[ad_1]

Motive to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business consultants and meticulously reviewed

The best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Market commentator Miya has outlined an attention-grabbing principle on why the Bitcoin price is poised to hit $110,000 by the top of the yr. The knowledgeable alluded to present macro situations and the way it’s sure to favor the flagship crypto on the finish of the day.

Why The Bitcoin Value Will Hit $110,000

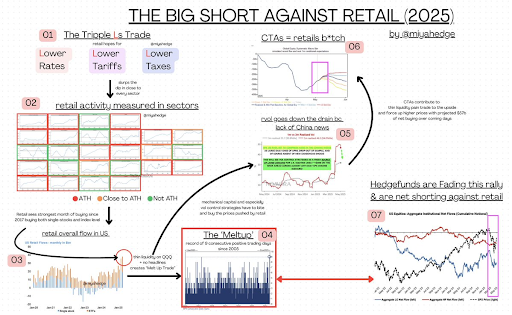

In an analysis titled ‘The Massive Quick in opposition to Retail,’ Miya predicted the Bitcoin value to achieve $110,000 by the top of the yr. On the similar time, the knowledgeable expects the S&P 500 to drop to 4,700. She opined that the stock market is heading in the direction of a foul summer season, which is why she expects a decrease low on the SPX however a “pristine” Bitcoin.

Associated Studying

Principally, Miya expects the Bitcoin value to learn from any potential downtrend within the inventory market, with traders viewing it as a flight to security. She remarked that the market is heading in the direction of a horrible macro state of affairs, which might trigger shares to crash. These predictions got here because the knowledgeable commented on the 9 consecutive inexperienced days that shares have loved and why she believes it received’t final lengthy.

The market commentator famous that Donald Trump has made three foremost guarantees to the market: decrease charges, tariffs, and taxes. These guarantees are anticipated to be stored, and she or he claims that the market is pricing them in as a certain factor. Merchants are at the moment betting on a price lower in June, whereas the US and China are set to satisfy to agree on a decrease tariff. Decrease taxes might come following a profitable tariff coverage.

Because of this, the inventory market has been on a nine-day-long uptrend, whereas retail merchants have made income by shopping for the dip. Nevertheless, Miya has warned that the market isn’t as robust because it appears and will quickly blow up, with the Bitcoin value benefiting when this projected crash occurs.

Why The Inventory Market Is Certain To Crash

The knowledgeable famous that this false thought of up-only offers retail investors the phantasm of complacency, as they do proper now with their $57 billion bid on prime of retail collected shares. Nevertheless, she remarked that ultimately, this may unfold with the “containership recession commerce” hitting the US in 5 days. BTC is anticipated to be a hedge in opposition to this macro state of affairs, which might result in a Bitcoin value surge.

Associated Studying

Miya defined that each one the ‘Magnificent 7’ earnings within the final season have been massively skewed and had been “ineffective data,” that means they can’t be relied on to point out a robust market. She added that TMT corporations that manufacture bodily {hardware} normally manufacture in waves, so the precise impacts will present up of their H2 capex over Q1 outcomes, that means the impression of tariffs hasn’t precisely began kicking in.

On the time of writing, the Bitcoin value is buying and selling at round $96,500, up over 2% within the final 24 hours, in line with data from CoinMarketCap.

Featured picture from Pixabay, chart from Tradingview.com

[ad_2]

Source link