[ad_1]

- Ethereum’s demand facet stays robust, signaling potential for additional development.

- ETH has dropped by 2.61% over the previous 24 hours.

Since reaching $4.1k two months in the past, Ethereum [ETH] has failed to take care of an upward momentum. Over this era, it has skilled excessive volatility, even dropping as little as $2.1k.

These market situations have woke up robust sentiments amongst crypto analysts, with some being optimistic whereas others are extremely pessimistic.

A kind of who’ve proven excessive optimism regardless of the value wrestle is CryptoQuant’s analyst Mac, who has identified that Ethereum nonetheless has room for development.

Why Ethereum can develop extra

In response to the CryptoQuant analyst, regardless of the prevailing detrimental provide facet components, Ethereum’s potential for upward development stays considerably excessive.

This upward potential will be seen by way of 4 main components. First, Ethereum’s present realized value was round $2.2k at press time, which was significantly undervalued, in comparison with its value of $2.6k.

2.2k serves as a robust help stage, as such, the circulating MVRV primarily based on the realized value yields a worth above 1. At this stage, it signifies that ETH is very undervalued.

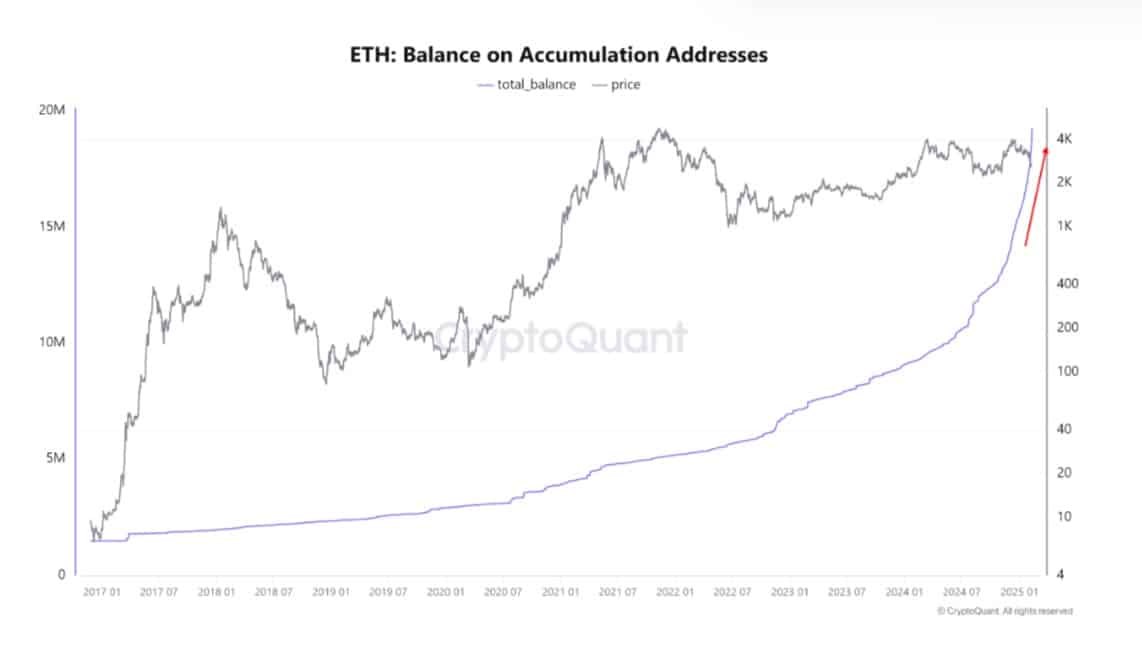

Second, Ethereum’s variety of everlasting holders who’ve gathered Ethereum and by no means bought has skilled a sustained rise.

Whereas some whales might have closed their positions, everlasting holders have absorbed this promoting stress.

