- Bitcoin fell under $106k, making its short-term bias bearish

- On-chain metrics highlighted a scarcity of huge sell-offs, which meant buyers have been comfy holding on

Bitcoin [BTC] fell under the fair value gap at $106.5k – An indication that its short-term bias was bearish at press time. Actually, it appeared prone to fall in the direction of $102.5k and as deep as $100k subsequent. A breakdown under $100k could also be unlikely although.

Geopolitical tensions and the opportunity of struggle are rising by the day as nations change missiles within the Center East. Inflation has slowed down within the U.S, however it’s not but on the Federal Reserve’s goal charge. Tariffs and financial uncertainty have additionally been looming. These elements have led buyers to flee in the direction of gold as a retailer of worth.

Regardless of the FUD in conventional markets, Bitcoin has remained sturdy above the $100k-mark. Because of this buyers are more and more treating the crypto asset as a retailer of worth.

Bitcoin buyers are in a wait-and-watch mode

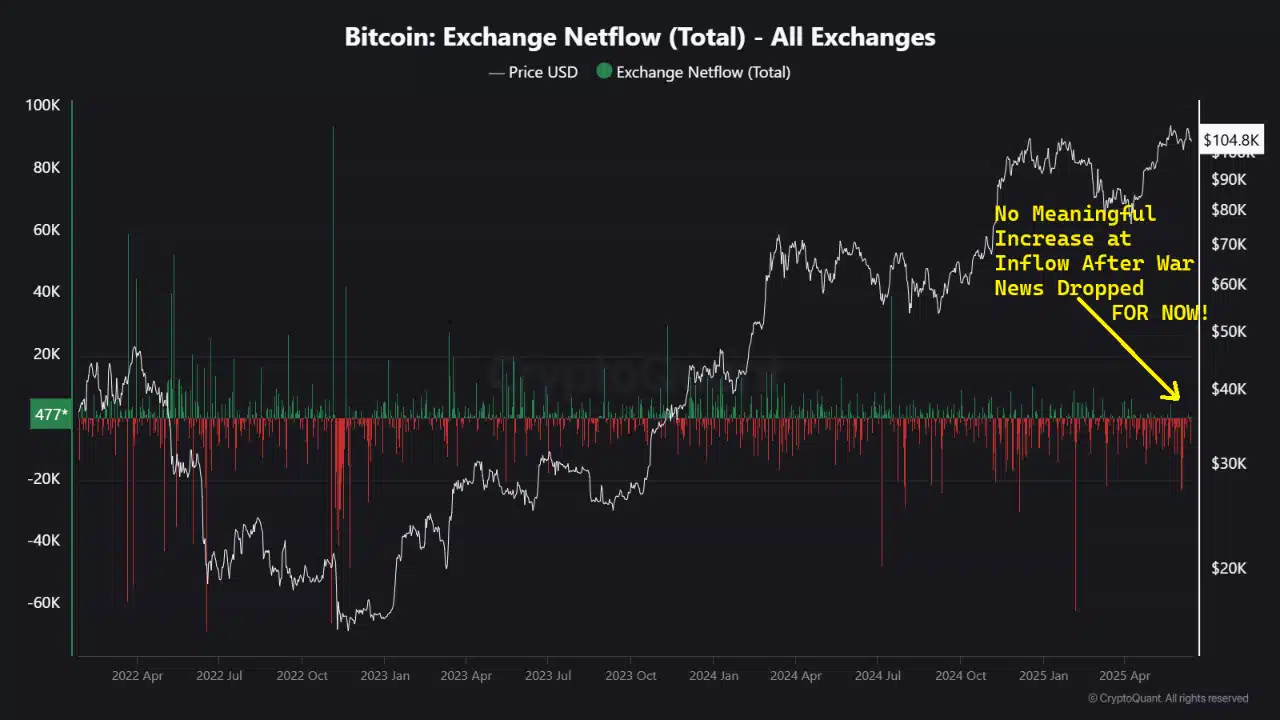

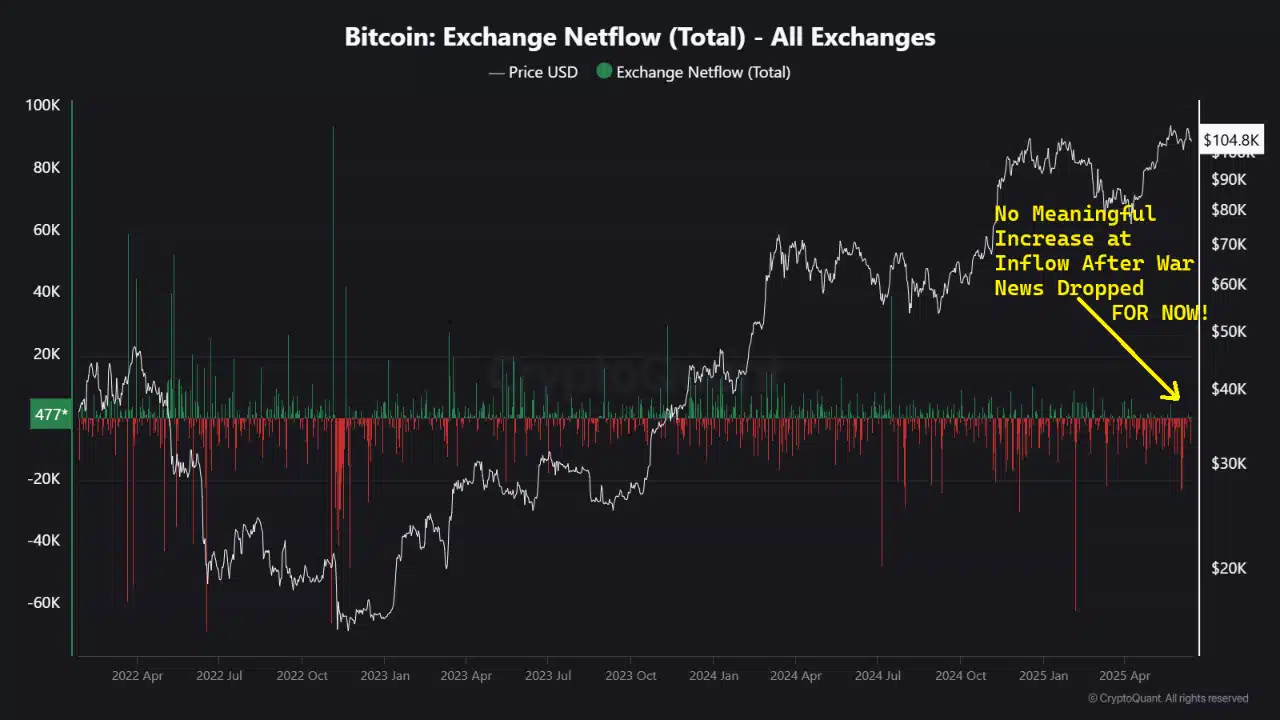

Supply: CryptoQuant Insights

In a put up on CryptoQuant Insights, consumer CryptoMe noticed that the change in netflows has not been excessive. There was no important constructive change within the netflows, which meant no excessive inflows as holders realized earnings and exited the market.

This lack of promoting, for now, could also be a constructive signal that buyers won’t be panicking.

