[ad_1]

The Bitcoin worth has been in spectacular kind over the previous few weeks, breaking above the psychological $90,000 stage previously week. The premier cryptocurrency appears to be approaching the weekend with the identical — if not larger — momentum after crossing $95,000 on Friday, April twenty fifth.

Who Is Actually Behind The BTC Rally?

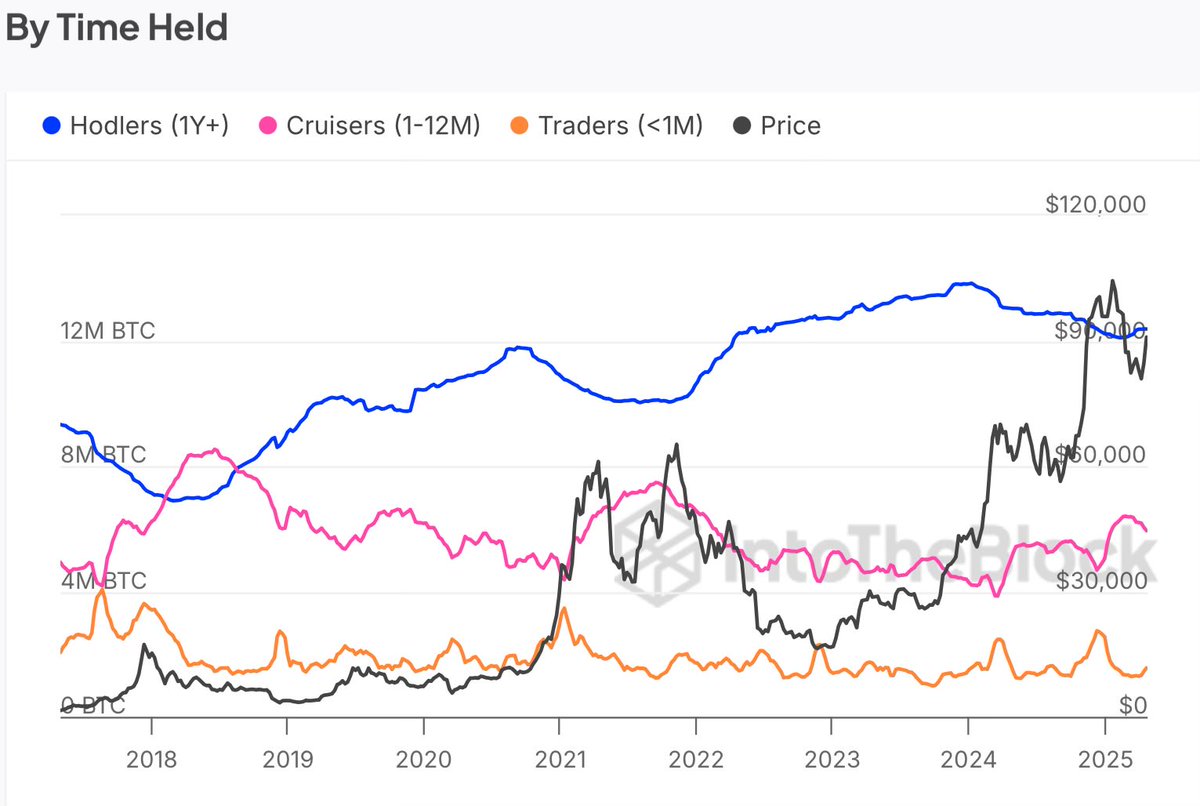

In a brand new publish on the X platform, on-chain analyst IT Tech took a deep dive into the current Bitcoin worth rally, figuring out the catalysts for the run from round $74,000 to $95,000. Based on a crypto pundit, current blockchain information reveals there was a transparent rotation of capital previously month.

This evaluation revolves across the exercise of assorted courses of Bitcoin traders (based mostly on the time spent holding their cash). Based on information from IntoTheBlock, most exercise has unsurprisingly come from the merchants (or short-term holders), who’ve elevated their stability by practically 19% previously 30 days.

IT Tech famous that these merchants, true to their reactive nature and pushed by FOMO (worry of lacking out), have been aggressively buying BTC since its worth fell to round $74,000. On the identical time, the short-term merchants haven’t taken their foot off the gasoline with the Bitcoin worth now dancing above $95,000.

Moreover, long-term holders appear to have stopped shaving off their holdings in current weeks, eradicating the “main overhead stress” on the Bitcoin worth. Based on information from IntoTheBlock, the stability of BTC long-term holders has grown by at the very least 0.3% within the final 30 days.

Supply: @IT_Tech_PL on X

Lastly, IT Tech highlighted an investor cohort dubbed “Cruisers,” with Bitcoin holdings aged between 1 to 12 months. Contemplating that their stability declined by 4.4% previously month, the on-chain analyst talked about these traders are both maturing into “Hodlers” or taking revenue.

IT Tech concluded that the Bitcoin worth may very well be coming into a speculative bullish part characterised by substantial short-term capital inflows and long-term stability. Nonetheless, the analyst warned concerning the dominance of the short-term fingers.

Given their reactive nature, extremely risky durations are traditionally correlated with the dominance of short-term holders. Which means that there could be excessive volatility in the way forward for the Bitcoin market. In any case, IT Tech believes the Bitcoin worth is but to reach the local top.

Bitcoin Value At A Look

As of this writing, Bitcoin is valued at round $95,210, reflecting a 2% improve previously 24 hours.

The worth of BTC on the day by day timeframe | Supply: BTCUSDT chart on TradingView

Featured picture from iStock, chart from TradingView

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent assessment by our staff of high expertise consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.

[ad_2]

Source link