Coinspeaker

Chainlink Tops the List of DeFi Protocols by Dev Activity as LINK Price Eyes $21 Resistance

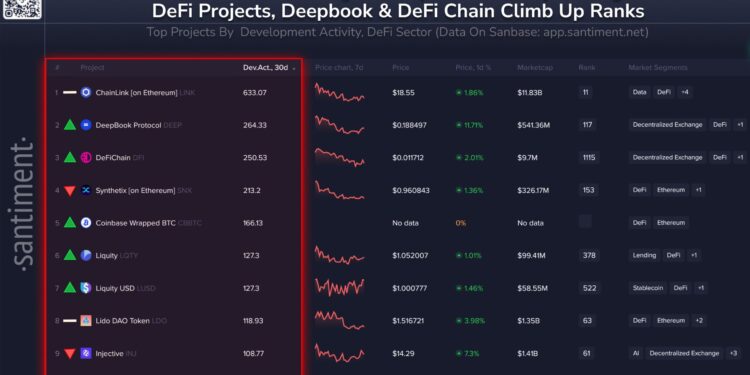

Whereas the crypto market lacks pleasure on the subject of costs, a significant improvement is going down behind the scenes within the decentralized finance (DeFi) sector. Chainlink (LINK), a blockchain oracle protocol, dominates the record of prime DeFi protocols by improvement exercise. In the meantime, DeepBook Protocol and DeFiChain have proven exceptional development of their rankings as properly.

As per the data posted by blockchain evaluation platform Santiment on X (previously Twitter), Synthetix

SNX

$1.01

24h volatility:

5.1%

Market cap:

$343.93 M

Vol. 24h:

$39.63 M

dropped to fourth within the rankings within the final 30 days, whereas DeepBook Protocol and DeFiChain have climbed up the ranks, securing the second and third positions, respectively.

Photograph: Santiment

Coinbase’s CBBTC secured the fifth spot, whereas Liquity and its stablecoin counterpart, Liquity USD, are making strides within the house, claiming the sixth and the seventh spots, respectively. Lido DAO continues to dominate the Ethereum staking sector, ranked eighth, whereas Injective dropped to the ninth spot. Additionally, as one of many main decentralized exchanges, Uniswap

UNI

$9.44

24h volatility:

3.8%

Market cap:

$5.67 B

Vol. 24h:

$288.49 M

rounded out the record, claiming the tenth rank.

Traders have remained bullish on Chainlink, with some market individuals calling the cryptocurrency the spine of the DeFi sector. Crypto traders additionally spotlight the foremost partnerships gained by Chainlink, together with the integration of the DLT on the base infrastructure stage of the SWIFT community.

Chainlink (LINK) Value Evaluation

LINK

$18.71

24h volatility:

2.6%

Market cap:

$11.93 B

Vol. 24h:

$547.21 M

is buying and selling at a value of $18.80, up 0.36% up to now day. The altcoin has dropped 7.78% up to now week and is buying and selling at a reduction of 64.74% to its all-time excessive of $52.88 witnessed in Could 2021. In the meantime, the day by day chart supplied by TradingView under signifies that the closest assist zone for Chainlink lies round $16-$17, the place patrons beforehand stepped in. A breakdown under this might result in additional draw back.

Photograph: TradingView

The 20-day Exponential Transferring Common at $21.03 is the fast resistance, adopted by $24.00. Whereas LINK continues to be in a short-term bearish section, traders may see a aid rally if it breaks above $21.03. However, the Relative Energy Index (RSI) reads a price of 37.96, indicating that LINK is within the decrease vary of momentum however not but oversold. A check of the oversold ranges may result in a possible bounce.

Lastly, the MACD indicator confirms that the bears are in management, with the MACD line (blue) under the sign line (purple). This means that bearish strain continues to be current, though the histogram is exhibiting indicators of flattening, which may point out a slowdown in promoting momentum.

Chainlink Tops the List of DeFi Protocols by Dev Activity as LINK Price Eyes $21 Resistance