[ad_1]

ETH diverges sharply from BTC as Q1 drawdown widens

Ethereum bore the brunt of Q1’s crypto correction, shedding 44.83% of its worth in comparison with Bitcoin’s extra reasonable 14.67% decline, as proven in knowledge from IntoTheBlock.

The divergence underscores Ethereum’s vulnerability as danger appetites shift, regulatory issues come up, and demand for Ethereum-based property weakens.

Whereas Bitcoin’s decline displays broader macroeconomic volatility, Ethereum’s sharper drop signifies a confidence hole. Merchants look like redirecting capital into Bitcoin, thought-about the “safer” cryptocurrency possibility.

Even conventional markets just like the S&P 500 outperformed Ethereum, emphasizing its underperformance as one of many quarter’s most notable tendencies.

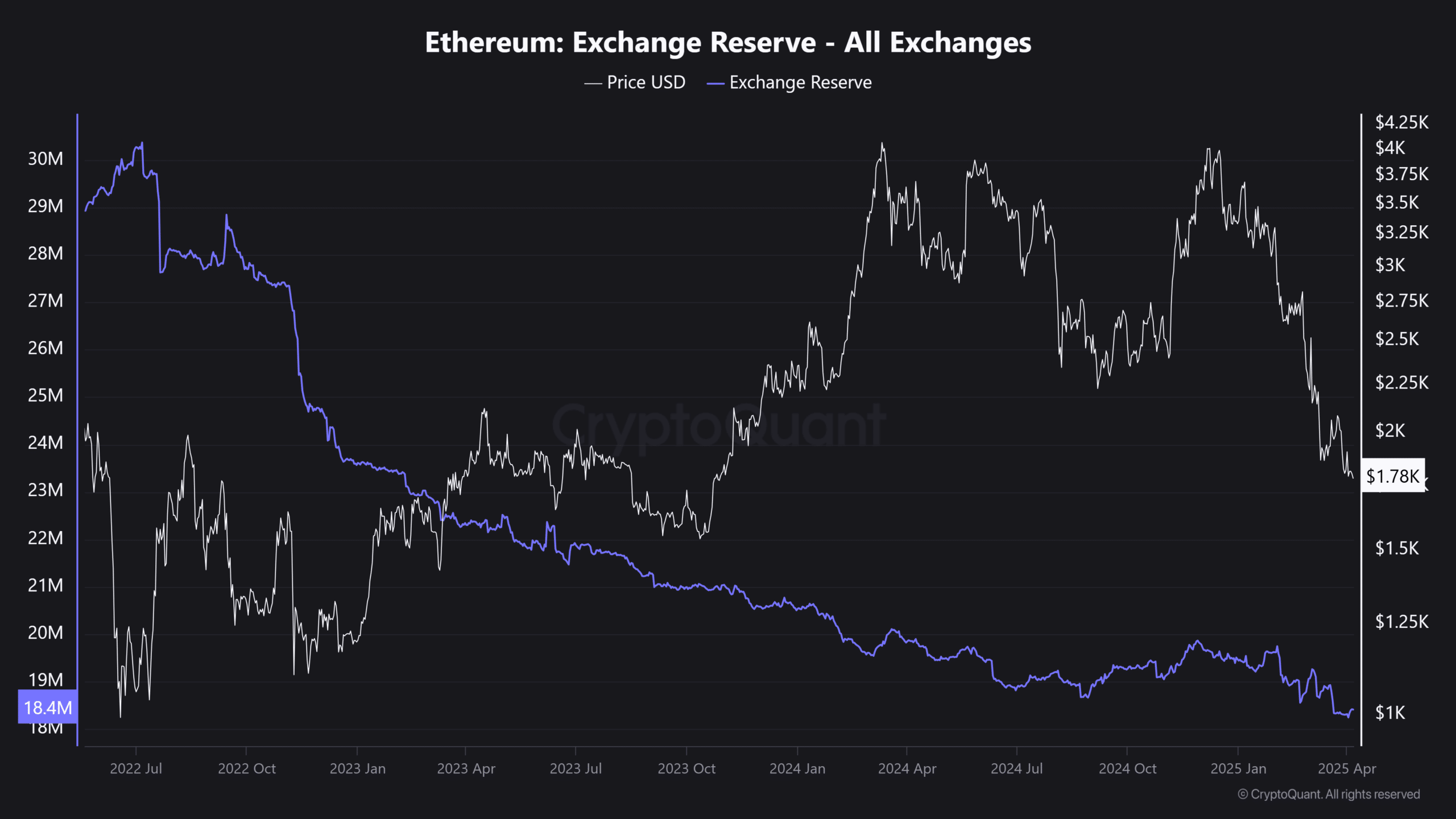

Alternate reserves hit new lows

Including to Ethereum’s regarding quarter is a continued drop in alternate reserves, which have now fallen to only 18.4 million ETH — the bottom stage in over three years, in response to CryptoQuant knowledge.