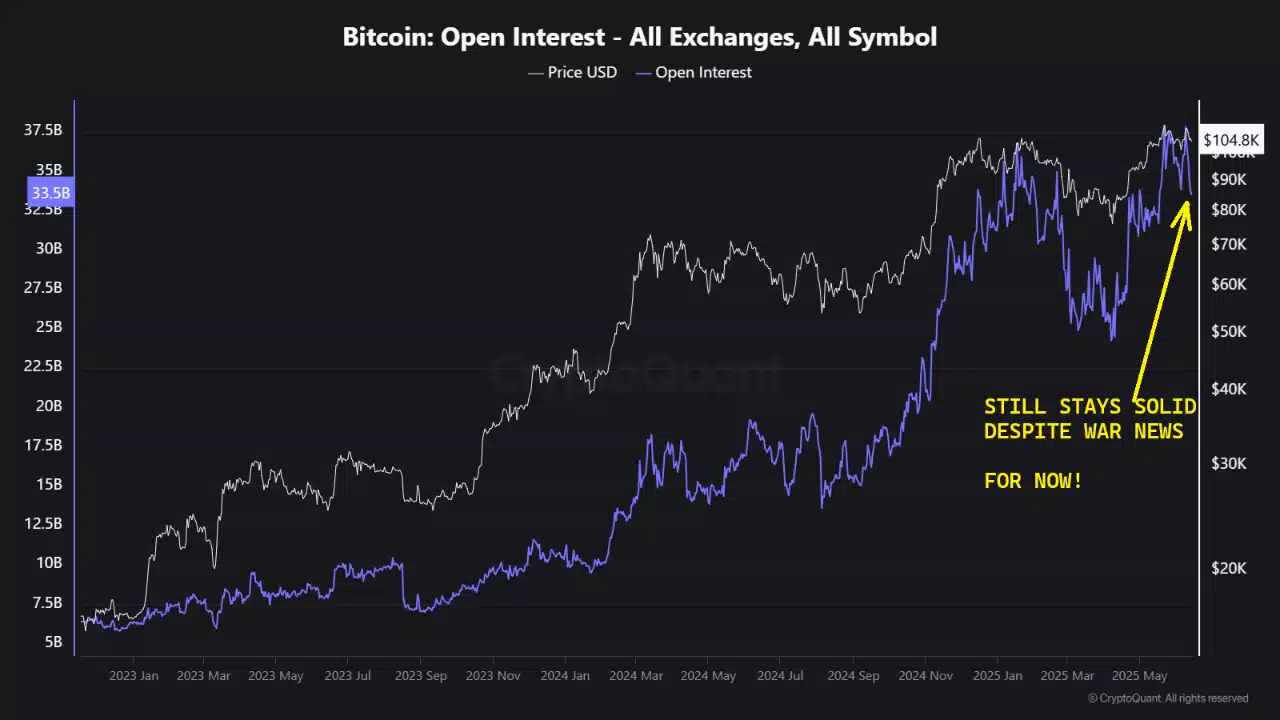

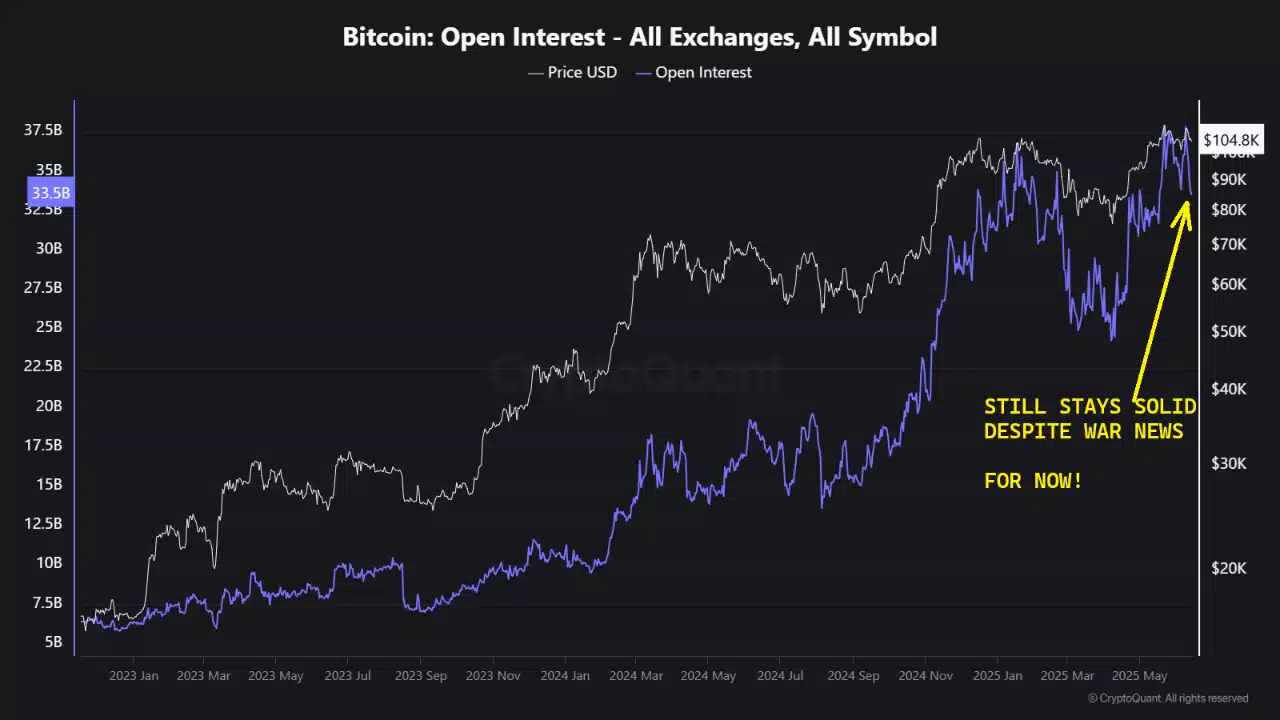

Supply: CryptoQuant Insights

The Open Curiosity on centralized exchanges didn’t present a big drop. The correction from $110k to $105k noticed lengthy liquidations, which meant lengthy positions have been forcibly closed, explaining an excellent chunk of the OI drop.

Nevertheless, it was not a large-scale sell-off. Excessive OI ranges meant speculative curiosity has been notably excessive, regardless of the concern and uncertainty available in the market. It could be one other signal that buyers are in wait-and-watch mode proper now.

Supply: Axel Adler Jr on X

In a post on X, crypto analyst Axel Adler Jr famous that the press time studying was at 46%, slightly below the impartial threshold of fifty%.

To renew the uptrend it noticed beforehand in June, the index should climb past 60%-65%. This would want sustained demand and capital inflow.

The 1-day chart revealed {that a} bearish bias was warranted for Bitcoin within the coming days. There was an extended southward wick final Friday, whose low at $102.6k may very well be revisited quickly. The CMF revealed that promoting stress was dominant, with the Superior Oscillator suggesting that downward momentum was prevalent.

General, market contributors ought to count on short-term volatility. Nevertheless, within the face of FUD, the energy of the holders has been encouraging. It may be good for retail buyers to undertake this wait-and-watch stance as properly.