[ad_1]

- Ethereum customers determined to lock their ETH after the Merge.

- ETH change provide has diminished by 16.4% over the earlier seven weeks.

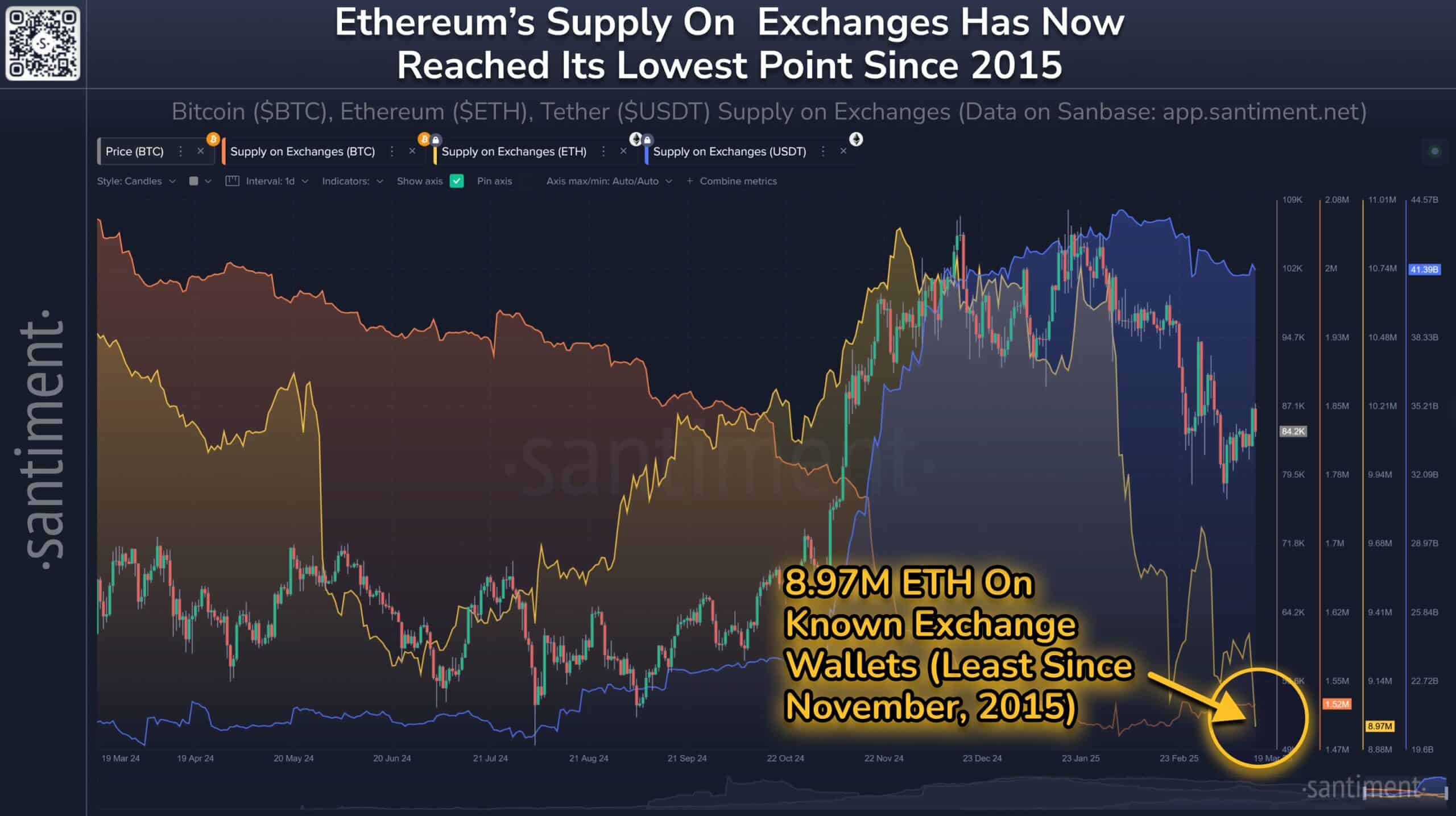

The quantity of Ethereum [ETH] on centralized exchanges has dropped to eight.97 million ETH, marking its lowest provide since November 2015.

Moreover, investor conduct has shifted considerably because the fast buying and selling provide of ETH reaches this historic low.

Santiment knowledge reveals a constant decline in Ethereum provide on centralized exchanges, reflecting elevated confidence in Ethereum’s long-term potential.

Because of this, ETH holders are more and more utilizing their tokens for staking and decentralized finance (DeFi) actions, shifting away from prioritizing fast buying and selling.

Provide shift: Impression of DeFi and staking

The voluntary switch of Ethereum from exchanges is primarily pushed by rising curiosity in DeFi features and staking rewards. After the Merge, ETH customers started locking their tokens because the shift to Proof of Stake provided staking rewards together with community safety advantages.

Moreover, Ethereum’s management within the DeFi sector has attracted numerous consumer teams collaborating in actions like lending, liquidity provision, and yield farming.

This shift in possession displays a choice amongst traders to interact actively throughout the ETH community slightly than retaining their ETH on centralized exchanges.

The rising interplay with the Ethereum platform helps its long-term sustainability and development.

Ethereum’s change provide decline accelerates

ETH change provide has decreased by 16.4% over the previous seven weeks, marking the biggest drop since late 2024.

This sharp decline displays rising investor confidence, as many shift their holdings towards staking and DeFi functions. Ethereum is evolving right into a yield-generating asset slightly than merely a buying and selling instrument.

The continued outflow from exchanges means that holders anticipate an increase in Ethereum’s worth, supporting a long-term bullish outlook.

Diminished change provide might considerably impression market dynamics. Restricted ETH availability would possibly drive costs larger on account of shortage at steady demand ranges.

Moreover, lowered liquidity on exchanges might result in elevated volatility, amplifying value actions. The continued migration of Ethereum from centralized platforms highlights robust community confidence, reinforcing bullish sentiment.

As DeFi and staking entice extra capital, Ethereum’s place as a worthwhile long-term asset strengthens throughout the evolving crypto market panorama.

[ad_2]

Source link