- Bitcoin’s short-lived breakout unraveled quick, as a geopolitical fakeout triggered pressured liquidations.

- Will escalating macro dangers proceed to suppress follow-through?

On the sixteenth of June, Bitcoin [BTC] depraved as much as $108,944, invalidating the native bearish setup with a decisive quick squeeze that liquidated $45.7 million in brief positions.

Extra critically, this breakout adopted three days of compression simply across the $105k resistance zone, the place merchants anticipated a repeat of early June’s rejection that despatched BTC tumbling to $100,424.

This time, nevertheless, as a substitute of retracing, BTC surged. So was this breakout the primary affirmation of an area backside, or will geopolitical overhangs unwind this transfer earlier than follow-through materializes?

Emergency escalation sends Bitcoin tumbling

Bitcoin almost triggered one other main liquidity seize round $109,700, the place merchants had stacked near $50 million in leveraged shorts. However the transfer fell quick. Worth stalled simply earlier than the sweep.

As an alternative, BTC reversed decisively, dropping 3.2% to an intraday low of $105,412 at press time. Within the course of, three long-heavy liquidity clusters bought worn out, every stacked with round $25 million in leverage.

So, what killed the setup? A macro fakeout.

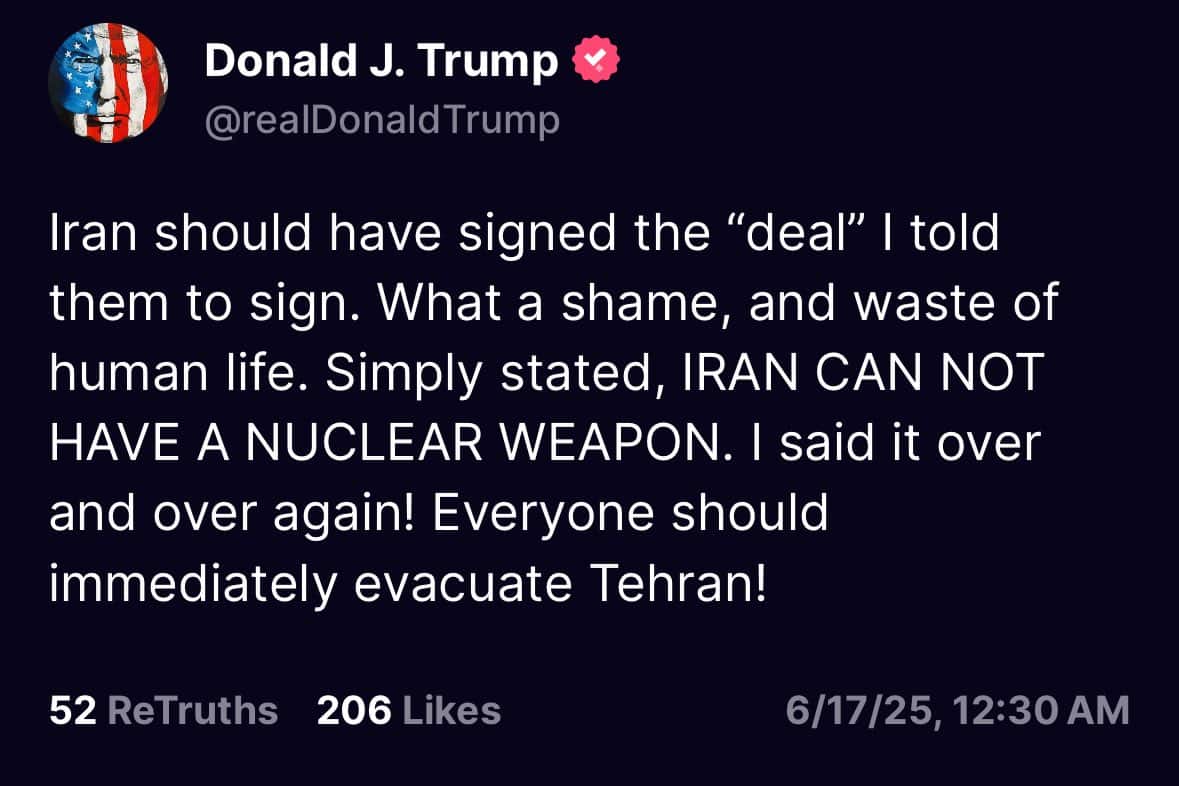

You see, the rally had been fueled by buzz that Trump had brokered a peace deal between Israel and Iran. However that narrative collapsed rapidly, as he dismissed the reviews and triggered an emergency alert as a substitute.

What got here subsequent was a basic bull entice.

Late longs jumped in chasing the transfer, solely to get wiped as issues reversed onerous. Open Curiosity dropped 1.47%, signaling liquidations throughout futures, whereas 23,900 BTC flooded again onto exchanges, marking a 231% spike from the day earlier than.

And but, this feels extra just like the early indicators of broader macro fragility. With directional conviction nonetheless lacking, Bitcoin slips again into “wait-and-see” mode, caught between headlines and hesitation.

G7 interruption provides weight to the narrative

Markets moved swiftly into risk-off mode. It started with President Trump ordering an emergency evacuation in Tehran, already a high-stakes sign. However the true kicker got here when he abruptly reduce quick his G7 go to.

However issues escalated additional. Fox Information’ Lawrence Jones reported that Trump advised the Nationwide Safety Council to be on standby within the emergency scenario room.

All of this piled on to rising hypothesis of a possible U.S. navy intervention, one thing danger belongings have been fast to cost in. Bitcoin, as soon as once more pinned beneath the $105k resistance, struggling to flip the extent into confirmed backside.

In the meantime, Bitcoin’s Funding Charges are nonetheless leaning closely lengthy, setting the stage for one more potential cascade.

At this charge, a transfer again to $100k is trying increasingly more probably if the macro FUD doesn’t ease up.