- Bitcoin hits $111K ATH, surpasses Google to turn into the Sixth-largest international asset by market cap.

- Macroeconomic instability and rising inflation drive traders to favor Bitcoin over gold and bonds.

Bitcoin [BTC] has simply notched a brand new chapter in monetary historical past.

Surpassing its earlier file, the king crypto hit a brand new ATH of $111K for the primary time, and has overtaken Google in market worth.

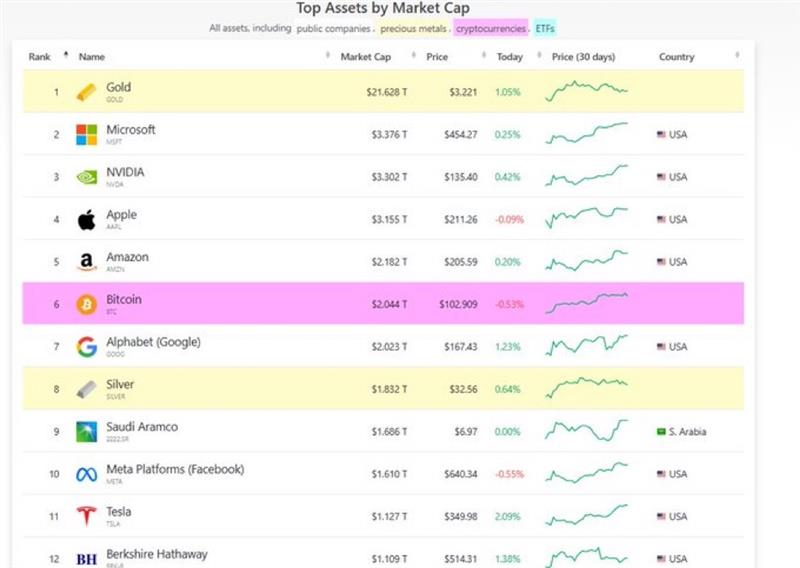

Ranked because the world’s sixth-largest asset, Bitcoin now sits simply behind gold, Microsoft, NVIDIA, Apple, and Amazon, exhibiting its rising weight within the international monetary panorama.

Bitcoin breaks new floor!

Bitcoin surged previous $111K on the twenty first of Could, setting a brand new all-time excessive and shutting the day by day candle at $110K on Binance.

The transfer caps off per week of regular beneficial properties, with BTC climbing over 10% since seventeenth Could. Notably, the RSI was at 77.42 at press time, indicating overbought situations as merchants pushed costs into uncharted territory.

Whereas momentum stays robust, technical indicators counsel the rally may very well be getting into a section of heightened volatility.

Bitcoin races previous Google!

With a market capitalization exceeding $2.17 trillion, Bitcoin has officially surpassed Alphabet (Google) to say the sixth spot among the many world’s largest belongings.

It now ranks simply behind Amazon, Apple, NVIDIA, Microsoft, and gold. The milestone locations Bitcoin forward of conventional heavyweights like silver, Saudi Aramco, and Meta.

With mounting bullish momentum, BTC has nowhere to go however up.

What’s behind the surge?

Bitcoin’s climb previous the $2 trillion market cap mark is a results of adjustments throughout the exterior surroundings.

Having reached its first trillion sooner than most belongings in historical past, Bitcoin is increasingly seen as a hedge in a altering monetary panorama.

In Japan, the place inflation continues to climb, the king coin is gaining traction as a sensible various to fiat and conventional shops of worth.

Within the U.S., issues over fiscal stability have added to its attraction.

Robert Kiyosaki, creator of “Wealthy Dad Poor Dad,” just lately pointed to failed U.S. Treasury bond auctions as a crimson flag, suggesting that belief in authorities debt is waning.

“Excellent news. Gold will go to $25,000. Silver to $70. Bitcoin to $500 okay to $ 1 million.”

His message was clear: Individuals are turning to Bitcoin.

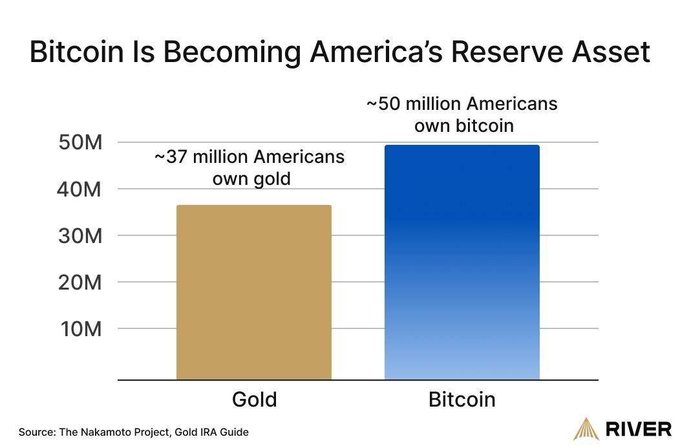

This sentiment is confirmed in information exhibiting Bitcoin holders outpacing these accumulating gold — a notable reversal in investor habits.