- The ETH/BTC pair hovered close to cycle lows, however key help round 0.05 BTC might present a launchpad.

- If BTC dominance declines, capital could rotate into ETH, driving a rebound within the pair.

The U.S. Greenback Index (DXY) has plunged to new lows, fueling speculation about capital rotating into threat belongings, significantly crypto. Traditionally, a weakening greenback has supported liquidity inflows into Bitcoin [BTC] and Ethereum [ETH].

Trump’s import tax hike intensified sell-side strain on the U.S. greenback, pushing it again to pre-election ranges. Nevertheless, AMBCrypto’s evaluation highlighted an important shift – BTC and DXY have decoupled, lowering the greenback’s reliability as a number one crypto market indicator.

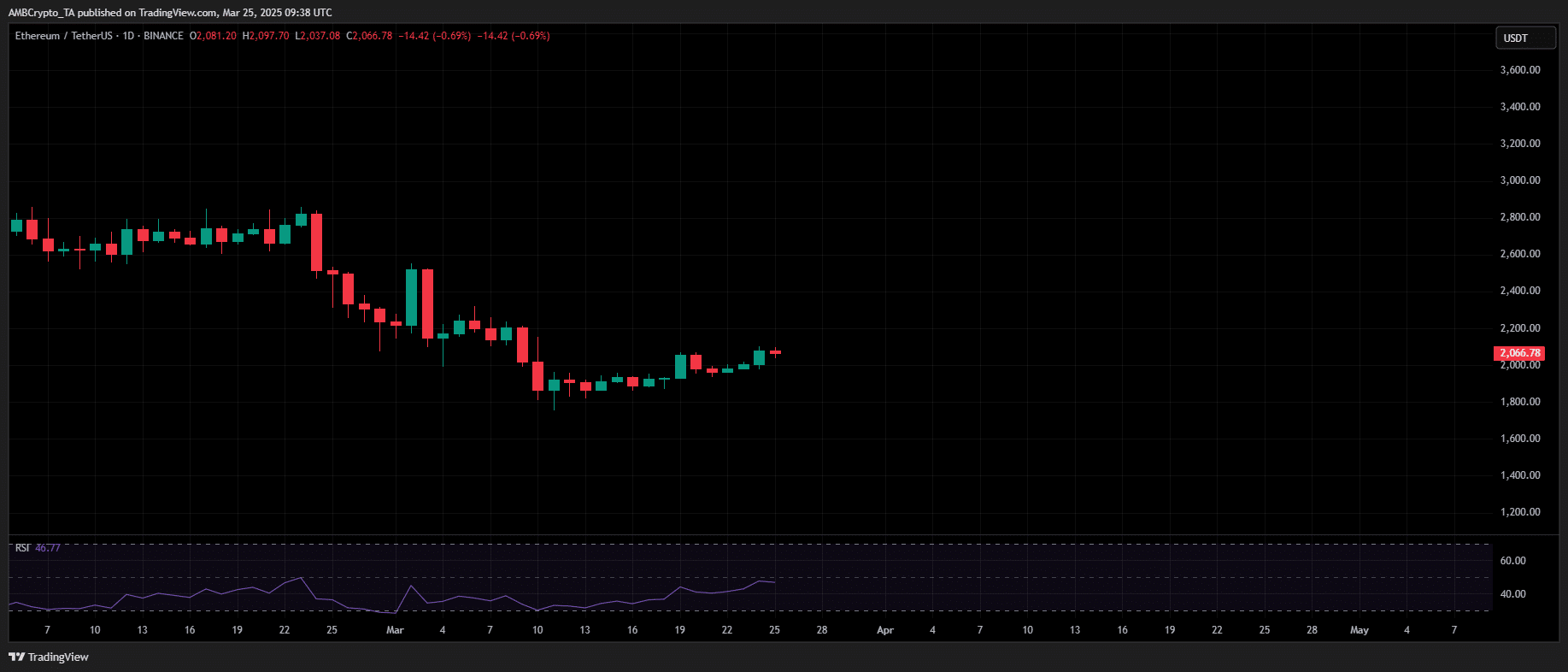

But, macroeconomic catalysts stay in play. As quickly as U.S. President Donald Trump announced a tariff break, Bitcoin reclaimed $86k after buying and selling beneath this degree for seventeen days, whereas Ethereum surged previous $2k.

