[ad_1]

- Metaplanet’s BTC holding hit 6.79K, surpassing El Salvador’s 6.1K BTC.

- The agency was about 30% away from its 10K BTC goal by the tip of 2025.

On the twelfth of Might, Japan’s Technique, Metaplanet, introduced an extra 1,241 Bitcoin [BTC] buy, bringing its total stash to six,796 BTC. The BTC’s stash is price over $700 million, primarily based on present market costs.

Apparently, Metaplanet has now flipped El Salvador’s holding, which was at 6,174 BTC (price $642 million) per Bitcoin Workplace data.

Metaplanet’s BTC plan

For comparability, El Salvador started its BTC acquisition plan in 2021, whereas Metaplanet jumped on the pattern final 12 months.

In truth, the Tokyo-based agency has a goal of buying 10,000 BTC by the tip of 2025.

With greater than six months left to go and about 30% shy of the goal, the corporate may even surpass the 10K BTC mark if the aggressive shopping for pattern stays on monitor.

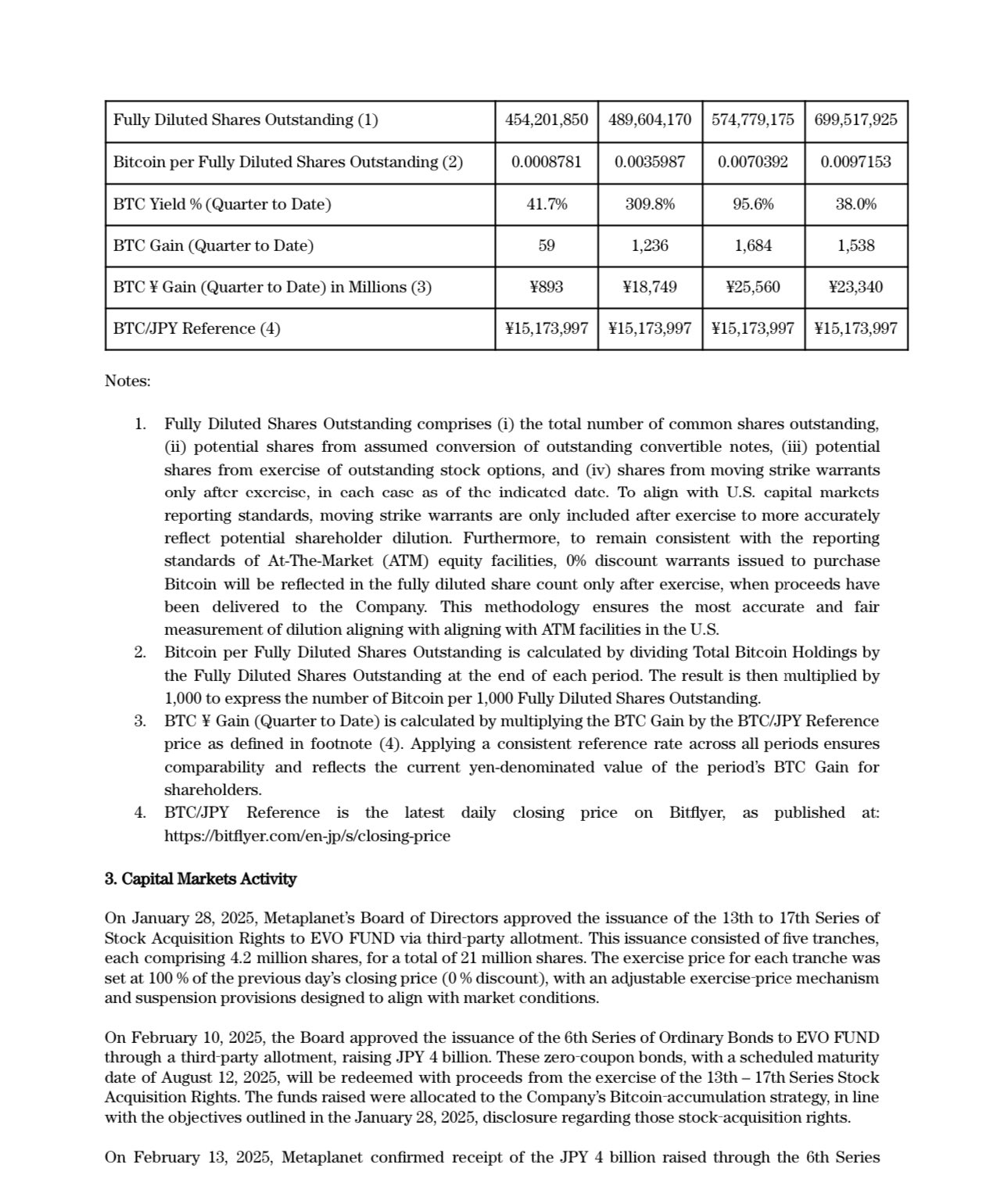

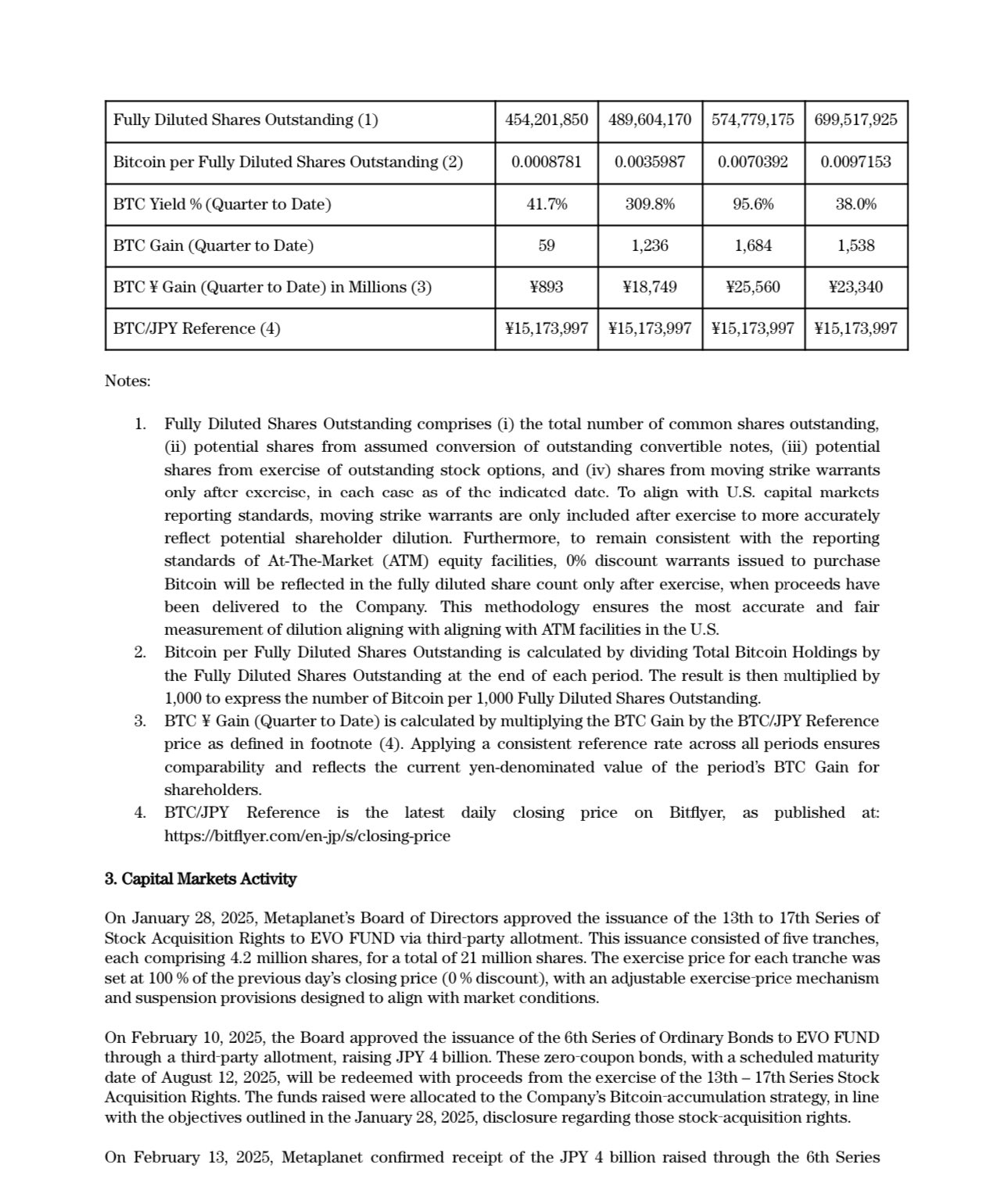

The agency makes use of the Technique playbook, together with the capital elevating mannequin primarily based on debt and fairness issuance.

Supply: Metaplanet (Capital elevating mannequin)

Technique (previously MicroStrategy) has an amazing stash of 568,840 BTC as of the time of writing. The huge BTC publicity has allowed the agency’s MSTR shareholders to learn handsomely.

From a year-over-year foundation, MSTR has jumped 238% whereas BTC gained 63%. However Metaplanet share has supplied higher returns than MSTR and BTC.

On a yearly foundation, Metaplanet elevated by 1,800% whereas on YTD (year-to-date), the share worth rose 58%.

On a YTD returns, MSTR rallied 28% whereas BTC pumped 6%, which means Metaplanet outperformed on the value entrance, regardless of having comparatively much less BTC stash than Technique.

That stated, a number of public corporations have jumped on the BTC company treasury bandwagon to supply shareholders higher Metplanet-like returns.

In accordance with Bitbo, public corporations alone have acquired 724K BTC (price $75B) or about 3.4% of the whole BTC provide.

General, the BTC adoption by international locations and corporations (private and non-private) accounts for 15% of the whole provide (over 3 million BTC) or $330B.

Merely put, institutional and nation-state adoption has grow to be a major catalyst for the BTC worth.

[ad_2]

Source link