Usually, such a decline can be learn as bullish, signaling long-term conviction and diminished promote stress.

The continued decline in ETH’s value tells a unique story. A discount in tokens on exchanges has not led to elevated shopping for momentum.

As a substitute, it could point out broader investor disengagement, a shift towards passive holding, staking, and even potential exit methods.

Whereas the provision is reducing, investor confidence seems to be fading as effectively.

Ethereum: Caught in no man’s land?

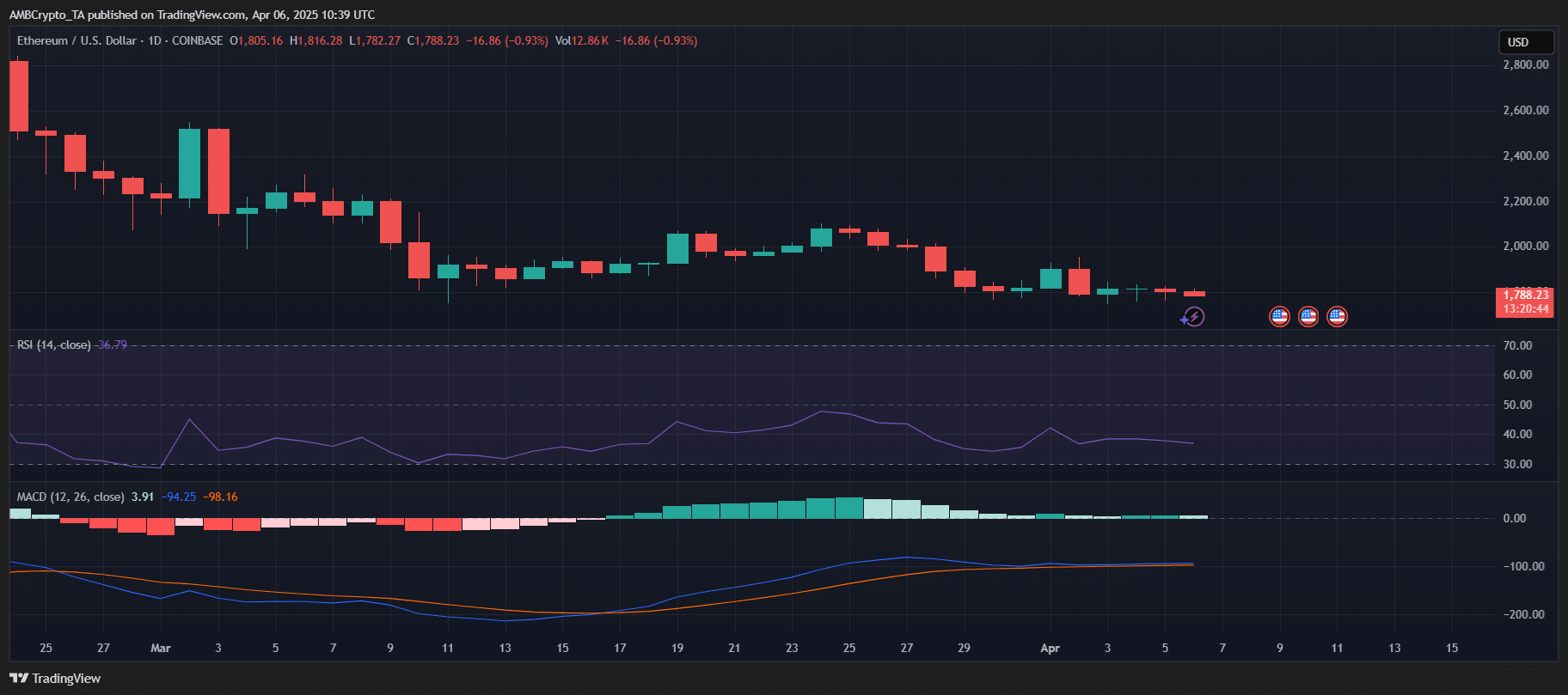

Buying and selling at $1,788 at press time, ETH sat simply above a key psychological stage of $1,750, with no clear indicators of bullish momentum.

The RSI hovered at 36.7 — edging towards oversold territory, but missing sufficient shopping for stress to spark a reversal. In the meantime, the MACD was exhibiting weak upward momentum, with the histogram barely flipping inexperienced.

The value has been range-bound for over two weeks, hinting at indecision somewhat than accumulation.

Except ETH can reclaim the $1,850-$1,900 zone with quantity assist, draw back danger stays. Within the brief time period, a break under $1,750 might set off a retest of $1,650.

[ad_2]

Source link