[ad_1]

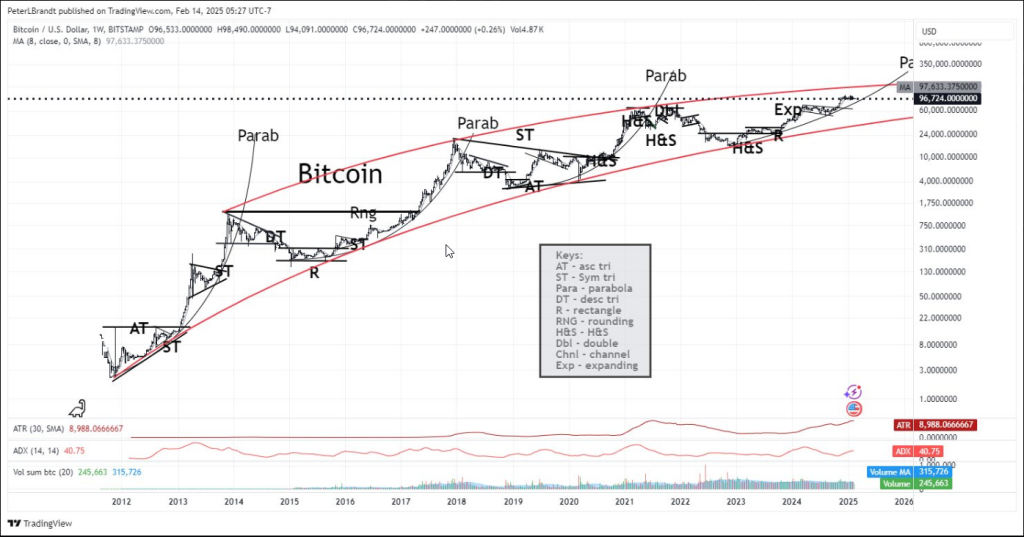

Peter Brandt, a seasoned dealer, has dismissed optimistic predictions within the wake of Bitcoin’s latest enhance to $97,000+.

His newest technical evaluation signifies that probably the most distinguished cryptocurrency might encounter problem in surpassing the coveted $200,000 threshold previous to 2030.

Bitcoin has demonstrated a combined efficiency, with a each day achieve of 0.17% and a 2.85% decline over the course of the week, prompting the forecast.

Associated Studying

The Protracted Path To Six Figures

Bitcoin will face vital challenges in breaching the psychological barrier of $100,000. The 8-week shifting common of $97,633, which has constantly rejected upward actions, presents the cryptocurrency with vital resistance.

From the world of loopy concepts comes this thought – a thought, not a commerce

Until Bitcoin has escape velocity by higher parabolic resistance line it’s most unlikely that BTC might be buying and selling above $200k on the finish of this decade. Solely☑️can reply. Little interest in non- ☑️replies pic.twitter.com/7a5N7Gliw8— Peter Brandt (@PeterLBrandt) February 14, 2025

The Common True Vary (ATR) of 8,988 and the Common Directional Index (ADI) of 40.75, which each assist a powerful pattern, present elevated volatility within the present market circumstances.

Historic Patterns Paint A Cautionary Story

Since 2012, Bitcoin has developed a particular sample that has captured the curiosity of technical consultants. Inside a purple rising channel, the cryptocurrency has been bouncing between two essential trendlines that function worth limitations.

Notably intriguing is Bitcoin’s tendency towards each sharp corrections and parabolic actions. Market veterans have raised their antennae as a result of placing similarities between the current rally and these earlier cycles.

Buying and selling Quantity Raises Crimson Flags

The numbers inform an attention-grabbing story about how individuals take part out there. There’s a likelihood that the present rally isn’t steady as a result of Bitcoin’s 20-period quantity whole of 245,600 is low in comparison with different breakout phases.

Sustaining a long-term upward pattern could possibly be difficult within the absence of a notable enhance in commerce quantity. For analysts watching Bitcoin’s subsequent main transfer, this weak quantity has been a rising concern.

Associated Studying

Assist And Resistance: The Drawing Of Battle Strains

The way forward for Bitcoin is contingent upon essential worth ranges that would decide its destiny. Sturdy assist is current within the $60,000 to $70,000 vary, whereas a strong resistance zone looms between $100,000 and $120,000.

If the state of affairs worsens, Bitcoin might revisit the decrease boundary of its long-term channel, which is roughly $40,000 to $50,000.

Brandt’s evaluation signifies that Bitcoin’s trajectory to $200,000 by 2030 is doubtful within the absence of a major break above the higher boundary of its parabolic trajectory.

The veteran dealer underscores the need of sustained momentum and the power to surpass essential resistance ranges with the intention to obtain such elevated valuations.

Featured picture from Pixabay, chart from TradingView

[ad_2]

Source link