[ad_1]

- BTC stalled at $98K and plunged after Powell’s sluggish Fed charge lower outlook.

- Demand for BTC has barely dropped amid macro uncertainty.

Bitcoin’s [BTC] early week restoration stalled at $98K and dumped to $95K following Fed’s chair Jerome Powell’s hawkish outlook on rate of interest cuts.

Throughout his semi-annual financial report back to the U.S. Congress on the twelfth of February, Powell bolstered that the company was not ‘in a rush to vary its coverage stance.’ He said,

‘Our coverage stance is now much less restrictively than it had been, and the financial system stays sturdy. We don’t must be in a rush to regulate our coverage stance.’

For context, a decrease rate of interest means cheaper capital, which is bullish for risk-on belongings like Bitcoin and shares.

Nonetheless, after a hawkish maintain in final month’s FOMC assembly, the sluggish Fed charge lower outlook and Trump’s tariffs have heightened bearish sentiment.

Will the January CPI report sway BTC?

U.S. labor markets and inflation standing decide the Fed charge cuts. Because of this, the markets will shift focus to key inflation information, the January CPI (Client Value Index) report scheduled for the twelfth of February.

In accordance with information tracked by Foreign exchange Manufacturing facility, the forecasted goal for month-to-month change for final month’s CPI is 0.3%.

If the precise CPI is larger, it could possibly be thought-about bearish as it could immediate the Fed to maintain the rate of interest unchanged for longer. Nonetheless, a decrease CPI print might barely increase the market and odds of a charge lower.

That stated, curiosity merchants have been pricing a 95% likelihood of one other charge pause, like in January, throughout the subsequent FOMC assembly in mid-March.

Whether or not the CPI print will change the market pricing stays to be seen.

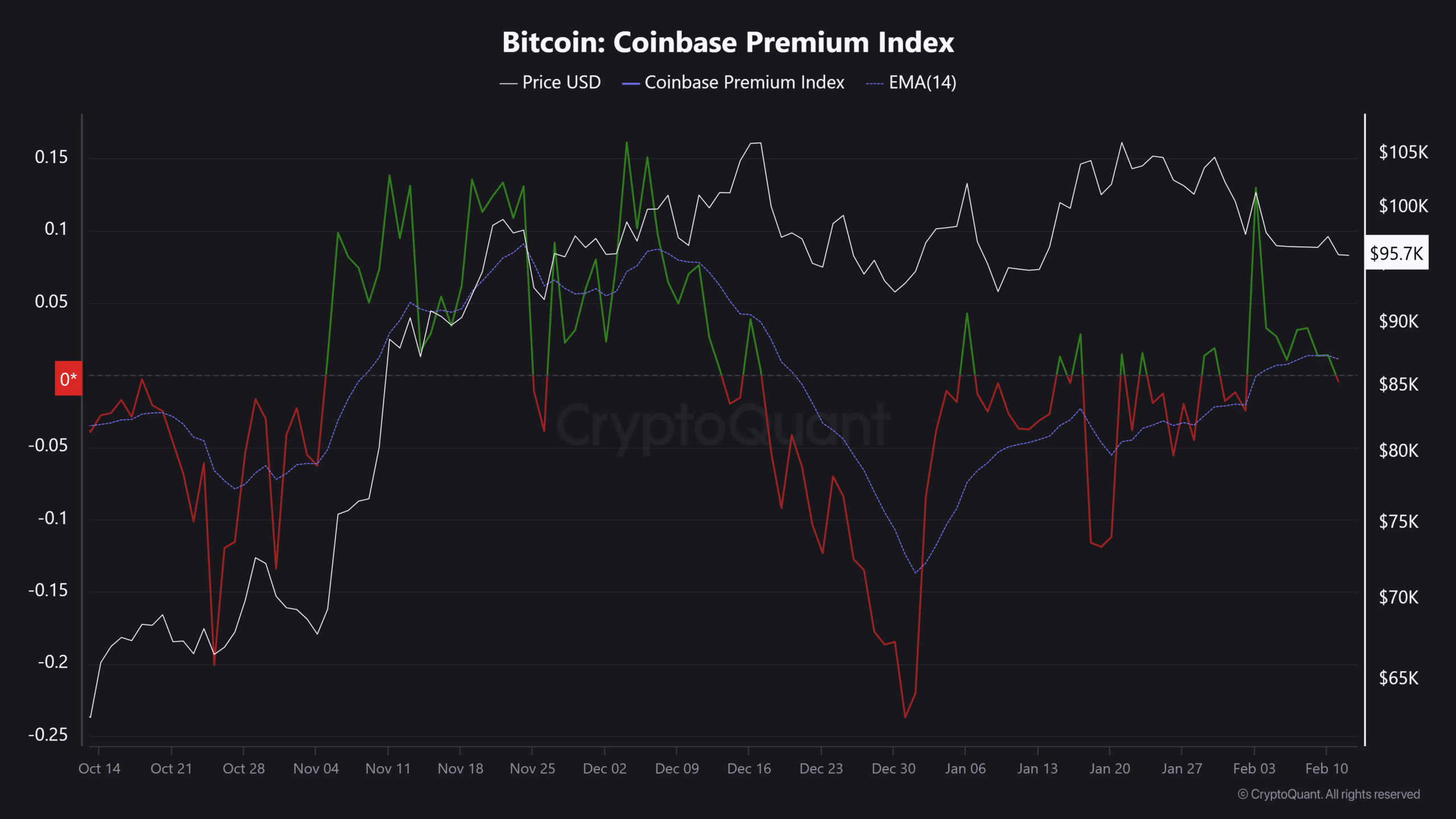

Observe, nonetheless, that the above headline danger has stored general demand muted, per Coinbase Premium Index. The indicator tracks U.S. buyers’ urge for food for the king coin and positively correlates with BTC value motion.

