[ad_1]

- Technique eyes $500M elevate from inventory gross sales for BTC acquisition.

- The agency’s replace elicited blended views from the crypto neighborhood.

On the 18th of March, Michael Saylor, founding father of Technique (previously MicroStrategy), introduced a plan to promote $500M value of recent ‘perpetual most well-liked inventory’ (STRF) for Bitcoin [BTC] buys.

Lately, the agency had issued one other most well-liked inventory ‘STRK’ for related BTC aims.

This was a part of the agency’s goal to lift $21B by inventory issuance and one other $21B by debt (convertible notes) for BTC buys.

Combined views on Technique’s plans

Clarifying the distinction between Technique’s new class of inventory issuance, Bitwise’s Head of Alpha, Jeff Park, said,

“You should purchase STRK immediately for a 9.4% yield with upside convertibility or STRF for a ten% yield with nearly no redemption function.”

Merely put, STRK could possibly be swapped for MSTR, however STRF doesn’t have such a function and carries extra danger.

Nevertheless, some crypto neighborhood members considered Technique’s ‘excessive leverage’ as a danger issue for the whole BTC market. One pseudonymous market analyst, Wazz Crypto, stated,

“This id*ot is making Bitcoin uninvestable at this level. Can it even be digital gold anymore if it’s tied to the solvency of a single firm?”

One other consumer, Simon Dixon, termed it a ‘next-level danger’ that might require a bailout if it goes below.

“Technique’s announcement of a perpetual 10% dividend paid in {dollars}—regardless of missing enough greenback income & working with a Bitcoin-based steadiness sheet—is next-level danger.”

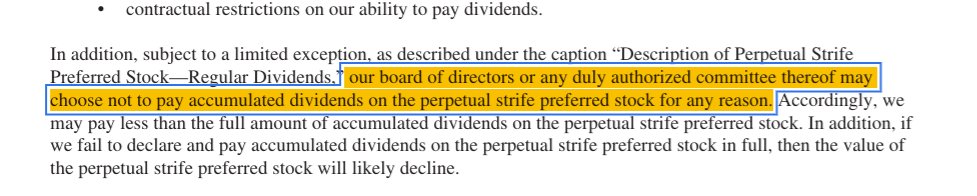

Nevertheless, Bitmex Analysis clarified that the agency may keep away from paying MSTR and STRF holders dividends.

“Appears $MSTR can keep away from paying these 10% to 18% dividends “for any cause.” The probably end result right here is class A $MSTR shareholders by no means ever get a dividend fee.”

For his half, long-term BTC critic Peter Schiff termed the brand new inventory issuance ‘ridiculous’ and added,

“The one factor protecting it (BTC) from deflating utterly is the Trump administration’s assist. As soon as that goes, it’s throughout for Bitcoin and $MSTR.”

