[ad_1]

Motive to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade specialists and meticulously reviewed

The very best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Ethereum noticed a dramatic turnaround this week, bouncing over 21% from its latest low of $1,380 in simply hours. The sharp restoration got here in response to an surprising shift in macroeconomic coverage: US President Donald Trump introduced a 90-day pause on reciprocal tariffs for all nations—besides China, which now faces a steep 125% tariff. The information despatched a ripple by means of world markets, sparking a short-term rally in danger property, together with crypto.

Associated Studying

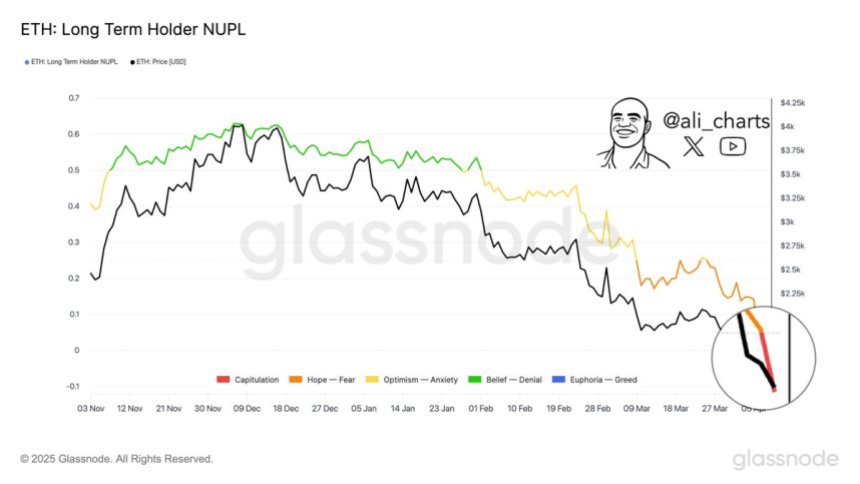

Ethereum, which had been beneath heavy promoting strain for weeks, seems to have discovered non permanent reduction. In line with Glassnode knowledge, long-term Ethereum holders are beginning to fold, offloading positions at a loss after months of decline. Traditionally, these moments of long-term holder capitulation have typically marked bottoming phases and preceded significant rebounds.

Whereas short-term volatility stays elevated, some analysts view this setup as a possible alternative zone, particularly for contrarian traders seeking to accumulate throughout peak concern. The market now watches to see if ETH can hold its gains or if broader uncertainty will drag costs again down. One factor is evident: the subsequent few days could possibly be pivotal for Ethereum’s pattern heading into the second half of 2025.

Ethereum Finds Reduction Amid Chaos, However Market Stays On Edge

Ethereum is now at a pivotal crossroads after enduring weeks of relentless promoting strain and uncertainty. The latest surge from sub-$1,400 ranges has supplied a glimmer of hope, as bulls start to push again towards the downtrend. This bounce follows aggressive volatility not simply in crypto however throughout world equities, with value motion rocked by continued geopolitical unrest and macroeconomic instability. US President Donald Trump’s unpredictable stance on tariffs stays a wildcard, holding world markets on edge.

Since peaking in late December, Ethereum has shed over 60% of its worth, triggering rising concern {that a} full-scale bear market could also be unfolding. Many traders have already exited positions, whereas others stay sidelined ready for readability. Nonetheless, some see alternative.

According to top analyst Ali Martinez, long-term Ethereum holders have now entered what’s generally known as “capitulation” mode—a stage when even essentially the most affected person traders start to fold beneath strain. Martinez believes this might current a uncommon window for contrarian patrons. “For these watching risk-reward dynamics, this section has traditionally marked prime accumulation zones,” he shared on X.

Whereas Ethereum’s path ahead remains to be unsure, present sentiment suggests {that a} vital take a look at is underway—one that might decide whether or not this restoration has legs, or if additional ache lies forward.

Associated Studying

Bulls Look To Verify Restoration With Key Breakout

Ethereum is displaying indicators of short-term power because it types an “Adam & Eve” bullish reversal sample on the 4-hour chart. This traditional technical formation, which begins with a pointy V-shaped low adopted by a rounded backside, typically indicators a possible breakout if value motion holds and follows by means of. For Ethereum, reclaiming the $1,820 degree is step one to substantiate this bullish construction.

If bulls can push ETH above this degree with conviction, the subsequent key problem lies on the 4-hour 200 transferring common (MA) and exponential transferring common (EMA), each of which converge across the $1,900 mark. A decisive breakout by means of this zone would validate the restoration setup and will kickstart a extra sustained transfer increased.

Associated Studying

Nevertheless, failure to reclaim the $1,800 degree within the coming days could preserve ETH caught in a consolidation vary. If rejected, value may stay rangebound between present ranges and the decrease assist space close to $1,300, the place ETH just lately bounced. For now, all eyes are on how value reacts to the resistance ranges forward, as bulls intention to regain management and shift the short-term momentum of their favor.

Featured picture from Dall-E, chart from TradingView

[ad_2]

Source link