Cause to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business specialists and meticulously reviewed

The best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Dogecoin’s muted spring rally has reignited a perennial retail query: can the world’s best-known meme coin break the $1 barrier earlier than the present market upswing exhausts itself? In a 13-minute market replace revealed on Sunday, unbiased strategist Kevin—recognized on-line as Kev Capital TA—answered with an unequivocal “sure,” pointing to a confluence of long-term Fibonacci targets, momentum indicators and a macro backdrop he believes is lastly turning supportive for high-beta crypto belongings.

Is $1 Practical For Dogecoin?

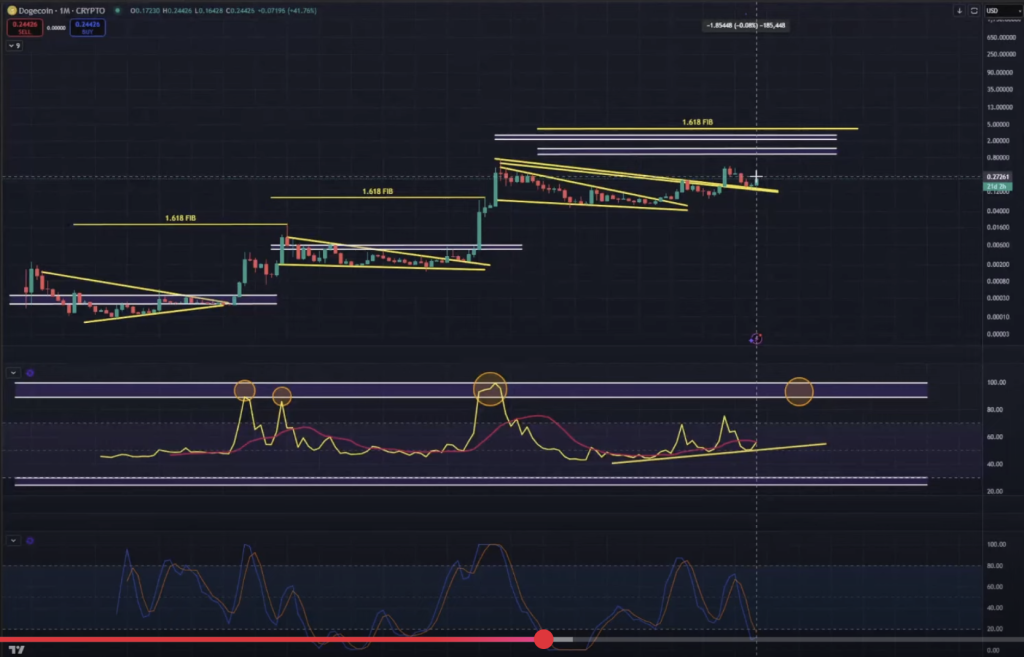

“Can Dogecoin hit $1 this cycle? The reply is sure, it completely can,” Kevin advised his followers on the outset of the video. He argued that Dogecoin is now in its third main cycle and has traditionally advanced to the 1.618 Fibonacci extension on the month-to-month chart. That extension presently sits at roughly $3.80, “effectively above a greenback,” he famous, whereas stressing that citing the extent is “not a value name” however a strategy to body upside potential.

Associated Studying

Kevin’s conviction rests on momentum gauges that, in his studying, present Dogecoin barely warming up. On the month-to-month relative-strength index, he traced an ascending development that has been intact for the reason that post-Luna crash lows in June 2022. “We hit roughly 50 cents with the month-to-month RSI at 75,” he mentioned, including that in prior cycles the indicator climbed to no less than 89.4. “Look how a lot room we’ve got to go.” A contemporary bullish crossover within the month-to-month stochastic oscillator would, in his view, verify the transfer.

The analyst additionally linked Dogecoin’s prospects to a macro combine he characterises as more and more benign: expectations for US price cuts, a deceleration in quantitative tightening and an increase in world liquidity. He contended that these forces, coupled with a downturn in Bitcoin dominance that his desk referred to as on 28 April at 65.45%, create the situations for a traditional “alt-season.” “Altcoins are oscillators to Bitcoin… financial coverage being simpler on the economic system is what drives that liquidity into the market,” he defined.

Key chart landmarks stay in focus. Kevin cited a “good inverse head-and-shoulders” accumulation which he entered at a mean value of $0.15—now “up 65–70%”—and set sequential targets at $0.48 and the earlier all-time excessive close to $0.74. The $1 degree would observe provided that liquidity developments proceed to enhance and Bitcoin dominance “durably” breaks down. “Realistically, if we maintain seeing this path of easing financial coverage… we will completely see Dogecoin at a greenback by the top of the 12 months,” he concluded.

Associated Studying

Sceptics may flag Dogecoin’s 2021 spike—fueled by social-media fervour and Elon Musk’s “Saturday Evening Dwell” look—as a one-off occasion; Kevin counters that the identical Pi-cycle moving-average pair that nailed prior tops is “nowhere close to crossing,” implying headroom earlier than froth returns. The shorter-term yellow common, he mentioned, “received’t even begin transferring increased till Dogecoin hits 40 to 41 cents,” leaving a notional 145% cushion between as we speak’s value and $1 even in an advancing market.

Though Kevin acknowledged that “we’re right here to make cash, we’re not right here to get hooked up,” he tempered expectations of parabolic targets circulating on social media. “We’re not going to show this right into a Dogecoin to $35 video… It is a video based mostly on info,” he advised viewers, urging them to deal with $1 as an formidable however data-driven milestone slightly than a assure.

With Dogecoin hovering close to $0.25 at press time, the meme coin would want a four-fold rally to tag the psychologically potent greenback mark.

Featured picture created with DALL.E, chart from TradingView.com