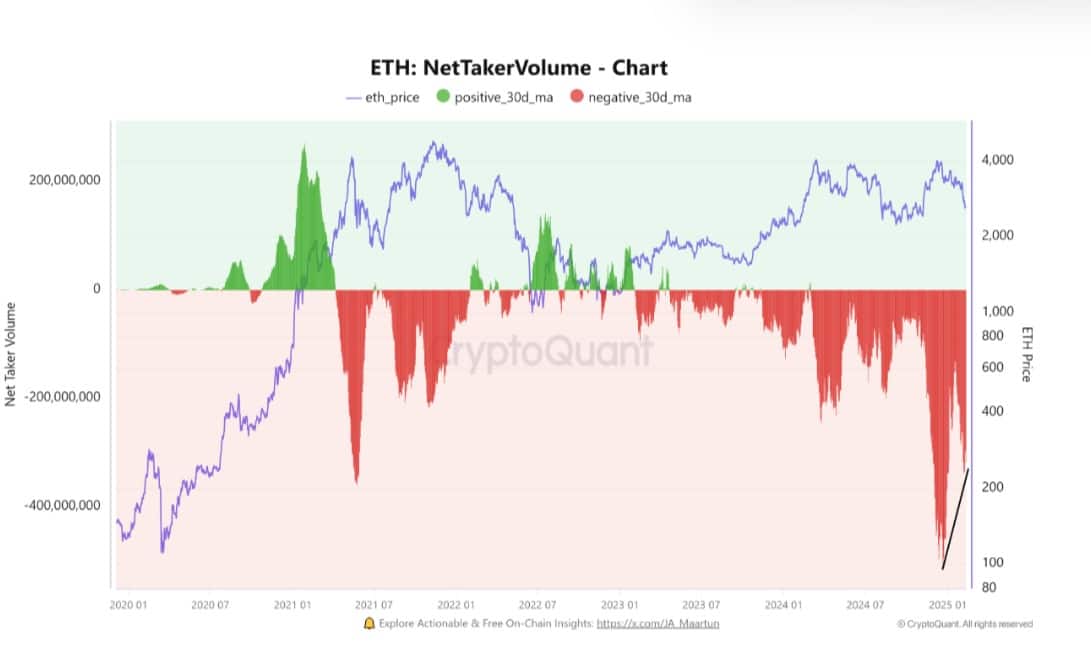

Third, Ethereum has seen the promoting stress within the futures market scale back. This means that though costs have declined, the promoting stress has additionally decreased, suggesting a relative influx of shopping for energy.

Lastly, institutional traders are aggressively accumulating Ethereum. When ETH’s value plunged, establishments turned to purchase the dip.

Thus, BlackRock purchased 100.5k ETH value $276 million, Cumberland ETH value $174 million, and different establishments similar to WLFI are actively shopping for.

This shopping for stress is vital because it’s performing as an element offsetting downward stress.

Subsequently, though Ethereum is struggling to maintain features, there are constructive components from the demand facet.

What ETH’s charts say

Notably, ETH was experiencing constructive sentiment from the demand facet.

