- ETH’s $2.7K breakout triggered a brief squeeze, however rising change reserves sign weakening momentum

- Ethereum’s decoupling from Bitcoin raises issues about sustainability, with L2s and retail participation faltering

Ethereum’s [ETH] break above the $2,700 mark shocked the market, triggering over $50 million in brief liquidations on Binance alone.

However beneath the floor, there’s one thing a bit extra complicated: rising Trade Reserves and notable whale outflows counsel that the bullish momentum could also be shedding steam.

On the similar time, Ethereum’s current value decoupling from Bitcoin – as soon as seen as an indication of rising power – now raises recent issues about sustainability and course for the broader Ethereum ecosystem.

Quick squeeze ignites as ETH breaks $2.7K

Ethereum’s surge previous the $2,700 resistance stage triggered a pointy liquidation occasion on Binance, wiping out over $50 million in brief positions, in line with CryptoQuant knowledge.

This zone, highlighted as a liquidity cluster on the Liquidation Delta chart, grew to become a magnet for stop-loss orders as ETH pierced by means of.

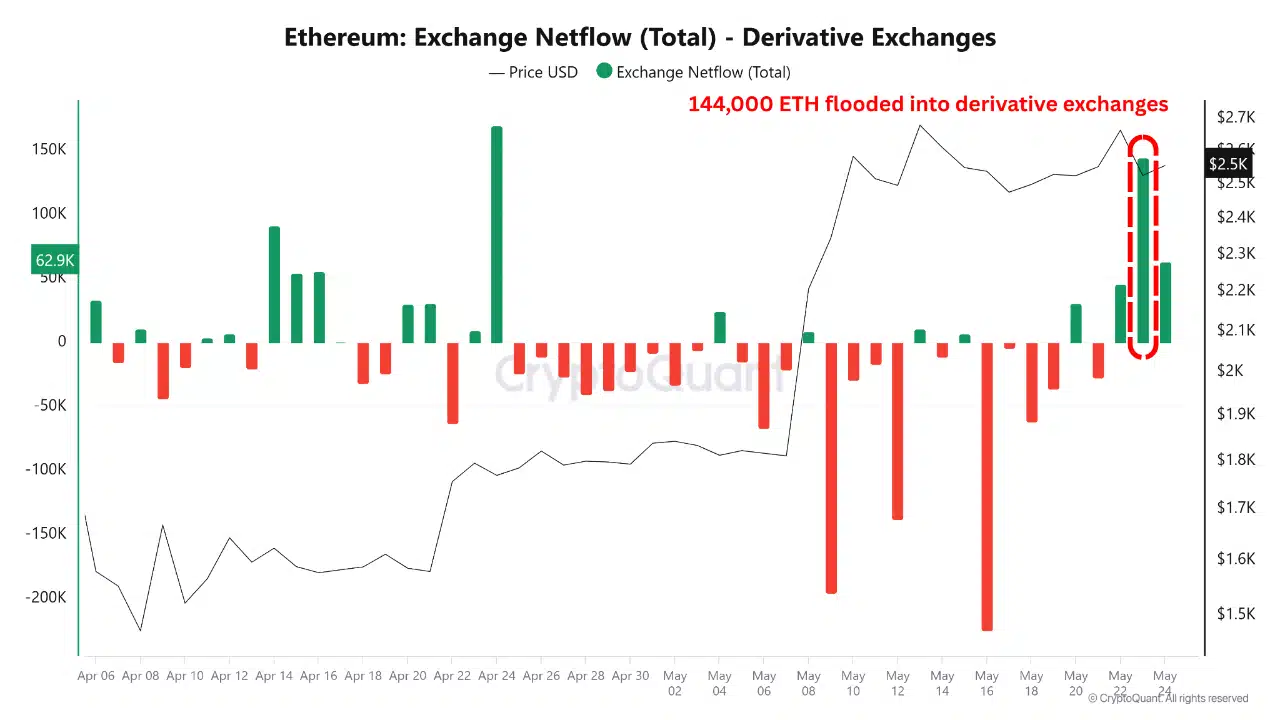

Nonetheless, that squeeze was instantly adopted by over 144,000 ETH flowing into Derivatives Trade Reserves—a pink flag. Such inflows usually precede renewed quick positioning, not development continuation.

Whereas the bulls briefly claimed victory, the speedy inflows and heatmap stress counsel warning could also be warranted amid the preliminary euphoria.

Ethereum-Bitcoin correlation collapses

For years, Ethereum and Bitcoin moved in near-lockstep, typically sharing a correlation above 0.7. However that relationship has almost evaporated.

In response to CryptoQuant, ETH’s 1-year Correlation with BTC plunged to only 0.05 as of the twenty second of Might – down from 0.63 at first of the yr.

This sudden decoupling disrupts one of many crypto market’s most constant patterns, forcing a reassessment of conventional portfolio methods.

Extra critically, it coincides with ETH’s relative underperformance throughout Bitcoin’s rally.

Decoupling dampens momentum

Ethereum’s divergence from Bitcoin is eroding market confidence. With out the tailwind of synchronized BTC rallies, Ethereum’s ecosystem is struggling to maintain development.

Retail participation seems to be thinning, and main L2s like Optimism, Arbitrum, and Polygon have failed to achieve traction in 2025. Forecasting fashions that when hinged on Bitcoin’s directionality are shedding predictive energy.

Ethereum could also be evolving right into a extra autonomous asset pushed by inside fundamentals, however that independence dangers isolating it throughout bull cycles.

For now, the decoupling appears to be extra simply wind than evolution.