[ad_1]

Though Ethereum (ETH) remains to be buying and selling almost 50% beneath its all-time excessive (ATH) of $4,878, indicators are rising that the second-largest cryptocurrency by market capitalization could quickly expertise a “supply shock” attributable to dwindling reserves on main cryptocurrency exchanges like Binance.

Binance Ethereum Reserves See Large Fall

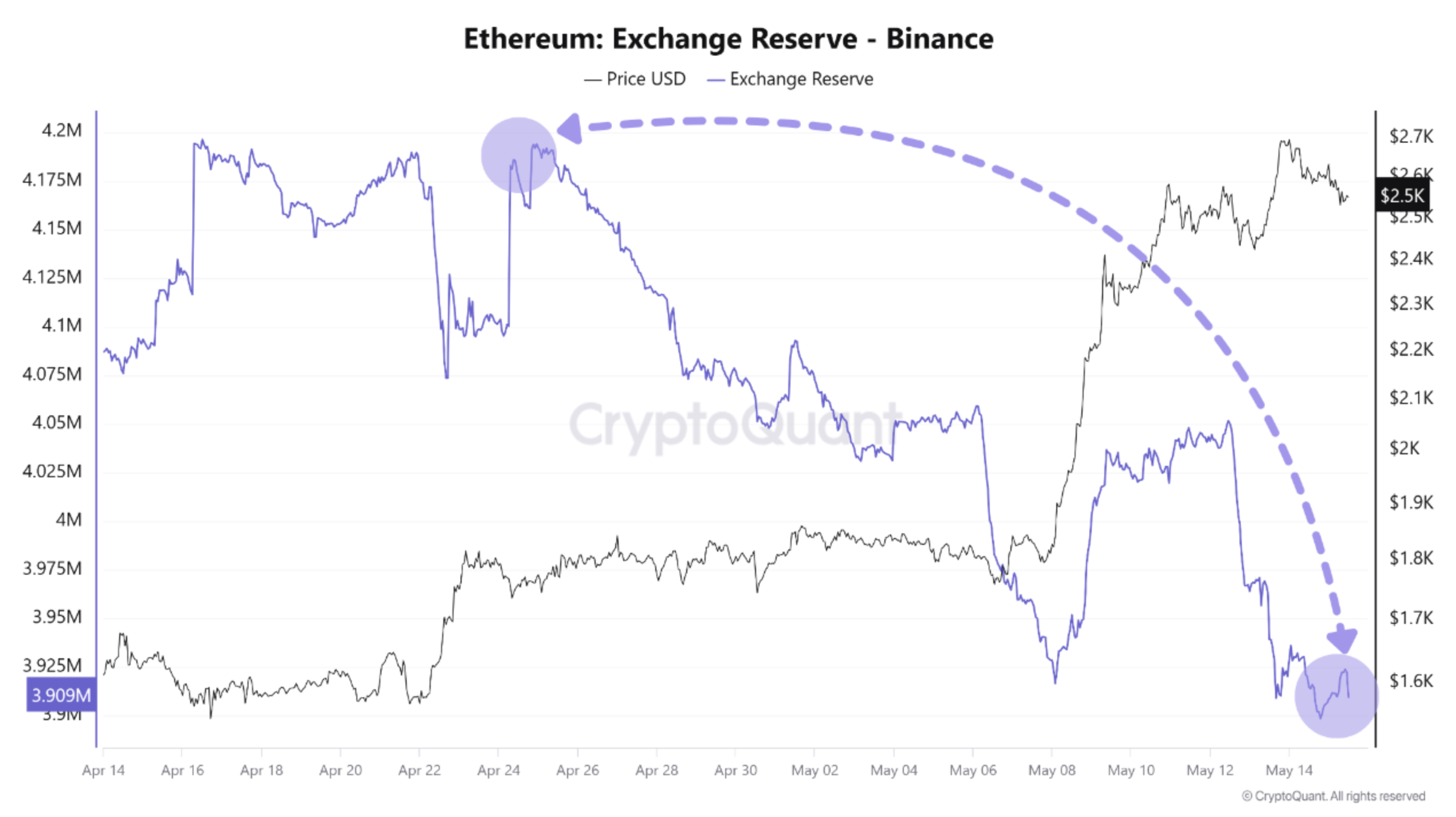

In line with a current CryptoQuant Quicktake put up by on-chain analyst Amr Taha, ETH reserves on Binance have been steadily falling since April 14. Taha famous that the alternate’s ETH reserves declined from barely lower than 4.2 million to three.9 million by Could 14 – a drop of round 300,000 ETH in only one month.

