[ad_1]

- Ethereum MVRV drops to 0.77, signaling a shopping for alternative for ETH.

- Ethereum is seeing growing demand as shopping for strain recovers

Over the previous 4 months, Ethereum [ETH] has struggled to maintain an upward motion. Inasmuch so, ETH has traded in a multi-month descending triangle.

Thus, Ethereum has made significant losses over the identical interval. Actually, as of this writing, ETH hovered round $1610—an 18.21% drop over the past 30 days.

Amidst this decline, ETH has seen its MVRV rating drop to current lows. Based on crypto analyst Burak Kesmeci, Ethereum’s MVRV has dropped under 1 and settled at 0.77.

Traditionally, a drop to those ranges has signaled a shopping for alternative with the altcoin being oversold.

Prior to now cycles, as per Ali Martinez, one of the best shopping for alternatives for ETH have traditionally occurred when the worth dips under the decrease MVRV Value Band, and that’s precisely the place it’s now.

In different phrases, the present MVRV positioning might supply buyers a strategic probability to build up at a reduction.

Is ETH set for a development reversal?

Based on AMBCrypto’s evaluation, Ethereum consumers are again out there and are at the moment accumulating the altcoin.

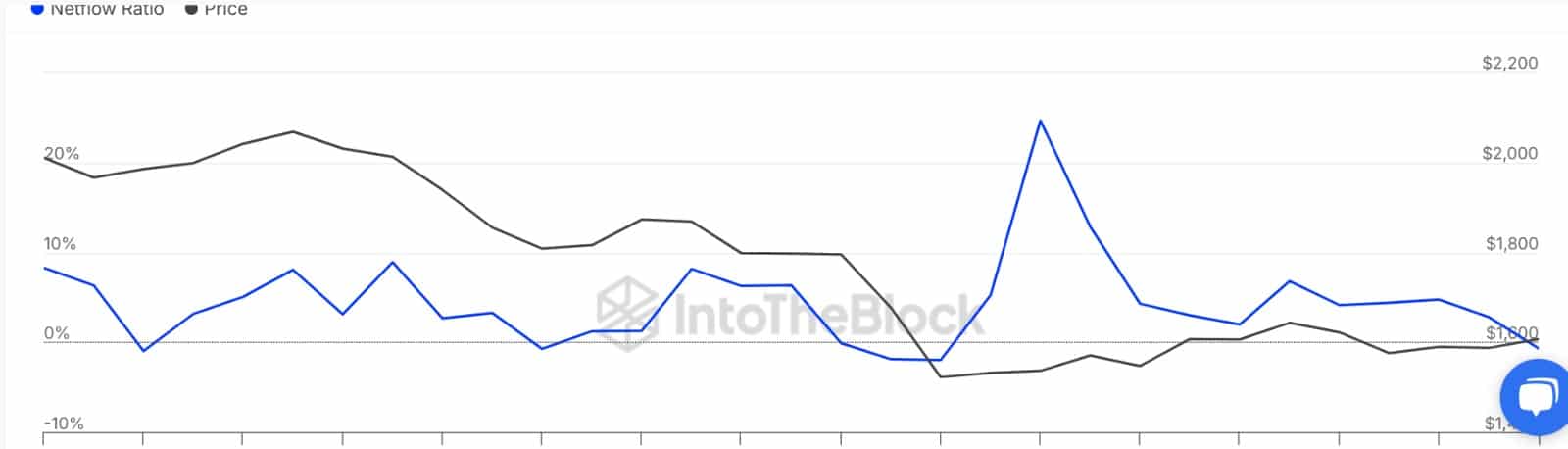

Taking a look at whale conduct, massive holders have stopped promoting the altcoin. As such, the Massive Holders’ Netflow to Change Netflow Ratio has declined for the previous seven days, hitting -0.71.

When this reaches unfavorable territory, it means that whales usually are not transferring their Ethereum into exchanges however withdrawing.

Accumulation underway?

Moreover, Ethereum’s Taker buy-sell ratio has remained above 1 for 2 consecutive days. When the taker ratio is about like this, it displays sturdy shopping for strain out there.

As such, there are extra consumers and they’re at the moment dominating the market. Such a development indicators rising demand throughout all market contributors.

Lastly, Ethereum’s Change Provide Ratio has declined sustainably over the previous 4 days, hitting 0.135.

A sustained drop on this metric factors to market contributors—each retail and institutional—pulling ETH off exchanges, usually an indication of rising confidence and diminished promote strain.

What subsequent for ETH?

Merely put, with MVRV dipping into oversold territory, buyers have interpreted it as a shopping for alternative. Inasmuch so, consumers at the moment are strongly again out there to build up the Ethereum.

With the present situations, it appears the MVRV rating is not going to stay under 1 for a very long time and ETH might rebound.

A rebound on ETH value charts might see the altcoin try a transfer in direction of $1706. Nonetheless, if the MVRV continues to remain under 1, ETH might drop to $1551 then begin one other upward motion.

[ad_2]

Source link