress.

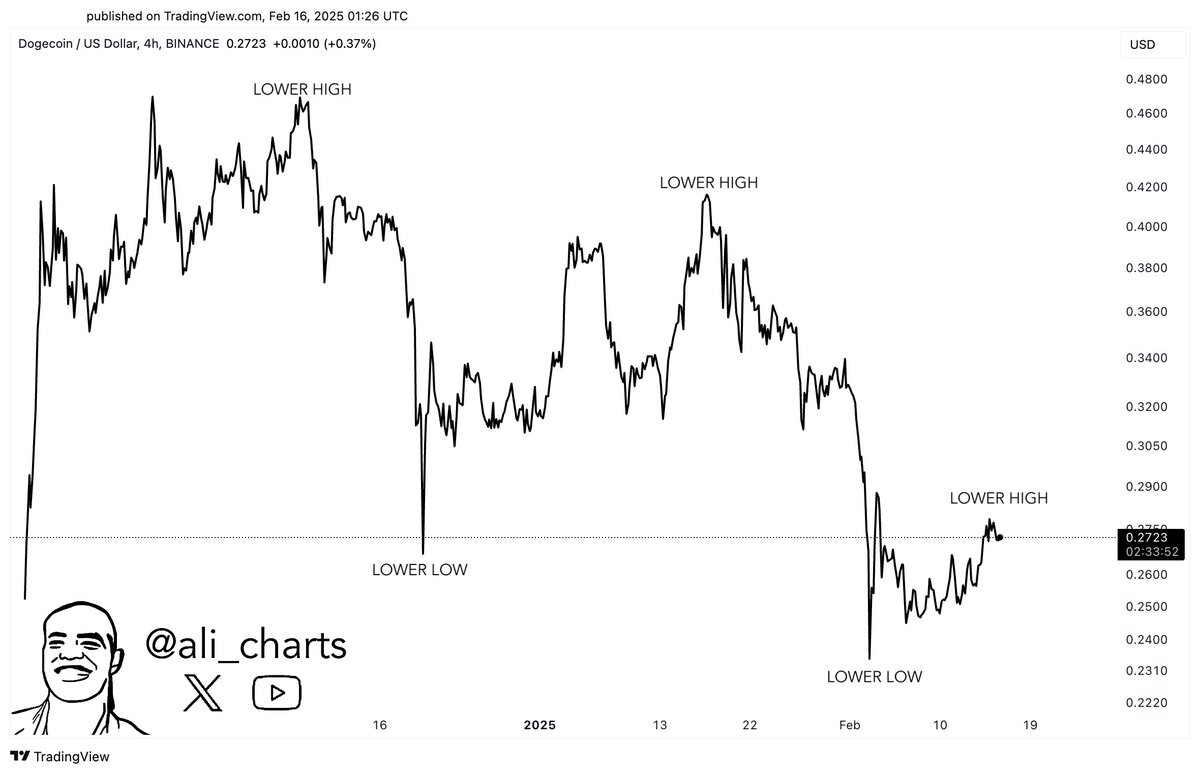

Notably, the Dogecoin worth is displaying some weakness over the past couple of weeks. For the reason that December 8 excessive at $0.4834, DOGE is continually writing decrease highs and decrease lows, a extremely bearish chart setup. Martinez shared the under chart and stated: “DOGE stays in a downtrend, forming decrease lows and decrease highs. A breakout above key resistance is required to shift momentum!”

For this to occur, DOGE would wish to interrupt above $0.44. Nevertheless, DOGE bulls can count on important resistance at $0.31 (0.382 Fibonacci retracement stage), $0.342 (0.5 Fib) and $0.375 (0.618 Fib). At press time, DOGE traded at $0.26.

Featured picture created with DALL.E, chart from TradingView.com

[ad_2]

Source link