Such a pointy lower over a comparatively quick interval has reignited discussions round ETH’s provide shortage narrative. When fewer cash are held on exchanges, the promoting stress tends to lower. This discount can result in higher prices if demand stays fixed, because the accessible ETH turns into extra restricted.

Taha proposed two doable causes behind the drop in Binance’s ETH reserves. First, he advised that buyers could also be transferring ETH to chilly wallets or deploying it in decentralized finance (DeFi) protocols for safety or yield era.

Second, institutional buyers could also be withdrawing giant quantities of ETH for functions comparable to over-the-counter (OTC) offers, non-public investments, or staking. These actions scale back alternate reserves with out essentially creating promoting stress. Taha concluded:

The 300,000 ETH decline in Binance’s reserves suggests a notable shift in investor habits – presumably towards long-term holding, staking, or institutional accumulation. Though this will alleviate instant promoting stress, merchants ought to intently observe this development and its interplay with total market demand.

Is ETH Getting ready To Rally?

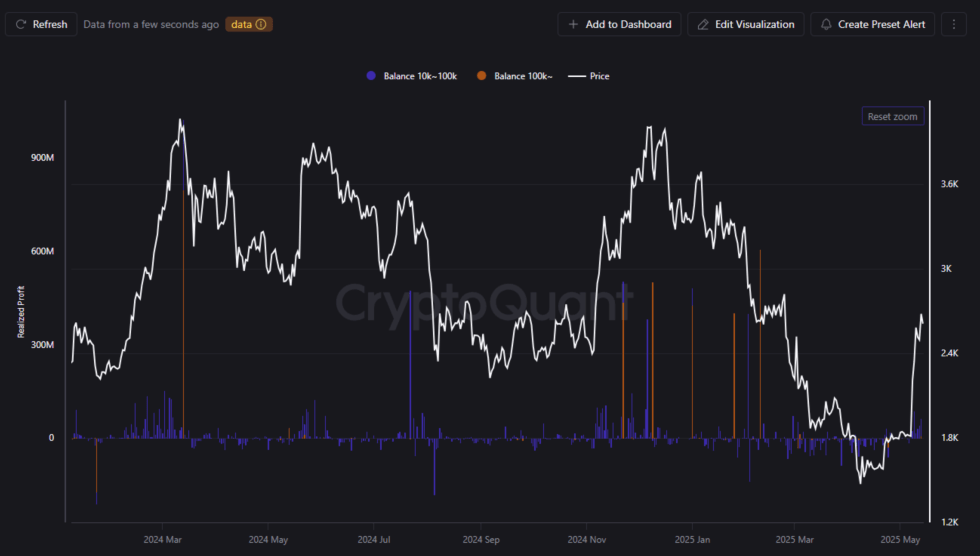

Extra knowledge factors recommend that ETH could also be gearing up for a significant rally within the quick to medium time period. In a separate CryptoQuant put up, contributor BlitzzTrading analyzed the habits of ETH whales.

For context, ETH whales are usually pockets addresses that maintain greater than 10,000 ETH. BlitzzTrading shared the next chart, illustrating that the final main correction in ETH occurred after whales took earnings when the value approached $4,000.

Presently, these whales don’t look like partaking in vital profit-taking. Nevertheless, BlitzzTrading suggested intently monitoring this metric, as a spike in whale promoting might sign a possible correction as soon as ETH enters overbought territory.

A number of analysts have set formidable worth targets for Ethereum on this market cycle. For instance, crypto analyst Ted Pillows not too long ago predicted that ETH might attain $12,000 later this yr.

Pillows additionally pointed out that ETH seems to be following the Wyckoff Accumulation sample – a basic market construction that always precedes vital worth will increase. He believes that if present momentum holds, ETH might reclaim the $4,000 stage by Q3 2025.

Ethereum’s fundamentals are additionally strengthening. The community not too long ago completed the extremely anticipated Pectra improve, which is anticipated to boost efficiency and safety. At press time, ETH is buying and selling at $2,541, down 2.2% over the previous 24 hours.

Featured Picture from Unsplash.com, charts from CryptoQuant and TradingView.com

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent overview by our crew of prime expertise consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.

[ad_2]

Source link