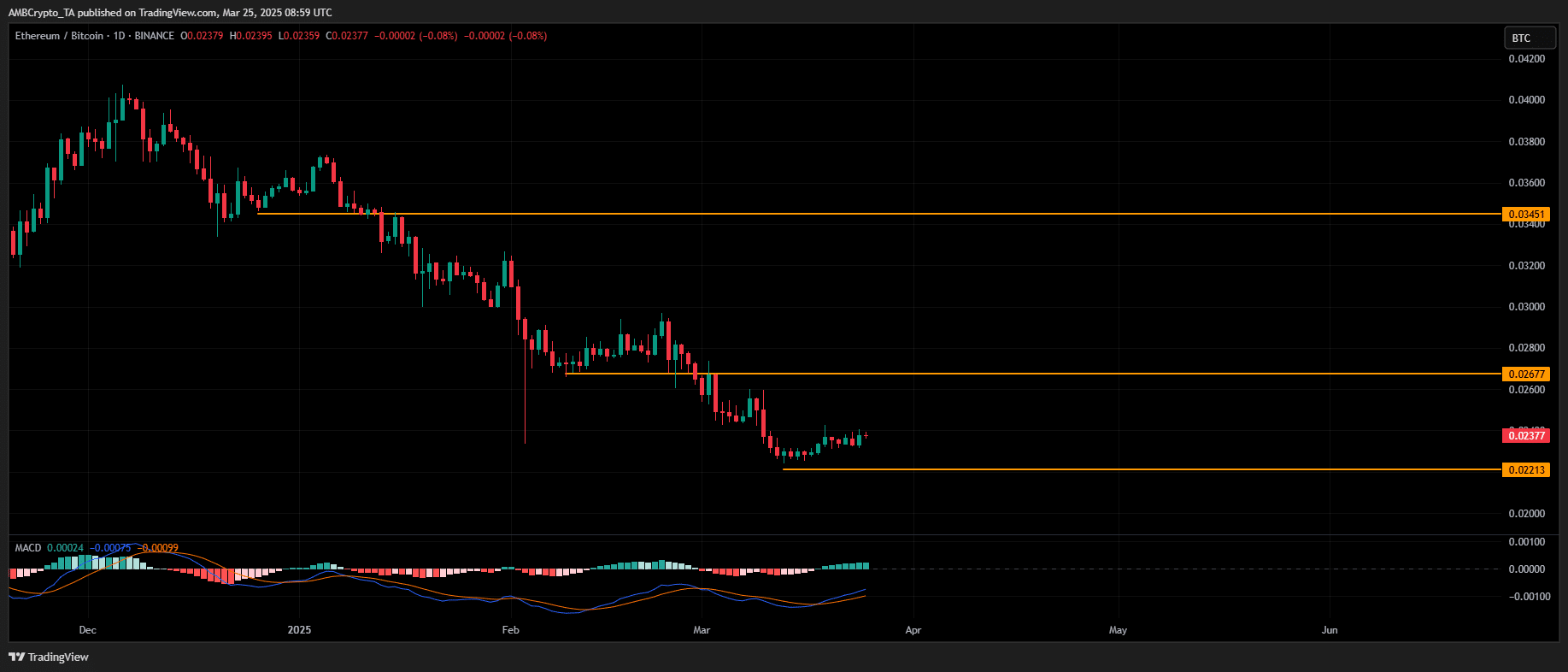

BTC’s present non-linear value motion presents ETH with a window to draw capital. The ETH/BTC pair indicators rising momentum because the MACD flips bullish for the primary time in almost a month.

A well-defined help cluster has fashioned, marking the third compression part in three months – a sign of a possible breakout and development reversal in ETH’s favor.

If the breakout construction is confirmed, analysts project a transfer towards 0.0019 BTC per ETH, with the pair at present hovering round 0.002 BTC.

Nevertheless, technicals alone gained’t do. In prior demand zones, consumers didn’t maintain accumulation, resulting in liquidity depletion and a breakdown to a five-year low.

If historical past repeats, the probability of additional liquidity sweeps stays elevated. In such a state of affairs, ETH/BTC might lengthen its draw back, additional weakening Ethereum’s relative power towards Bitcoin.

ETH/BTC: Breakdown continuation or development reversal?

For a confirmed ETH/BTC reversal, a BTC retracement stays a important set off.

Present market construction identifies $89k as a significant resistance zone for Bitcoin, the place a previous breakout try failed on the twenty fourth of March, reinforcing overhead provide.

If BTC faces sustained rejection at this degree, a corrective transfer might unlock ETH/BTC rotation, providing a possible bid for Ethereum dominance.

Nevertheless, bullish conviction seems weak. Because the post-election rally, ETH has proven an elevated correlation to BTC’s draw back, persistently forming decrease highs.

On the third of March, BTC’s 8.54% single-day drawdown led to a 14.66% ETH decline.

This structural shift suggests Ethereum is changing into more and more reactive to Bitcoin’s drawdowns moderately than benefiting from capital rotation.

If BTC retraces sharply, ETH dangers shedding the $2K liquidity zone, probably driving ETH/BTC to contemporary cycle lows.