[ad_1]

The worth of Bitcoin seems to have returned to its uneven motion throughout the $82,000 — $86,000 consolidation vary, reflecting the extent of indecisiveness at present taking place out there. Nevertheless, a specific class of BTC investors appears to be shifting within the crypto market with utmost confidence and conviction.

In accordance with the newest on-chain commentary, long-term buyers look like growing their publicity to the world’s largest cryptocurrency by market capitalization. Beneath is what this new shift in market dynamics means for the present Bitcoin cycle.

Has The Bitcoin Bear Market Began?

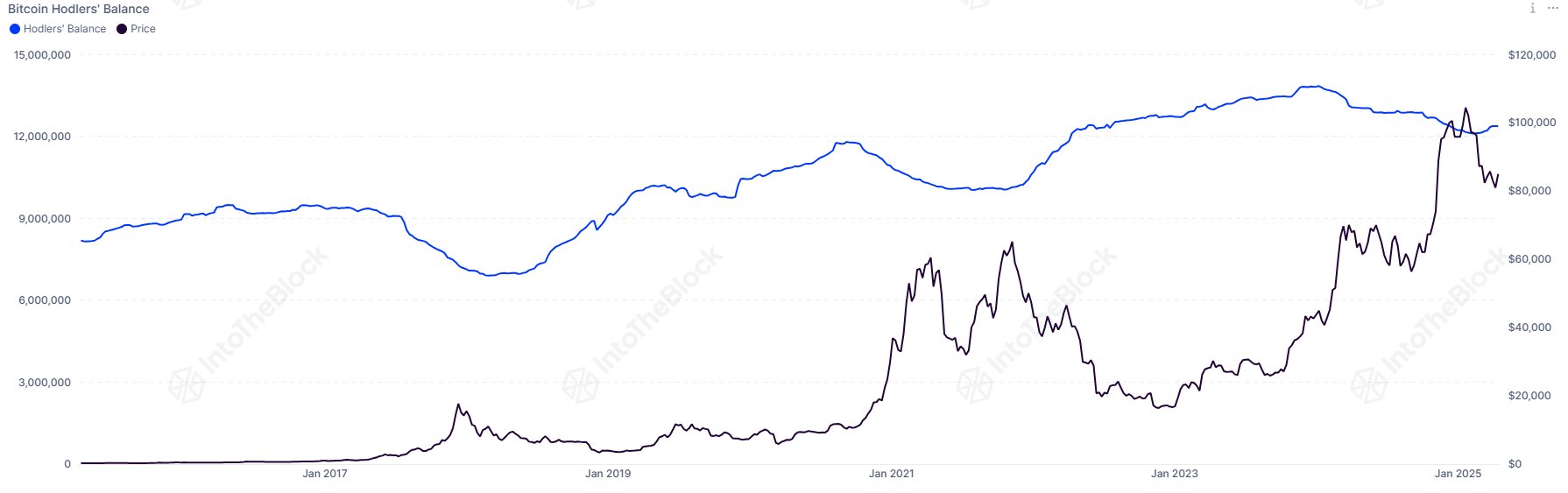

In a brand new publish on the X platform, crypto analytics agency IntoTheBlock shared {that a} dependable indicator that gives perception into Bitcoin’s cyclical habits is flashing an fascinating sign once more. The related on-chain metric right here is the long-term holders (LTH) steadiness, which tracks the quantity of BTC held by wallets for greater than a 12 months.

In accordance with IntoTheBlock’s publish on X, the Bitcoin LTH steadiness has witnessed a pointy upswing in current months, coinciding with the premier cryptocurrency’s drop from the cycle highs. The on-chain agency talked about {that a} rising long-term holder steadiness is traditionally correlated with the onset of a bear market.

Supply: @intotheblock on X

As noticed within the chart above, long-term investors are inclined to accumulate closely initially of bear markets and early accumulation phases. This sample may be seen in late 2018 and 2022, the place the LTH balances skilled a pointy improve adopted by value drawdowns.

In the end, this accumulation sample means that seasoned buyers is perhaps shifting their funding technique in anticipation of massive value actions. However, it’s value mentioning that this is also a mid-cycle breather, with the Bitcoin value consolidating now to renew its bullish run later.

Lack Of Retail Exercise Suggests Room For Upward Development

Curiously, a separate—and contrasting—piece of on-chain data has emerged, suggesting that the Bitcoin value may not have reached its cycle high simply but. This analysis is predicated on the quantity of “retail exercise by buying and selling frequency” skilled by the premier cryptocurrency throughout its final surge from $70,000 to above $110,000.

In accordance with distinguished crypto analyst Ali Martinez, Bitcoin value tops have traditionally coincided with surges in retail exercise. Martinez famous the retail exercise lacked the identical momentum when BTC’s value transfer from $70,000 to $110,000 in the direction of the top of 2024 and early 2025. If historical past is to go by, this means that there may nonetheless be room for upward progress for the flagship cryptocurrency.

As of this writing, the worth of Bitcoin stands at round $84,730, reflecting a 0.4% leap up to now 24 hours.

The worth of BTC on the day by day timeframe | Supply: BTCUSDT chart on TradingView

Featured picture from iStock, chart from TradingView

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent overview by our workforce of high expertise consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.

[ad_2]

Source link