[ad_1]

Motive to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade consultants and meticulously reviewed

The very best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Charles Hoskinson, who co-founded Ethereum and now leads the Cardano blockchain, has projected that Bitcoin may attain a value of $250,000 by the tip of this yr or subsequent yr. His prediction, made throughout a CNBC interview, comes regardless of the current droop within the wider monetary markets together with crypto.

Why Bitcoin Will Hit $250,000 Inside Much less Than 2 Years

Hoskinson emphasized that rising geopolitical tensions and evolving commerce dynamics are creating supportive circumstances for decentralized networks like Bitcoin. Talking on a world that seems to be “shifting from a rules-based worldwide order to an incredible powers battle,” he advised this shift would spotlight the constraints of conventional banking and commerce methods, steering extra transactions towards cryptocurrencies.

“If Russia needs to invade Ukraine, it invades Ukraine. If China needs to invade Taiwan, it’s going to try this. So treaties don’t actually work so nicely, and international enterprise doesn’t actually work so nicely there. So your solely choice for globalization is crypto,” Hoskinson instructed CNBC.

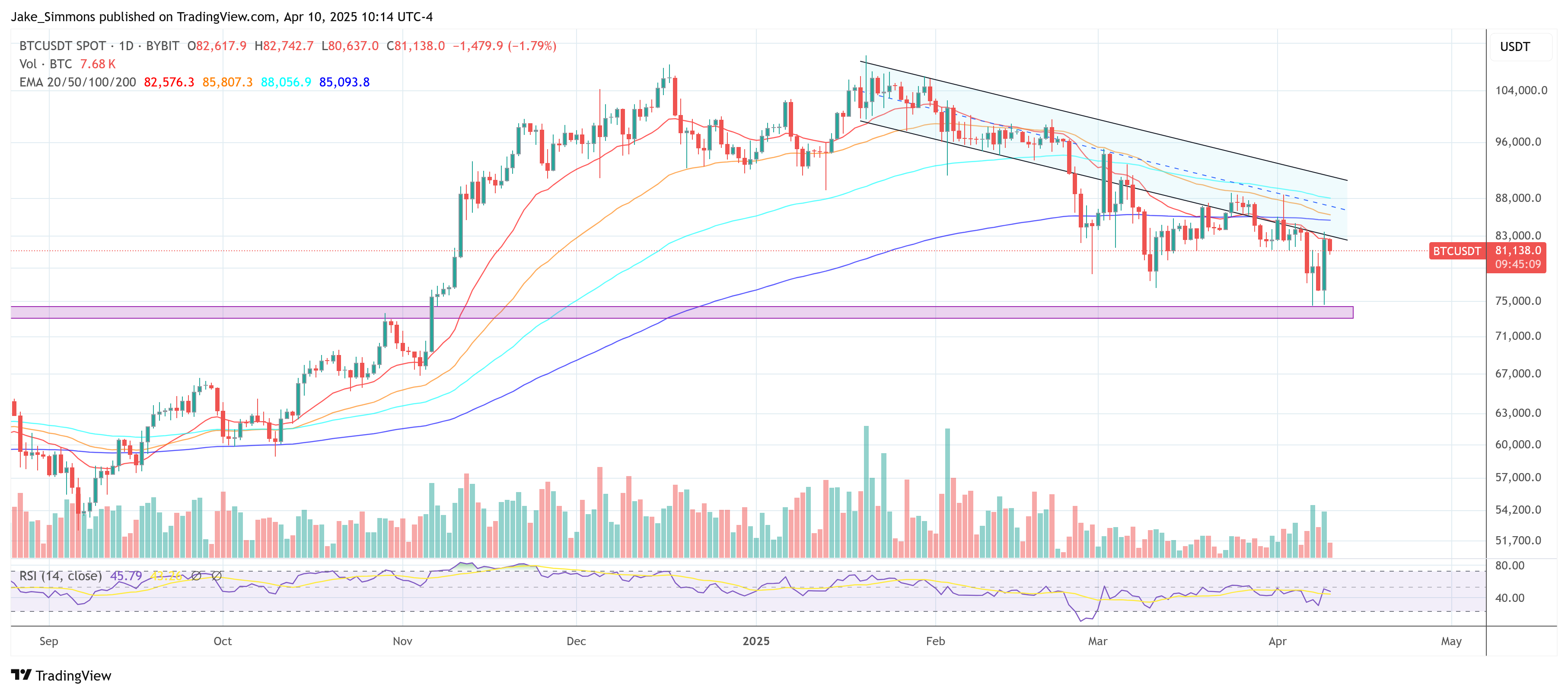

He additionally famous the numerous sell-off in crypto and different danger property, a development that has partially stemmed from US President Donald Trump’s reciprocal tariffs on nations worldwide. Bitcoin dipped beneath $77,000 over the past week earlier than briefly surpassing $83,000 on Wednesday, and stays significantly decrease than its report excessive above $100,000 set in January. Nonetheless, Hoskinson’s confidence stands: “No, I believe Bitcoin might be over $250,000 by the tip of this yr or subsequent yr.”

Among the many components which may drive such a dramatic value surge, Hoskinson pointed to the Federal Reserve probably decreasing rates of interest in response to market pressures. “You then’ll have quite a lot of quick, low cost cash, after which it’ll pour into crypto,” he stated, explaining how extra liquidity may result in renewed curiosity in digital property. The potential for large tech firms corresponding to Microsoft and Apple to enter the crypto house additionally figures into his bullish outlook.

One other part of Hoskinson’s optimism lies within the prospect of latest laws. He singled out anticipated stablecoin laws in addition to the Digital Asset Market Structure and Investor Safety Act, each of that are at present making their method by way of Congress. He believes these regulatory strikes may streamline the crypto market and pave the best way for institutional adoption.

Stablecoins, that are pegged to fiat forex and backed by real-world property, could show particularly engaging to main know-how firms trying to facilitate fast, cost-effective international transactions. “The stablecoin invoice specifically could lead on the ‘Magnificent 7’ firms to start adopting the property,” he added, referring to Apple, Microsoft, Amazon, and different mega-cap tech giants.

Hoskinson additional argued that after these regulatory frameworks develop into clearer, the market will seemingly “stall for in all probability the following three to 5 months,” earlier than “an enormous wave of speculative curiosity” re-enters the house round late summer season or fall. That renewed enthusiasm, mixed with a extra settled geopolitical panorama and a secure regulatory atmosphere, may, in his view, push Bitcoin’s value as excessive as $250,000.

At press time, BTC traded at $81,138.

Featured picture from YouTube, chart from TradingView.com

[ad_2]

Source link