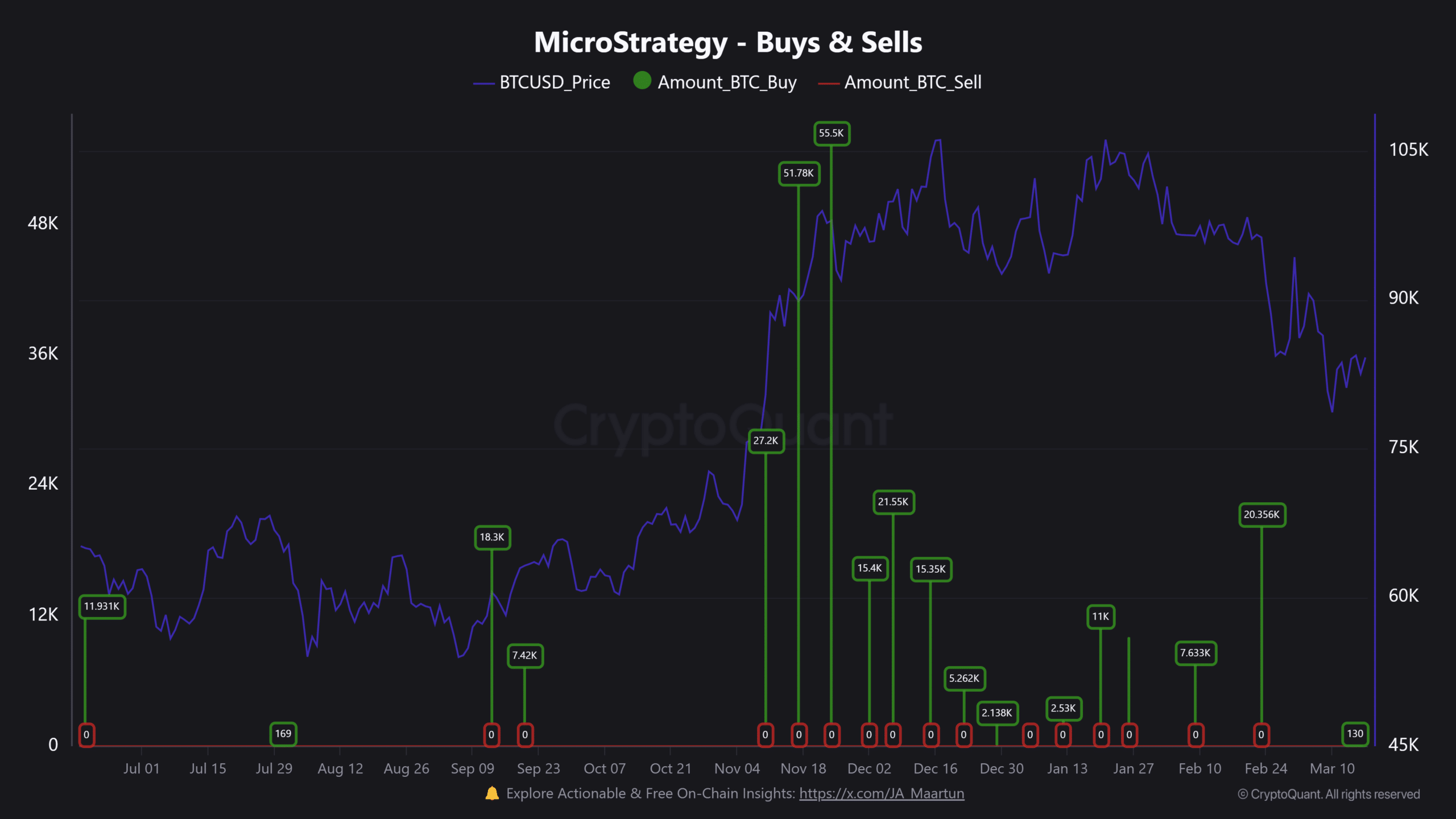

In comparison with final quarter, the agency’s BTC shopping for tempo has slowed in 2025. On sixteenth March, it purchased 130 BTC, growing its stash to 499,226 cash – A 2.3% management of complete BTC provide.

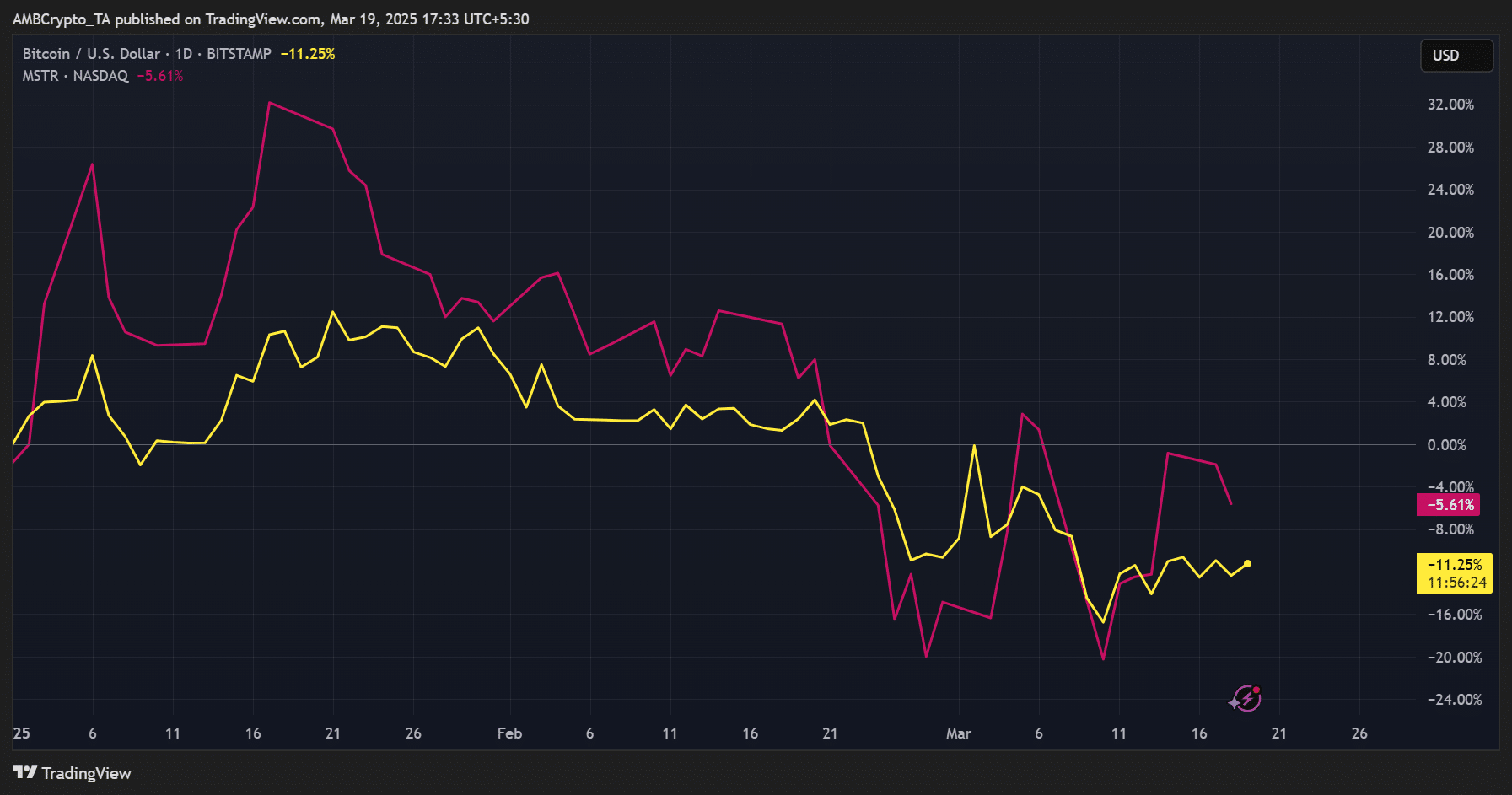

As of this writing, MSTR was valued at $282, down 48% from its latest highs of $543, following latest BTC losses. Previously two weeks, it fluctuated between $230 and $300 as BTC remained beneath $90K over the identical interval.

On a year-to-date (YTD) efficiency, MSTR held the risk-off sentiment higher and was down solely 5% in comparison with BTC’s 11% decline.

Final week, MSTR posted a 26% achieve as BTC retested $85K, suggesting the inventory may put up a robust restoration if the cryptocurrency reversed its losses.

[ad_2]

Source link