Key Notes

- So long as the ETH worth defends the $2,468 stage, it might pave the best way for a rally to $3,900, in line with Rekt Capital.

- SharpLink Gaming has filed with the SEC to lift $1 billion for buying Ethereum as a part of its company treasury technique.

- REXShares has filed a prospectus for Solana and Ethereum staking ETFs, signaling rising institutional curiosity.

.

Amid the broader market sell-off, the Ethereum (ETH) worth has dropped to $2,500 not too long ago, nevertheless, on-chain knowledge and rising inflows into spot Ethereum ETFs present {that a} restoration to $3,000 may very well be coming quickly. Moreover, SharpLink Gaming has filed a prospectus with the U.S. Securities and Change Fee for $1 billion widespread inventory providing to construct its Ether Treasury.

On-Chain Metrics Assist Ethereum Worth Restoration

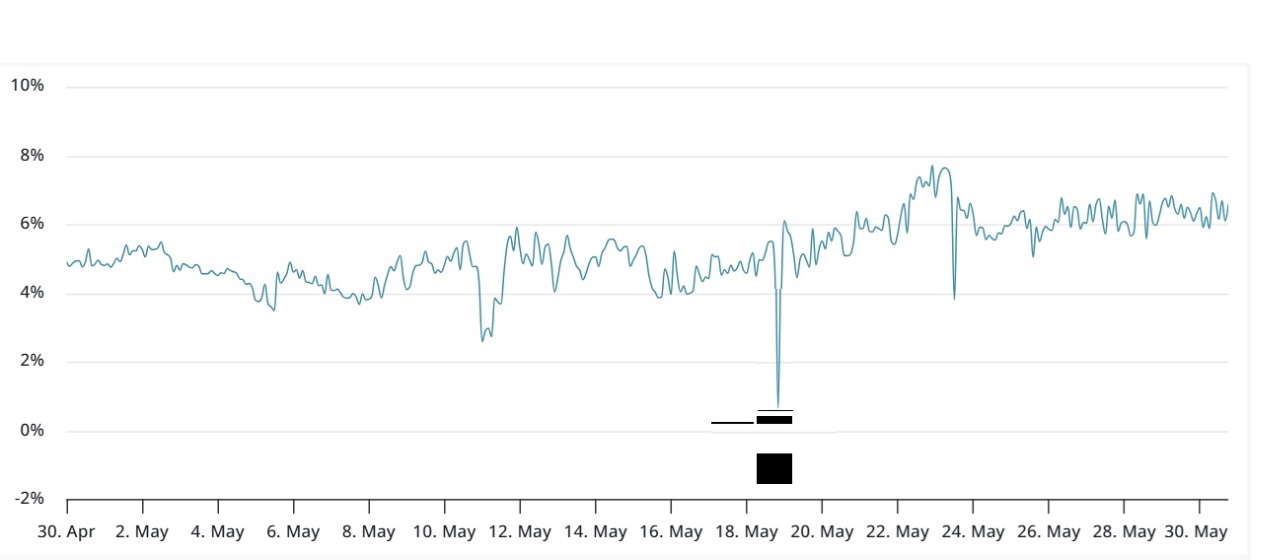

A number of the key on-chain metrics clearly help ETH price recovery within the close to time period. Following the rejection at $2,700, Ethereum corrected 9% within the final two days, dropping to $2,500 as soon as once more. This led to $160 million in liquidations in bullish leveraged ETH futures positions. Nonetheless, regardless of this drop, ETH futures’ annualized premium continues to remain close to 6%.

In impartial market situations, the premium often floats between 5% to 10%, reflecting the compensation sellers look for delayed settlement.

Amid the current rejection at $2,700, the ETH worth has confronted some pullback within the final two days. However as per knowledge from Rekt Capital, so long as the altcoin defends $2,468, the gates for a rally to $3,900 stay open from right here.

Ethereum has been efficiently retesting black as help for the previous few weeks

In doing so, Ethereum is repeating early 2024 historical past (inexperienced circle) with a profitable retest, the one distinction is that it has simply taken longer this time#ETH #Crypto #Ethereum https://t.co/MbGqBBZxCI pic.twitter.com/6RIWCEqYTJ

— Rekt Capital (@rektcapital) May 29, 2025

SharpLink Gaming Information With US SEC For $1 Billion ETH Purchases

In its submitting to the U.S. Securities and Change Fee (SEC) on Friday, Might 1, SharpLink Gaming plans to conduct $1 billion widespread inventory providing with the intention to enhance the holdings in Ethereum Treasury. The SEC filing notes:

“We intend to make use of considerably all the proceeds from this providing to amass Ether, the native cryptocurrency of the Ethereum blockchain, generally known as “ETH”.

The event follows SharpLink’s Might 27 announcement of its plans to introduce an Ethereum-based company treasury technique. In a major transfer, the corporate additionally appointed Ethereum co-founder Joseph Lubin as chairman of its board of administrators. Following the information, SharpLink Gaming’s inventory skyrocketed, surging 400% throughout the Might 27 buying and selling session.

Ethereum futures annualized premium | Supply: Laevitas.ch

REX Shares information for Staking on Ethereum ETFs

As per the current submitting by REX Shares, staking for spot Ethereum ETFs may very well be coming inside the subsequent few weeks. James Seyffart, Bloomberg’s distinguished ETF analyst, has revealed that REXShares has filed an efficient prospectus to introduce Solana and Ethereum staking ETFs in the USA.

These funds, structured as 40-Act funds, make the most of a singular strategy that bypasses the normal 19b-4 approval course of.

Alternatively, inflows into spot Ethereum ETFs have picked up tempo as soon as once more. The Ether ETFs have recorded ten consecutive days of inflows, with BlackRock’s iShares Ethereum Belief (ETHA) making a majority contribution.

Disclaimer: Coinspeaker is dedicated to offering unbiased and clear reporting. This text goals to ship correct and well timed data however shouldn’t be taken as monetary or funding recommendation. Since market situations can change quickly, we encourage you to confirm data by yourself and seek the advice of with knowledgeable earlier than making any choices primarily based on this content material.

Bhushan is a FinTech fanatic and holds aptitude in understanding monetary markets. His curiosity in economics and finance draw his consideration in the direction of the brand new rising Blockchain Know-how and Cryptocurrency markets. He’s repeatedly in a studying course of and retains himself motivated by sharing his acquired information. In free time he reads thriller fictions novels and typically discover his culinary abilities.