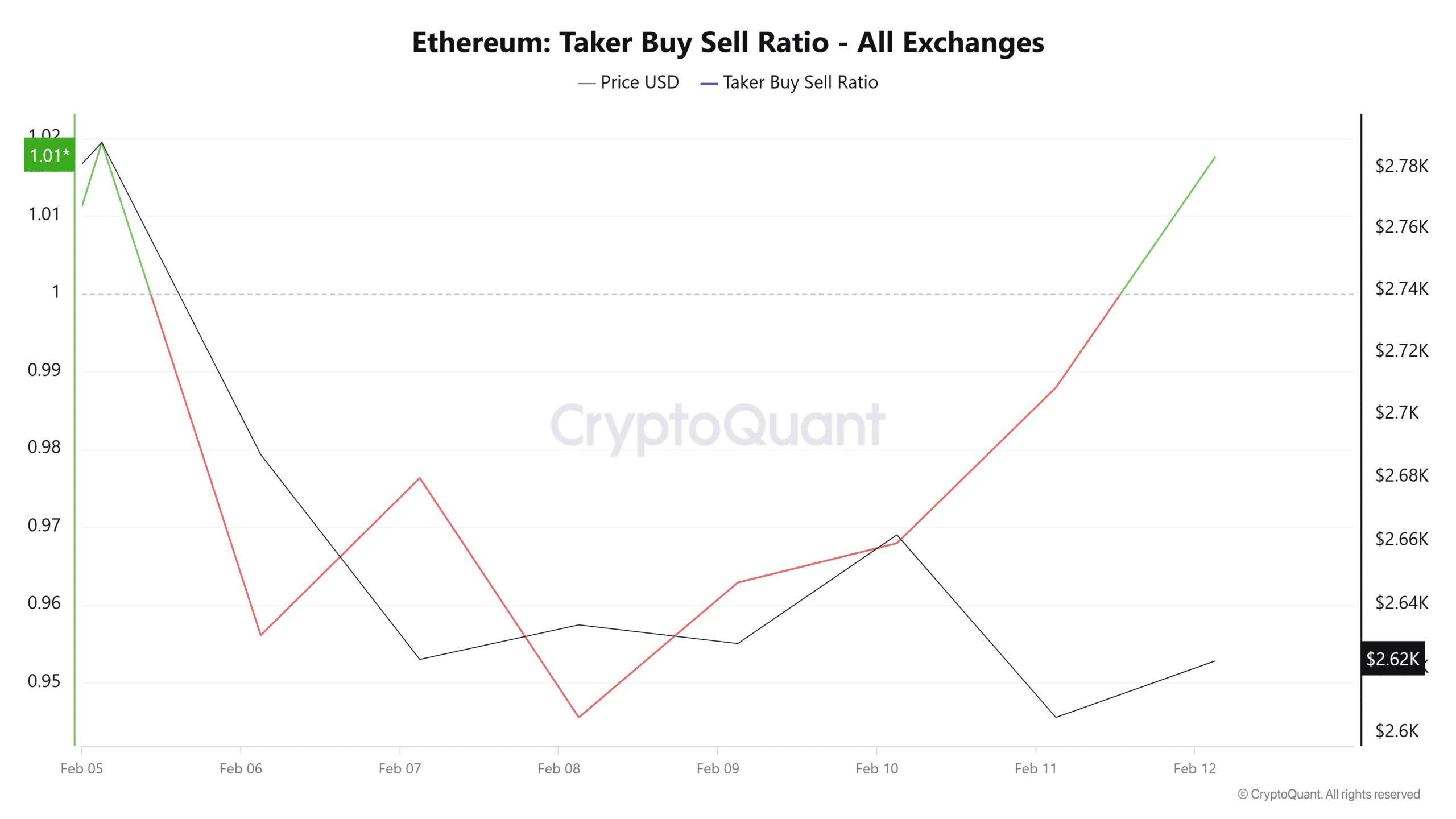

At press time, Ethereum’s Taker buy-sell ratio flipped constructive to achieve 1.05 after being detrimental for the previous 5 days. This suggests that consumers have reentered the market and are outweighing sellers.

Moreover, Ethereum’s Fund market premium has flipped constructive for the primary time this week.

When FMP turns constructive, it means that traders are bullish and longs are paying shorts to carry their commerce as they anticipate the market to rebound.

Lastly, Ethereum’s trade reserve is at a yearly low, suggesting that traders are actively accumulating ETH. As such, extra ETH is transferring off exchanges, suggesting that traders are holding their property in chilly storage.

In conclusion, though Ethereum is struggling on the availability facet, the demand is excessive. With a excessive demand, ETH might see the market strengthen to reclaim a better resistance.

Subsequently, with the availability and demand sides nonetheless combating for management, ETH will proceed to commerce sideways till the markets and macroeconomic situations are robust sufficient for an uptrend.

[ad_2]

Source link