[ad_1]

- Bitcoin was buying and selling close to the low finish of its historic seasonal vary.

- Bitcoin bulls had been defending the essential weekly MA50 at $75.8K, because the SOPR pattern signaled a protracted interval of consolidation.

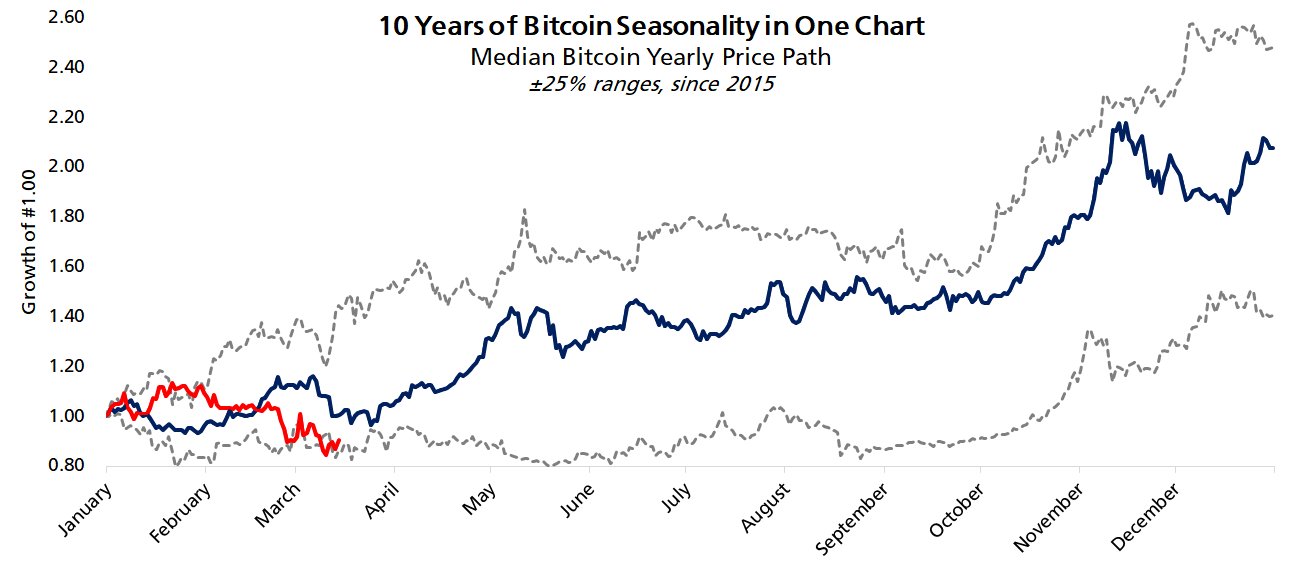

Evaluation of Bitcoin [BTC] since 2015 indicated the cryptocurrency achieved its most inexpensive worth interval, as denoted within the “10 Years of Bitcoin Seasonality in One Chart.”

Historic information confirmed that BTC maintained the shortest progress vary between 0.80 and 1.00 throughout January and February, correlating precisely with the present place.

Bitcoin confirmed its best annual worth adjustments all through the time span of April by means of October as a result of these months created all adjustments in market worth.

Ranging from April the expansion sample continued to stabilize till October the place it continued its common upward growth from 1.40 to extend the value to 1.60.

Present information suggests Bitcoin may surpass its earlier all-time excessive by June 2025. Its projected progress might attain 2.00 or increased, with anticipated worth ranges between 2.20 and a couple of.60 from late 2024 to early 2025.

This projection depends on historic tendencies, the place April’s seasonal uptick and October’s momentum usually fueled vital beneficial properties.

Past June, Bitcoin’s worth might stay under 1.20 until April sees its common upward pattern, the greenback’s weak spot stabilizes, or investor curiosity will increase.

Why a brand new ATH for BTC is feasible earlier than June

This new anticipated ATH of Bitcoin will be backed by the truth that BTC bulls are defending the important 50 weekly Shifting Common (MA50) by holding out at $75.8K. At the moment, the value is hovering round $83.1K, simply above the MA50.

The primary help degree has traditionally served as a rebound zone. As an example, Bitcoin rose from $67K in July 2024 to $83K in December, demonstrating sustained optimistic market motion.

