- Japan’s bond market faces a liquidity disaster, echoing the warnings of 2008’s monetary turmoil

- Crypto belongings have been gaining traction as traders search protected havens amid Japan’s financial instability

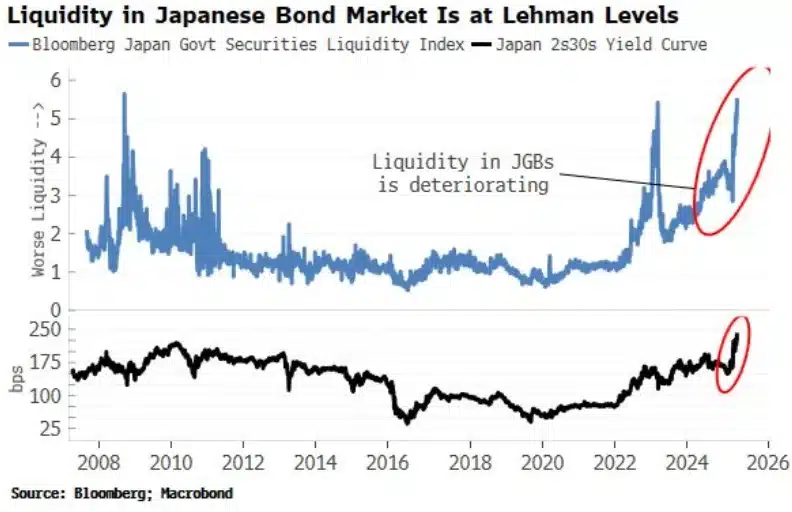

Japan’s authorities bond market has been fighting its deepest liquidity disaster because the 2008 international monetary meltdown, elevating considerations of a wider monetary shock that might ultimately attain digital asset markets.

Over the previous month and a half, long-term bond yields have soared, with the 30-year yield hitting 3.20% – A 100 foundation level spike. Quite the opposite, the 40-year bond has plunged in worth, erasing over $500 billion in market capitalization.

As soon as thought-about secure, Japan’s long-dated bonds at the moment are underneath intense stress, with analysts like Financelot warning that liquidity circumstances resemble these seen throughout the Lehman Brothers collapse – An indication of brewing systemic menace.

“Japan’s bond market liquidity has dropped to 2008 Lehman disaster ranges. Are we about to expertise one other monetary disaster?”

Japan’s financial disaster deepens

The upheaval in Japan’s bond market largely originates from the Financial institution of Japan’s abrupt change in financial coverage. After years of aggressive bond purchases, the BOJ scaled again its intervention, releasing a flood of provide that despatched yields sharply greater.

Regardless of decreasing its shopping for, the central financial institution nonetheless holds $4.1 trillion in authorities debt, over half of all excellent bonds, leaving a long-lasting distortion on market dynamics and investor sentiment.

Moreover, Japan’s nationwide debt has climbed to $7.8 trillion, driving its debt-to-GDP ratio to a document 260% – Over twice that of the USA.

The financial fallout has been swift and extreme, with Q1 2025’s actual GDP contracting by 0.7%, far worse than forecasts, whereas inflation climbed to three.6% in April.

On the similar time, actual wages dropped by 2.1% year-over-year, fueling rising fears of an entrenched stagflationary cycle.

Neighborhood reactions

Owing to the identical, the Kobeissi Letter took to X and famous,

As anticipated, on the again of such monetary turmoil, speak of Bitcoin hasn’t been too far behind both. One analyst added,

Japan’s crypto journey

Regardless of mounting stress in Japan’s bond market, the nation’s crypto trade is increasing steadily, with the Japan Digital and Crypto Property Alternate Affiliation reporting 32 registered crypto-asset alternate operators on 30 April

Buying and selling exercise stays robust, with February figures exhibiting spot volumes nearing JPY1.9 trillion (USD13.1 billion) and margin buying and selling volumes shut behind at JPY1.5 trillion.

On the similar time, Japan has been urgent ahead with regulatory readability. Particularly because the ruling Liberal Democratic Get together’s Web3 Mission Crew has been advocating for formally recognizing crypto-assets as a separate asset class underneath the Monetary Devices and Alternate Act.

In opposition to this backdrop, Bitcoin [BTC] is more and more seen as a hedge towards conventional monetary instability, particularly because the once-reliable yen carry commerce comes underneath mounting stress.

Subsequently, with Japan’s debt turmoil intensifying, crypto-linked belongings are quick turning into a most well-liked protected haven for traders.

How is Metaplanet performing for example?

This additionally coincided with Metaplanet’s inventory surging by 15.55% on 27 Might, hitting its higher restrict as soon as once more as confidence in its Bitcoin-centric technique strengthens amid rising bond yields and financial instability.

Concurrently, Cardano [ADA] has been capturing the eye of Japanese retail traders, with rising demand for the ADA/JPY pair.

Such a shift in sentiment means that as conventional monetary constructions falter, Japan’s crypto panorama might emerge as a vital refuge for capital in search of resilience and readability.