[ad_1]

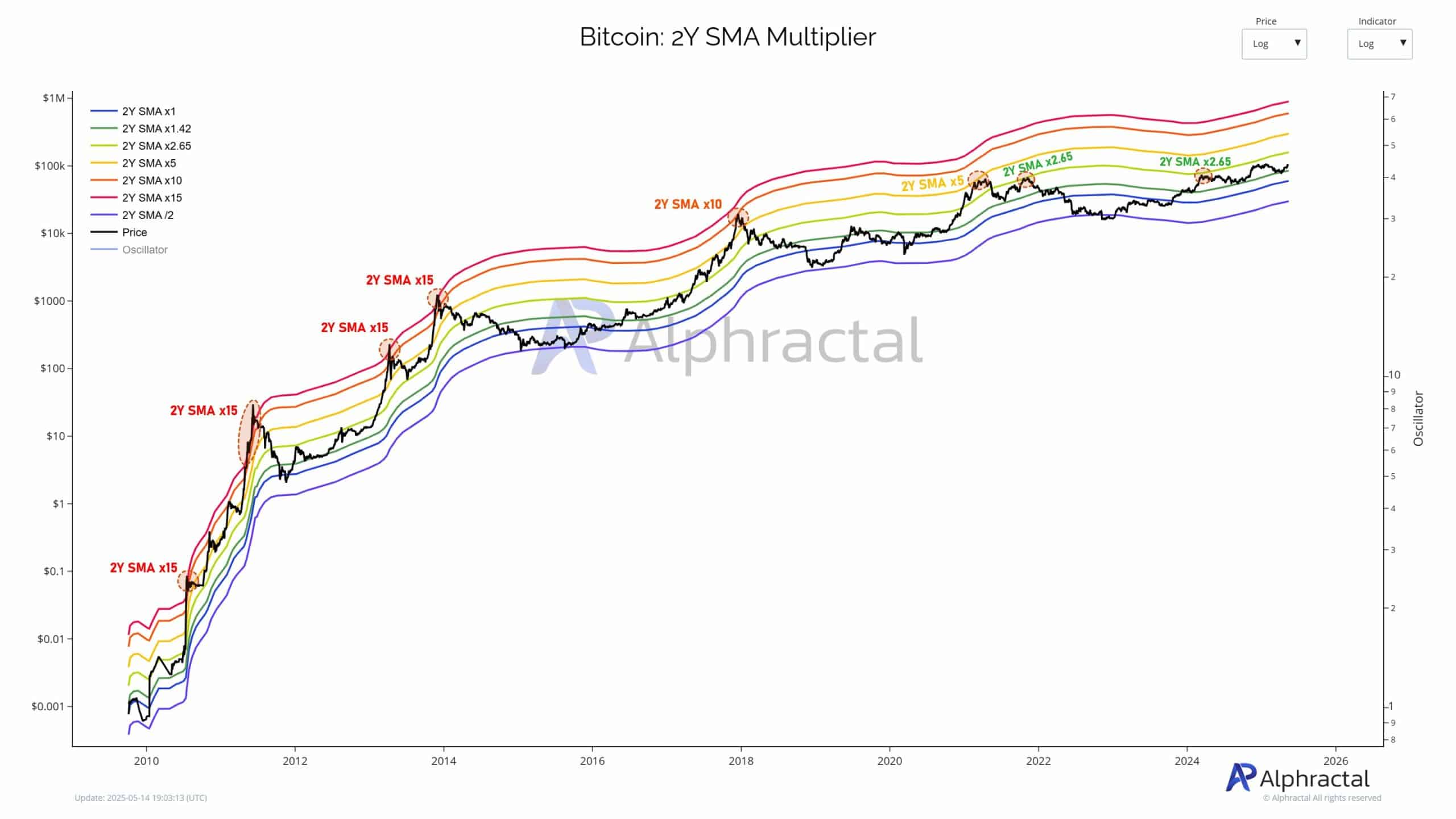

- Bitcoin’s cycle tops have steadily declined from 15× to 2.65× the 2-12 months Easy Transferring Common.