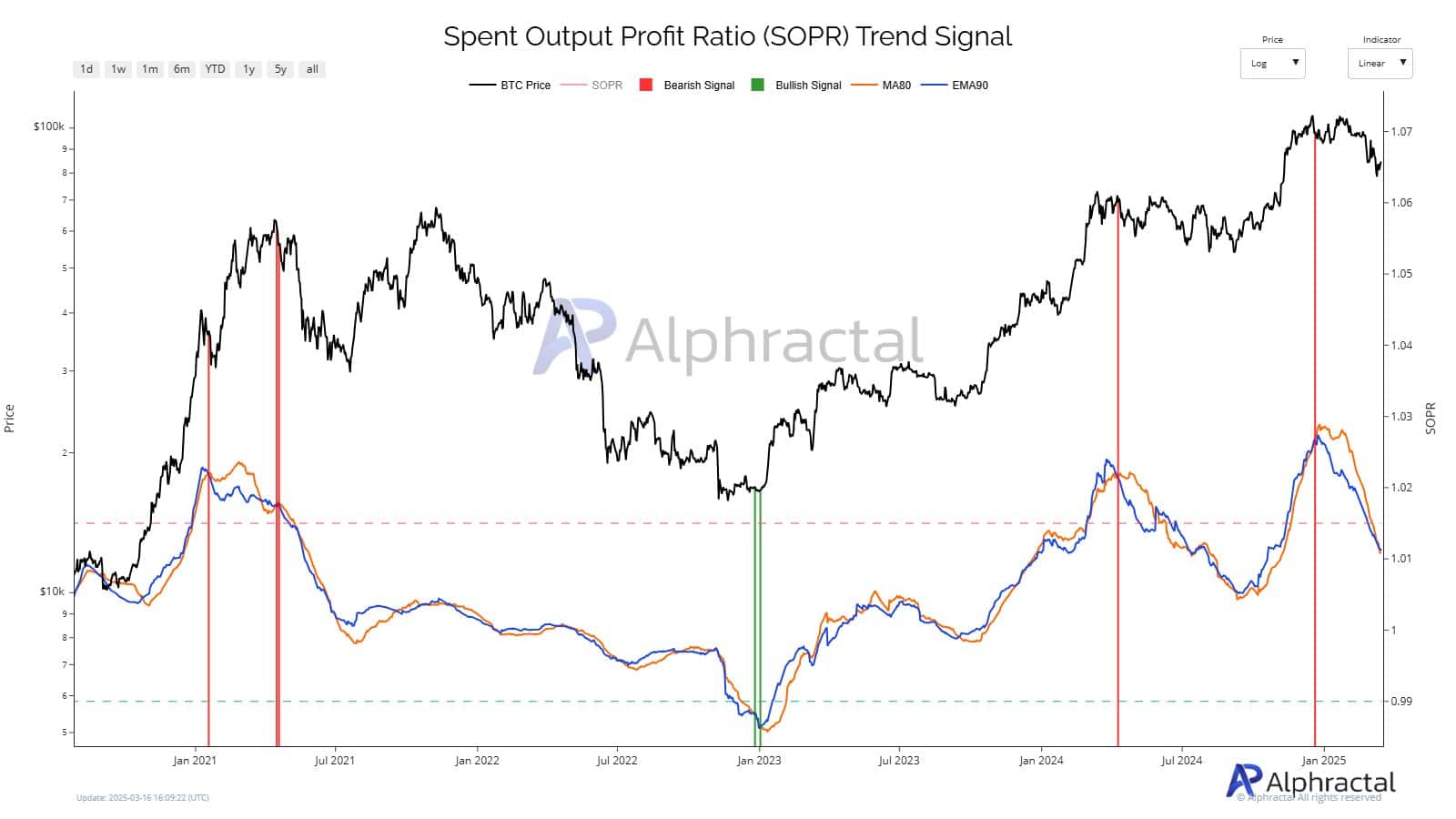

Additional evaluation of the Spent Output Revenue Ratio (SOPR) pattern sign suggests Bitcoin may keep prolonged stability. A lower in SOPR from 1.07 to 1.00 throughout January 2025 signifies that consumers have halted profit-taking.

Traditionally, when SOPR reached roughly 1.00—similar to in mid-2023—the market usually skilled worth will increase. This sample suggests Bitcoin may doubtlessly attain a brand new all-time excessive by June.

Moreover, analyst Avocado reported that Funding Charges on Binance held a destructive place of -0.02 as of March 2025 as BTC traded round $83.6K.

In June 2024, a destructive Funding Fee of -0.02 triggered a worth improve, pushing Bitcoin from $50K to $70K. An identical Funding Fee motion may doubtlessly drive BTC’s worth above $100K.

Nonetheless, if a protracted destructive Funding Fee coincides with a failure of the MA50 help, BTC’s worth may drop to $70K. This state of affairs may additionally delay the achievement of a brand new all-time excessive.

[ad_2]

Source link