After a surge in early February, the indicator has returned to a impartial degree. Equally, BTC retraced from $101K to $95K over the identical interval.

Any additional dip within the Coinbase Premium Index to destructive territory might restrict BTC’s short-term rebound, regardless of the pending provide shock because the OTC steadiness shrinks.

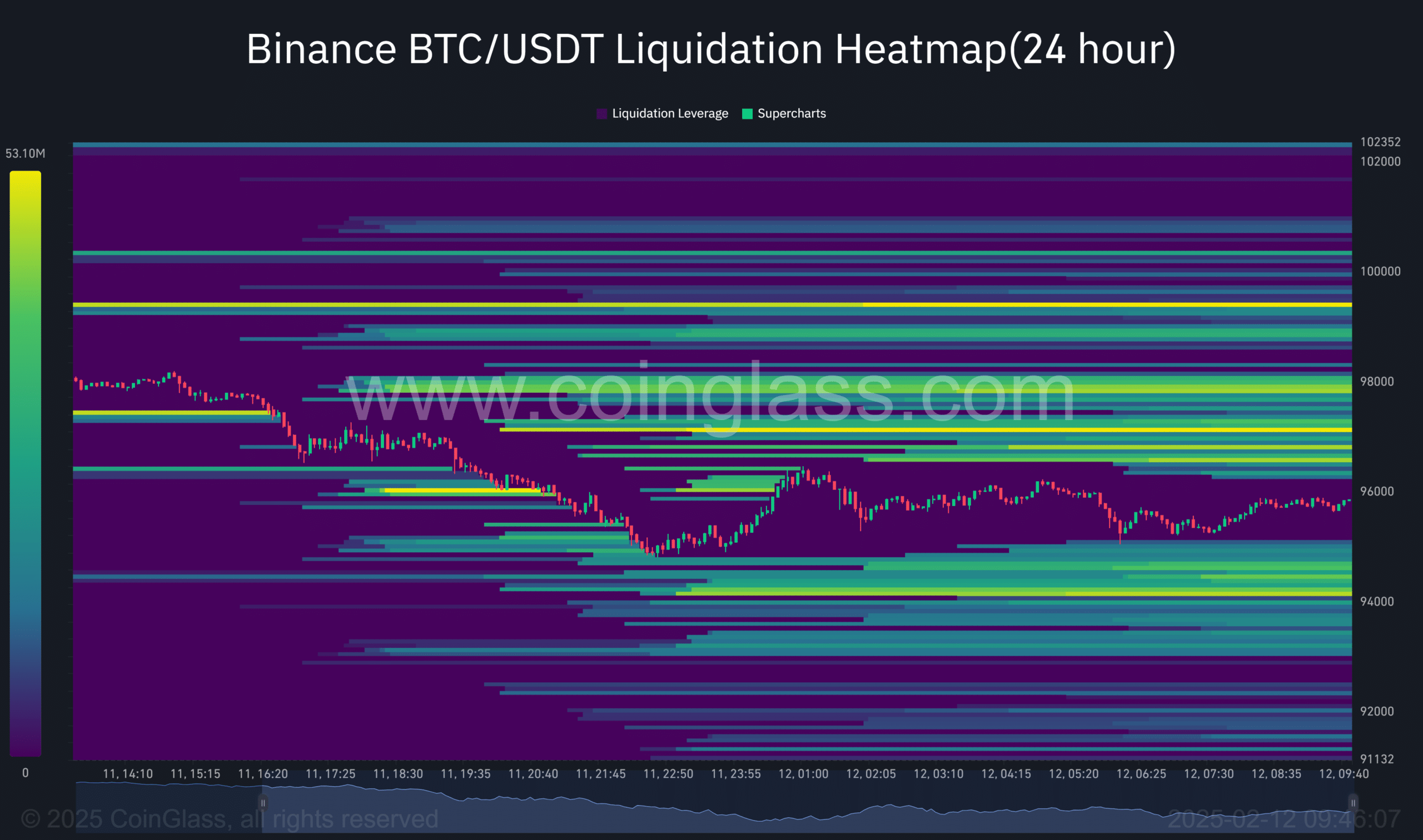

Within the meantime, the cryptocurrency’s uneven market might persist in keeping with the Coinglass liquidation heatmap. Pockets of liquidity (brilliant ranges) are on both facet of value motion.

Merely put, BTC might proceed fluctuating between $94K and $100K within the quick time period.

[ad_2]

Source link