- Regardless of decrease cycle multiples, BTC is exhibiting indicators of structural energy.

Over the previous eight years, Bitcoin [BTC] has seen an enormous shift in its worth conduct because the market matures.

With every cycle, BTC’s peak has fashioned at a decrease a number of of its 2-year easy shifting common (2Y SMA), reflecting shrinking volatility and a extra steady market construction.

From wild rallies to tempered surges

Taking a look at earlier cycles, Bitcoin’s early bull runs had been explosive, with tops occurring at 15x the 2Y SMA in line with the Alphractal.

These explosive upswings signaled wild speculative progress, largely pushed by a skinny market and early adopters.

Nevertheless, from 2017, the market began altering as Bitcoin reached the worldwide market with widespread consciousness. The crypto’s progress, though staggering, was extremely subdued.

Throughout this time, the highest was reached round 10x the 2Y SMA, indicating excessive volatility amid rising maturity.

In 2021, institutional cash flooded in. But, the cycle’s peak dropped once more, first hitting 5×, then reversing round 2.65× the 2Y SMA.

This marked a structural shift: Bitcoin was not only a commerce—it was changing into a macro asset.

2.65× stays the mark—Can BTC moonshot to $159K?

In the latest cycle, Bitcoin has did not surpass the two.65× a number of once more, exhibiting a narrowing of features and indicating a extra mature asset.

At the moment, the 2Y SMA ×2.65 degree displays decrease volatility, deeper liquidity, and a mature person base. That degree now sits round $159,000. If BTC makes a significant upswing, $159k will act as the following key resistance.

As noticed above, though Bitcoin is at present experiencing diminishing cycle tops, there’s nonetheless extra room for progress.

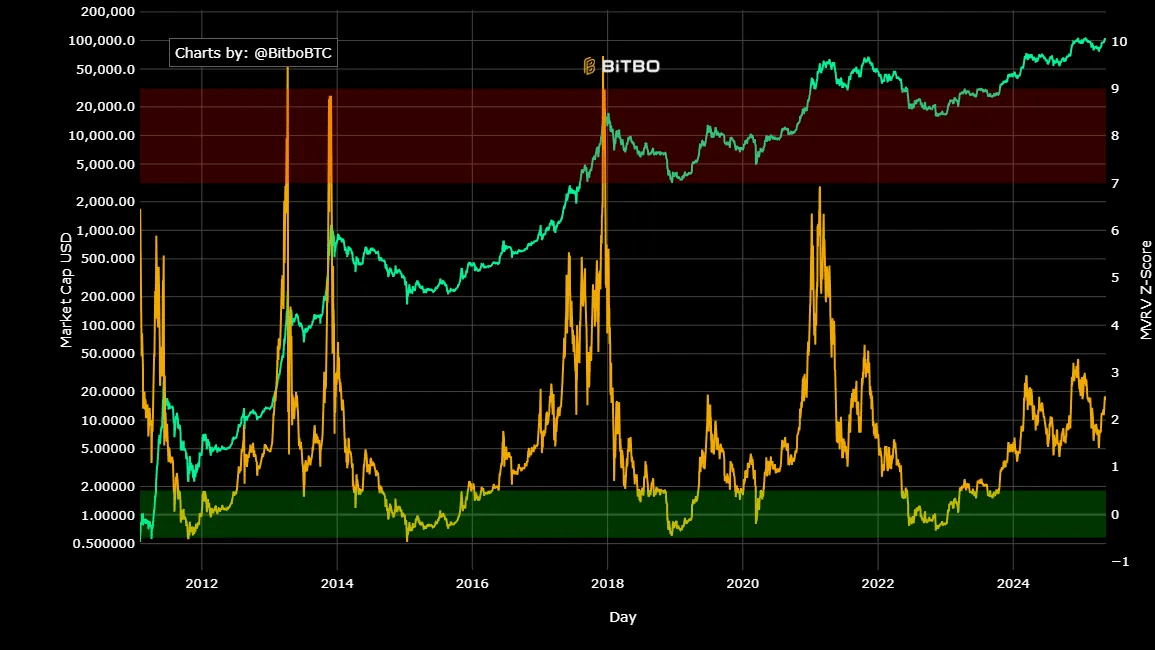

Taking a look at Bitcoin’s MVRV, it’s at present revolving round 2.4, signaling that the market remains to be beneath euphoria territory.

