- Whale wallets elevated holdings to 16.793 million ETH as Alternate Netflows confirmed a pointy rise in outflows.

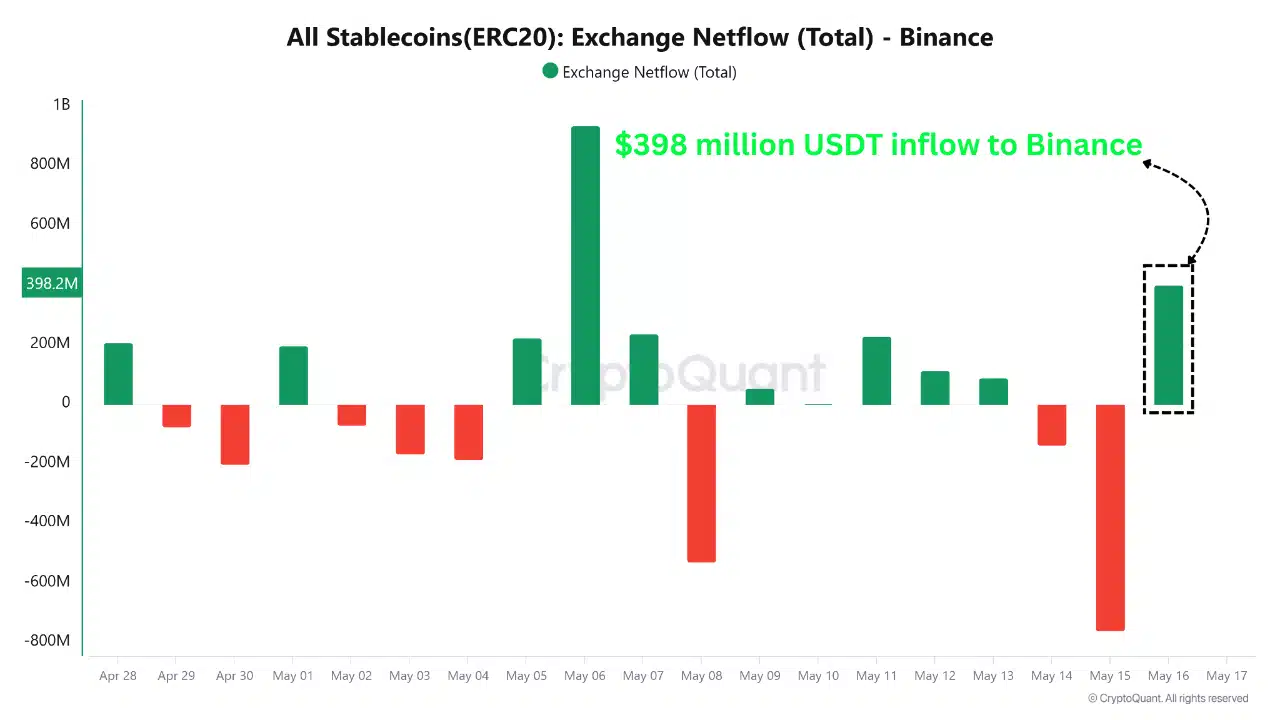

- A $398M USDT influx and $540M ETH outflow on the identical day sign aggressive repositioning by giant traders.

Ethereum [ETH] fell to $2,492, shedding 3.73% in 24 hours, following a rejection close to the $2,800 mark.

This pullback unfolded whilst whale wallets ramped up accumulation and stablecoin inflows surged, hinting at a strategic repositioning behind the scenes.

Nonetheless, short-term sentiment stays fragile.

Whereas some merchants look like exiting with losses, on-chain exercise reveals strategic buildup. This divergence creates uncertainty round ETH’s subsequent transfer as key technical ranges come into play.

Doubling down or signaling warning?

Whale wallets holding 10K–100K ETH have elevated their holdings to 16.793 million ETH, suggesting sturdy accumulation.

On the similar time, Alternate Netflows confirmed a pointy 84.22% weekly spike in ETH outflows, reinforcing a bullish long-term view.

Nonetheless, one whale not too long ago offered 10,543 ETH at $2,476, incurring a $2M loss in simply two days.

This solitary dump, whereas eye-catching, doesn’t essentially undercut the broader accumulation pattern. Having stated that, it does replicate the continuing unease in a risky market.

What does $398M in USDT and $540M in ETH sign?

On-chain knowledge revealed a big shift: $398 million price of Tether (USDT) flowed into Binance, whereas $540 million price of ETH was withdrawn from centralized exchanges on the identical day.

This marks the biggest single-day ETH internet withdrawal since early April, signaling that giant holders are possible shifting belongings into chilly storage or staking environments.

In the meantime, the large USDT influx suggests whales are arming themselves with dry powder to build up extra ETH because it trades inside a perceived accumulation vary.

In fact, this twin transfer hints at greater than probability. It suggests whales are circling with precision.

Extra customers be a part of Ethereum, current customers go quiet

Curiously, Ethereum’s community noticed an 18.73% improve in new addresses over the previous week. But, Energetic Addresses dropped 3.18%, suggesting current customers have pulled again.

This divergence means that whereas long-term curiosity in Ethereum is rising, short-term engagement is cooling off.

Subsequently, though new customers are becoming a member of, current ones could also be ready on the sidelines. This habits is commonly seen throughout transitional market phases when traders hesitate earlier than the subsequent massive transfer.

Ethereum’s Open Curiosity dropped by 3.29% to $16.02 billion, highlighting a discount in speculative positions.

Merchants appear to be closing leveraged bets after the current value rejection at $2,800. This decline displays risk-off sentiment as volatility spikes.

Nonetheless, it may well additionally sign that the market is resetting, clearing weak palms earlier than the subsequent leg.

Is ETH discovering assist or stalling at key Fib ranges?

Ethereum not too long ago touched $2,629, aligning with the two.618 Fibonacci extension, earlier than retreating.

The present value hovers close to $2,492, sitting between crucial assist and resistance zones. Stochastic RSI reveals impartial momentum with values at 61.31 and 51.47.

Subsequently, ETH could also be consolidating earlier than a directional breakout.

Worth motion round this Fib degree must be intently watched. If bulls maintain above $2,292 (Fib 1.618), upward continuation stays potential.

Regardless of immediately’s drop, Ethereum reveals sturdy whale assist and rising stablecoin inflows. Whereas short-term volatility has triggered remoted exits, broader metrics level to accumulation.

If consumers defend present ranges, a rebound towards $2,800 stays potential.