[ad_1]

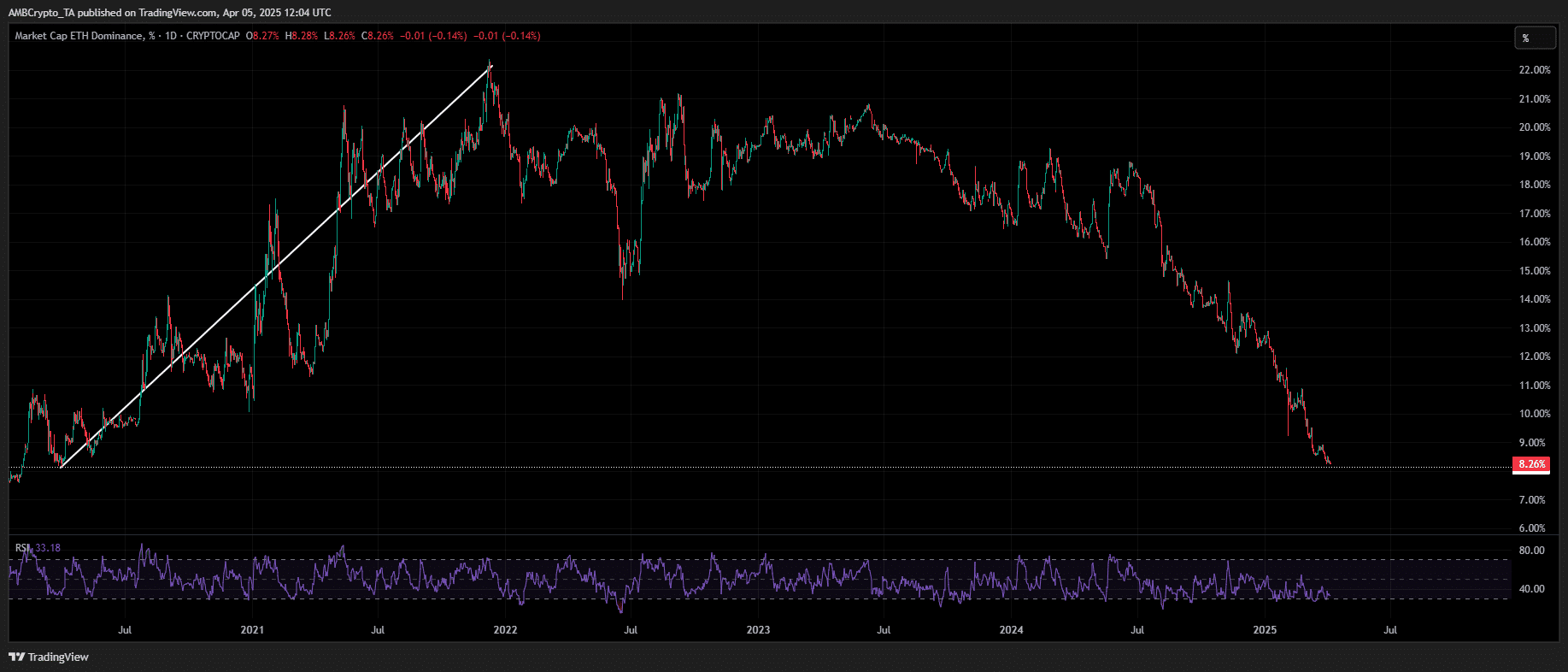

- Ethereum dominance has collapsed to a five-year low of 8%.

- AMBCrypto’s knowledge reveals Ethereum’s dominance has declined since mid-2024, regardless of a bullish cycle.

Ethereum [ETH] emerged as considered one of Q1’s greatest high-cap underperformers.

Whereas its worth drawdown stays in focus, a extra regarding metric is its market dominance, which has plunged to a five-year low of 8%.

In truth, it’s the metric that has retracted ranges final witnessed throughout the COVID-induced market cycle.

Again then, ETH dominance staged a pointy Q2 restoration, reclaiming a double-digit foothold.

Nevertheless, this time, key technicals diverge – RSI stays anchored in oversold territory, failing to reset regardless of ETH buying and selling at a two-year low.

Clearly, Ethereum’s risk-off sentiment stays elevated, suppressing fresh retail inflows and limiting upside momentum. Given the present situations, a 2020-style dominance resurgence seems unlikely.

Moreover, past on-chain metrics and technicals, a broader structural shift is obvious.

AMBCrypto’s evaluation of the chart above highlights Ethereum’s sustained dominance downtrend since mid-2024, regardless of a traditionally bullish macrocycle.

Key catalysts – together with post-halving capital rotations, the Trump rally, and the Federal Reserve’s three charge cuts – didn’t ignite a significant restoration.

Regardless of these tailwinds, ETH closed the 12 months with a modest 47% annual achieve.

Nevertheless, its market dominance eroded by 4%, retracing to 12% by This autumn 2024, underscoring persistent “relative” weak spot towards broader market trends.

Ethereum dominance declines towards macro traits

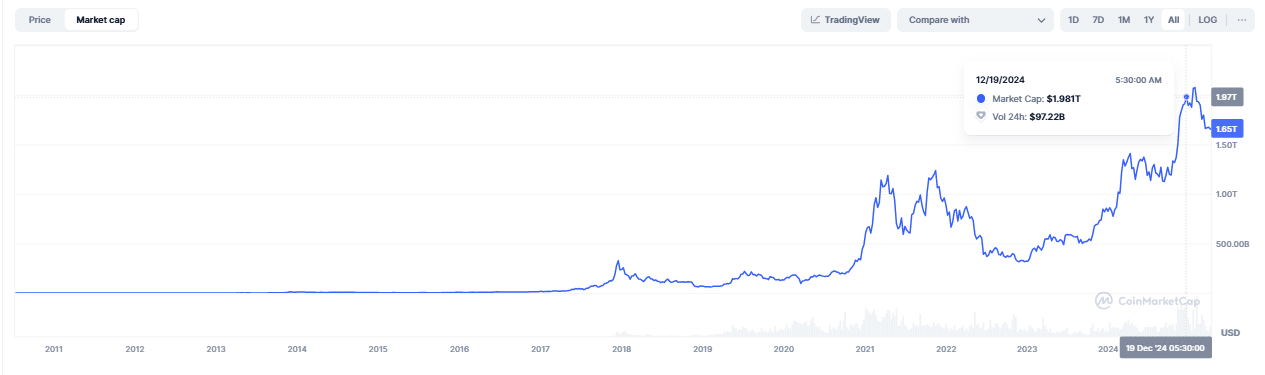

As Ethereum’s dominance eroded all through 2024, Bitcoin’s market dominance (BTC.D) surged from 54% to 61% by mid-This autumn, propelling BTC’s whole market capitalization close to the $2 trillion milestone for the primary time in historical past.

This shift underscores ETH’s relative weak spot, pushed by aggressive capital rotations into Bitcoin, fueled by macro-driven risk positioning and speculative front-running of a possible “Trump pump.”

An identical capital stream imbalance is now unfolding. Institutional demand for Bitcoin has dominated since March, whereas ETH ETFs proceed to bleed outflows, signaling weak conviction.

As macro uncertainty deepens, institutional liquidity will dictate market stability. Bitcoin is more and more cementing its position as a risk-off asset.

In the meantime, Ethereum continues to lose market share – its five-year dominance low reinforcing the narrative of persistent capital rotation away from ETH.

[ad_2]

Source link