Traditionally, Bitcoin tops have emerged round 3.5 to 4.0. Thus, at present ranges, there’s nonetheless extra room for progress earlier than the cycle tops.

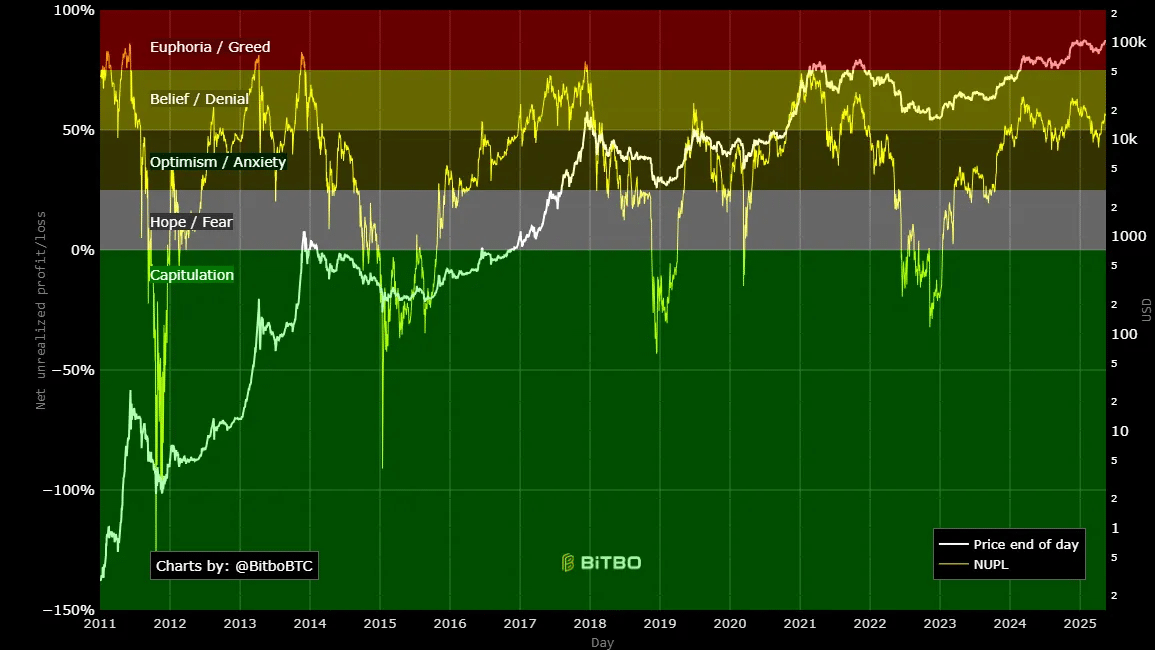

Including to that, NUPL (Web Unrealized Revenue/Loss) stays within the perception/denial zone—not but in greed or euphoria.

With vital maturity in market conduct, BTC holders are at present unlikely to pursue excessive revenue taking as they anticipate larger costs for the present cycle.

Backside line

Subsequently, though future cycles can not expertise a 15x surge, there’s nonetheless extra room for progress, the place Bitcoin is extra steady, much less risky, and dependable as an funding.

Within the prevailing market, BTC nonetheless has extra room for progress. If the momentum of the cycle holds and BTC surpasses $110k, we might see a surge to $159k ranges.

Within the brief time period, nevertheless, that is unlikely, however for the reason that market is but to achieve a prime, this degree may very well be the place markets calm down for the present cycle.

[ad_2]

Source link