[ad_1]

- Bitcoin discovered some help on the $74.5k stage.

- The worth motion in late March may repeat itself, based mostly on clues from the liquidation heatmap.

Bitcoin [BTC] fell beneath the $80k mark on the sixth of April and reached $74.5k on the seventh of April, a date that despatched shockwaves throughout the worldwide markets.

The main crypto can’t be known as resilient at a time like this — it’d already be in a bear market.

Michael Saylor’s Strategy remained on the sidelines through the current main dip, making headlines as soon as once more however this time for a scarcity of exercise out there.

Bitcoin may consolidate for a while

The bearish market construction was bolstered when the current decrease low at $78.6k was breached on the seventh of April. The worth has not fashioned a backside and bounced, so a brand new swing low was not but set.

The RSI on the day by day chart was falling decrease to indicate rising bearish momentum. But, though buying and selling quantity has ticked larger over the previous ten days, the OBV remained with out a pattern throughout this era.

This confirmed that the OBV didn’t point out overwhelming promoting stress, the likes of which we noticed towards the top of February.

This was solely a faint glimmer of hope. The 61.8% Fibonacci retracement stage on the $74.4k area was about to be examined as help as soon as extra. It was unclear if BTC bulls may defend this stage.

Zooming into the 4-hour chart, we discovered that there was some house for hope. The $75.1k and the $80k ranges appeared to type a short-term vary for Bitcoin.

Each the OBV and the RSI have made larger lows through the current retest of the vary’s low.

This exaggerated bullish divergence revealed the potential for some bullish momentum within the quick time period. Nonetheless, it was not sturdy sufficient to reverse the downtrend or the current losses.

