[ad_1]

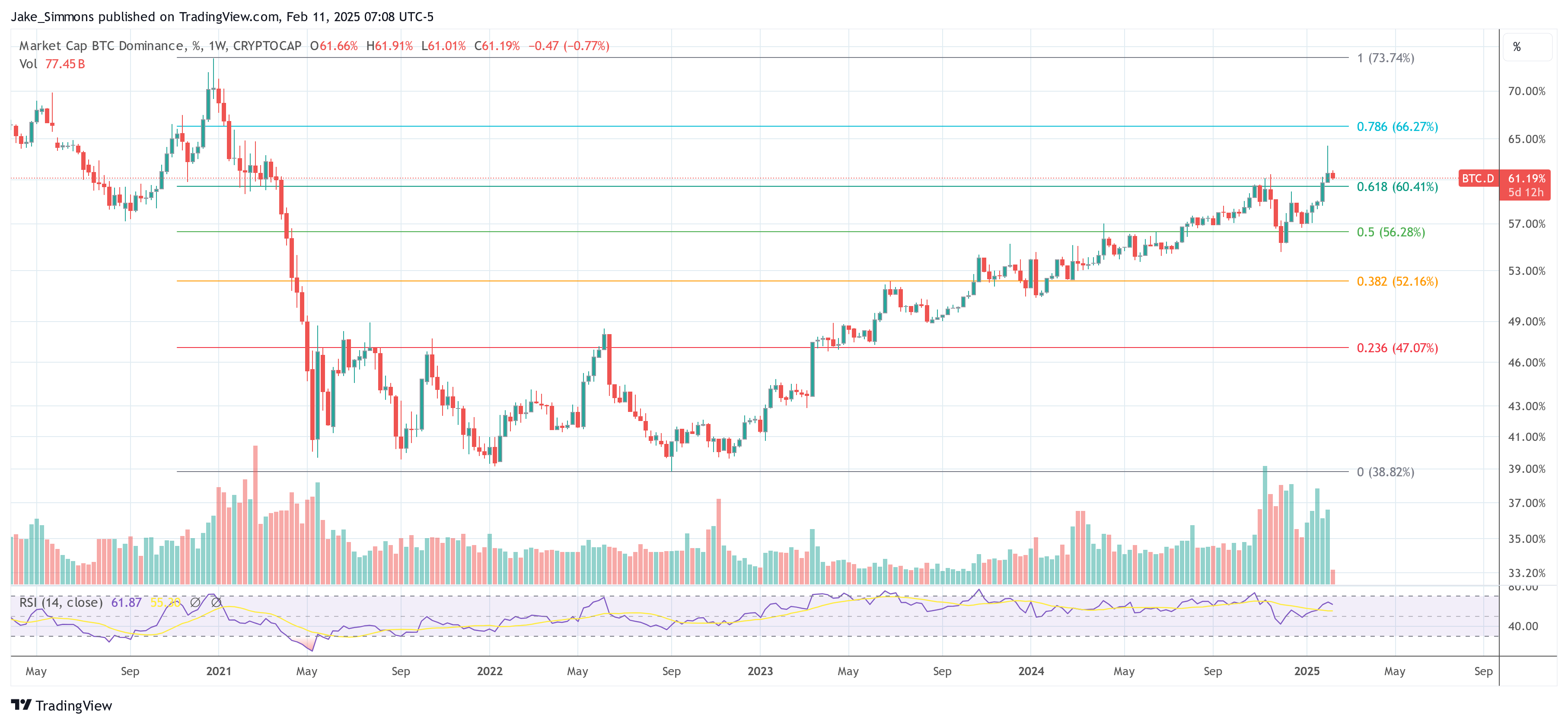

The Bitcoin dominance (BTC.D) surged above 64% this week, its highest degree since March 2021, sparking debate over an impending quick squeeze that might ship its worth skyward. The stark warning comes from Joe Consorti, Head of Development at Theya, who took to X on Monday to stipulate what he views as a decisive turning level for Bitcoin versus the remainder of the digital asset market.

A Historic Break In Bitcoin’s Correlation Patterns

In his post, Consorti contends that Bitcoin’s current worth motion marks the primary time in its 16-year historical past that each its worth and market dominance have risen in tandem. Traditionally, Bitcoin’s dominance would rise initially, solely to wane as hypothesis spilled into altcoins. Nonetheless, Consorti states: “That is the primary time in historical past that bitcoin’s share of the whole digital asset market is rising whereas its worth is climbing. In previous cycles, retail-driven hypothesis pushed bitcoin’s worth up and later funneled cash into altcoins, inflicting bitcoin dominance to decline. That dynamic is gone.”

In keeping with Consorti, the times when a broad altcoin rally would observe Bitcoin’s preliminary surge look like over. Bitcoin dominance lately touched 64%—its highest degree since February 2021. Consorti attributes the phenomenon to a major change in market participation: “This cycle, establishments, sovereigns, and long-term holders are main the cost, more and more allocating capital completely to bitcoin whereas largely ignoring the remainder of the market.”

Associated Studying

Final week’s market turbulence resulted in what Consorti calls “the single-largest liquidation event in ‘crypto’ historical past,” citing knowledge that greater than $2.16 billion in positions have been worn out inside 24 hours. Ethereum led the liquidation figures with $573 million, and the most important single liquidation—a $25.6 million ETH/BTC order—occurred on Binance. “As you may need guessed, ETH/BTC shouldn’t be having a good time,” Consorti notes, stating that the ETH/BTC pair is buying and selling at 0.026—its lowest degree in over three years.

He argues these liquidations spotlight the precarious nature of closely leveraged altcoin markets: “All of it worn out instantly when worth moved in opposition to them. This wasn’t your normal technical correction, it marks the beginning of an extinction-level occasion for altcoins.”

The “Altcoin On line casino” In Disaster

Consorti’s evaluation means that what he dubs “the altcoin on line casino” is now collapsing. He factors to failed narratives round in style tasks—Ethereum, Solana, and DeFi amongst them—which have struggled to keep up investor confidence: “Altcoins have survived purely on narratives. Every cycle, a brand new batch of narratives emerged, promising world-changing innovation. None of them lasted.”

He contrasts this with Bitcoin’s core worth proposition, which, in his view, requires no advertising: “Bitcoin, alternatively, doesn’t want a story. It doesn’t want advertising or hype. It exists, and it thrives as a result of it was constructed to do one factor—shield wealth in a world of perpetual financial enlargement.”

Consorti additionally references Ethereum’s “merge” and its supposed deflationary design, stating that because the improve, ETH’s complete provide has elevated by 13,516 ETH—undermining the “ultra-sound cash” declare.

Associated Studying

Including a coverage dimension to the market’s transformation, Consorti highlights an announcement from Senator John Boozman throughout the White Home Crypto Working Group’s first press convention: “Some digital property are commodities, some are securities.”

This, he suggests, is a tacit acknowledgment that Bitcoin stands aside from different digital property. In an extra growth, Consorti cites a remark from White Home AI & Crypto Czar David Sacks, who talked about the group is evaluating the viability of a Strategic Bitcoin Reserve—a shift from the earlier “Nationwide Digital Asset Stockpile” terminology used underneath a Trump-era government order.

Consorti frames this as a “main growth” that alerts rising recognition of Bitcoin’s distinctive properties: “This language shift is monumental. A number of years in the past, the US authorities was overtly hostile towards bitcoin. At the moment, they’re discussing stockpiling it.”

Amid this upheaval, Consorti means that the subsequent dramatic transfer in Bitcoin may very well be an explosive quick squeeze. Funding charges on perpetual futures, he notes, have gone “deeply destructive,” harking back to when Bitcoin traded close to $23,000 in August 2023. This means a tilt in leverage towards merchants betting in opposition to Bitcoin—a place that might quickly unwind: “Whereas final week’s leverage flush worn out most lengthy positions, the subsequent main transfer may very well be the other—an explosive rally fueled by compelled quick liquidations.”

Ought to the market flip in opposition to these short-sellers, the compelled buy-backs may drive the value increased with uncommon velocity and quantity—particularly if total liquidity stays skinny. He concluded, “Merchants who overextended their leverage to quick bitcoin will finally have to purchase it again when the value strikes in opposition to them, similar to overleveraged longs have been worn out final week. Bitcoin is coiled. The stage is being set for a possible quick squeeze. The longer this dynamic of quick dominance persists, the larger the danger of a compelled shirt liquidation cascade that sends bitcoin’s worth increased with drive.”

At press time, BTC.D stood at 61.19%.

Featured picture created with DALL.E, chart from TradingView.com

[ad_2]

Source link