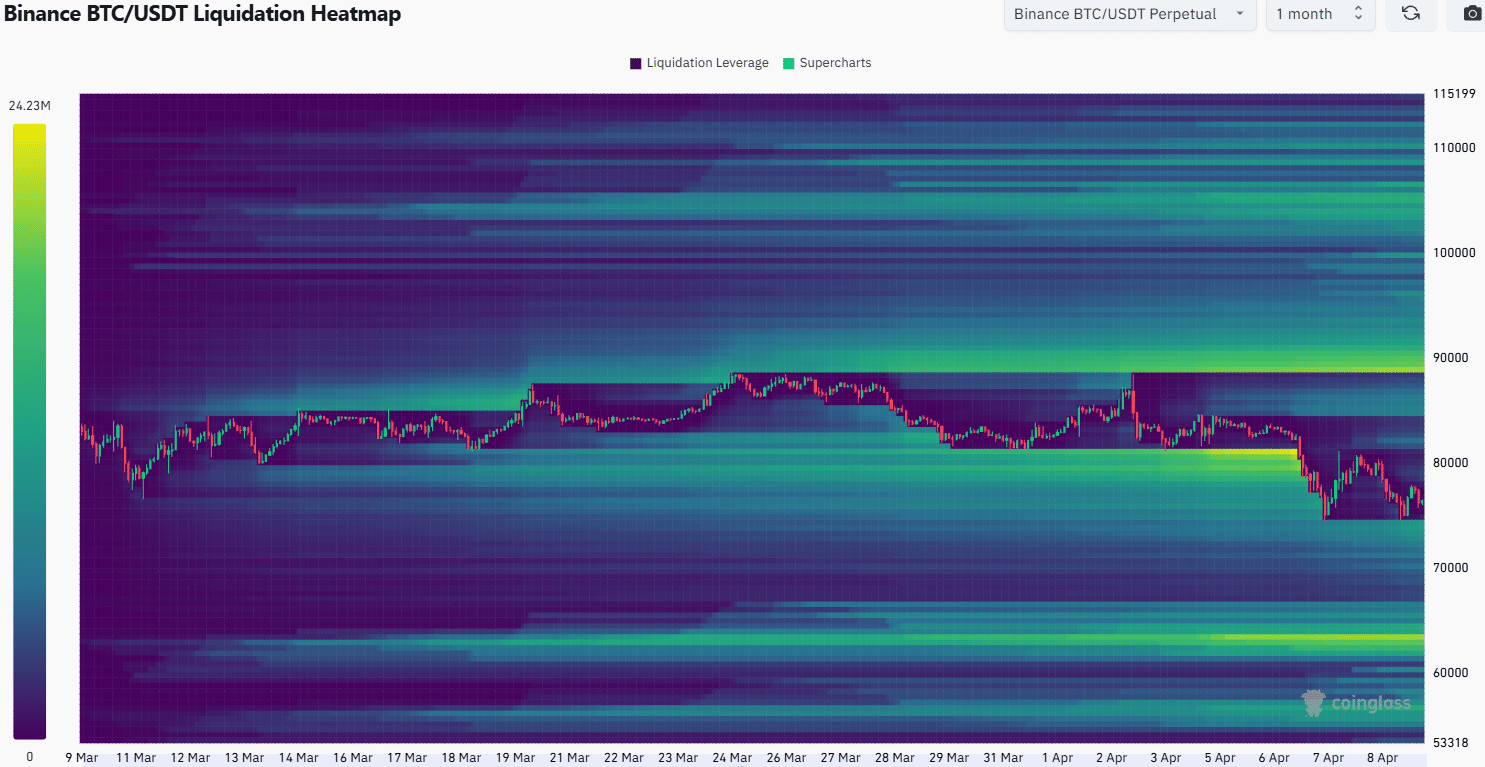

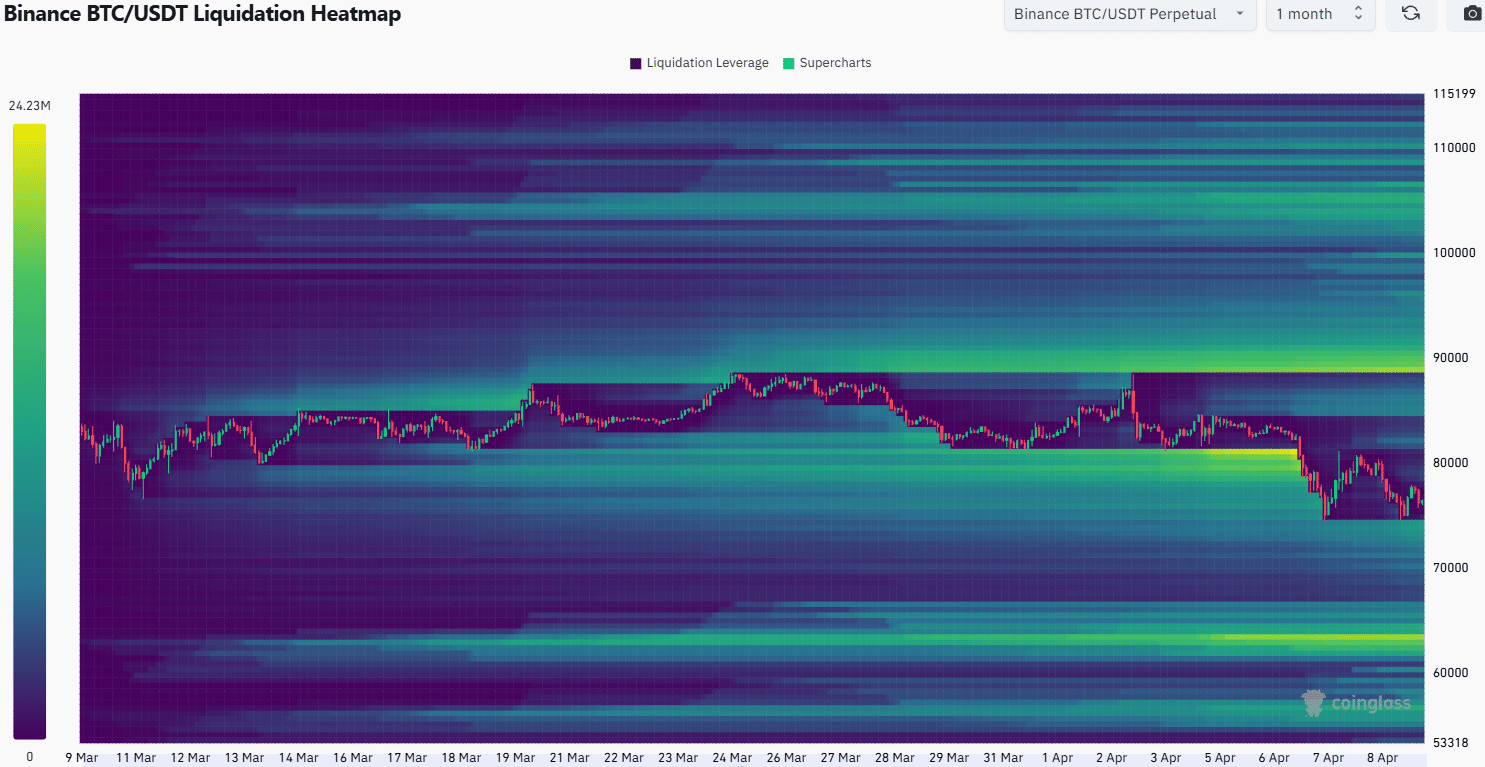

Supply: Coinglass

The thought of consolidation got here from the 1-month liquidation heatmap. Within the second half of March, BTC traded above the $82k short-term help. It allowed time for a build-up of lengthy liquidations round $81.1k.

Equally, the value of Bitcoin may stabilize above $74.5k. This was to construct up lengthy liquidations to the south earlier than looking them down.

Merchants needs to be ready for BTC to dive beneath $74.5k, since uncertainty was rising every day.

Disclaimer: The data introduced doesn’t represent monetary, funding, buying and selling, or different sorts of recommendation and is solely the author’s opinion

[ad_2]

Source link