[ad_1]

- The crypto market confirmed resilience, anticipating long-term features from Trump’s commerce struggle.

- Bitcoin holds sturdy as pro-crypto sentiment builds in Washington.

Following the extremely anticipated “Liberation Day” tariffs, the cryptocurrency market has skilled notable volatility, pushed by geopolitical developments and regulatory actions.

Because the dominant asset by market capitalization, Bitcoin [BTC] continues to set the tone for broader crypto market sentiment.

Buying and selling at $84,121 at press time, BTC registered a modest 0.65% enhance from the earlier shut.

Regardless of considerations over a possible “market-wide” correction, the anticipated sell-off didn’t materialize. In consequence, the market stays within the inexperienced, sustaining its upward trajectory.

What occurred in crypto immediately?

Let’s take a step again to investigate the aftermath of the commerce struggle. The Volatility Index (VIX) spiked to an eight-month excessive, reflecting a surge in market uncertainty and threat urge for food.

All three main U.S. inventory indices noticed large sell-offs, erasing trillions in market capitalization, with the Magnificent Seven stocks trading 34% under their respective all-time highs.

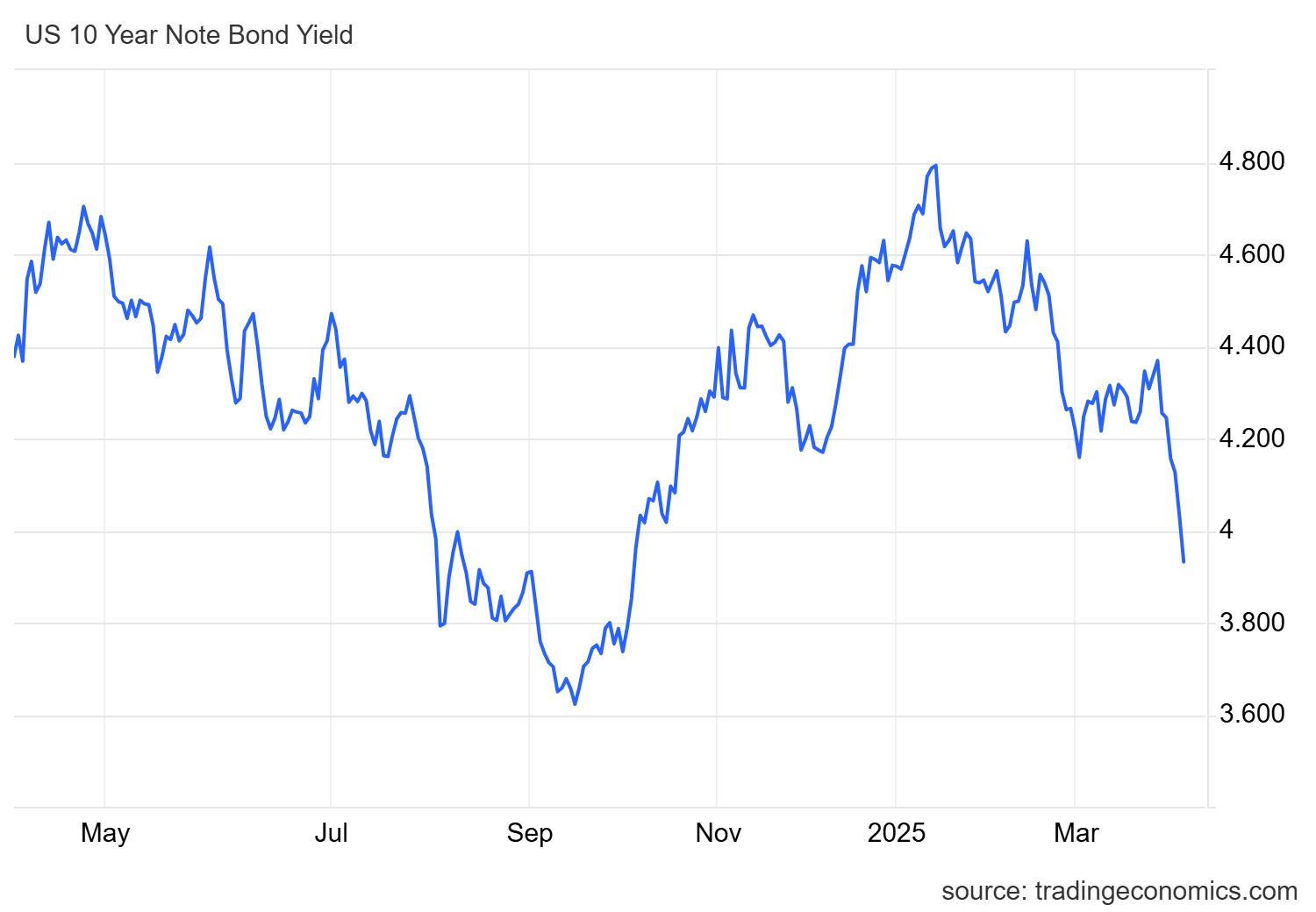

In the meantime, the 10-year Treasury yield (the rate of interest the U.S. authorities pays to borrow cash) retraced to pre-election ranges, dropping by -90 foundation factors (bps).

Usually, when yields fall, traders usually transfer cash into secure belongings like Treasury bonds, anticipating slower financial progress in Q2.

In response, market individuals shortly priced in a 20% probability of three charge cuts in 2025, up from earlier expectations of two.

Why? Analysts speculate that U.S. mixture demand might sluggish as the consequences of the tariffs take maintain, which might immediate the Federal Reserve to chop charges. This might enable extra low-cost capital to movement into the market.

Within the crypto market, traders clearly recognized long-term worth, significantly in Bitcoin, given the shifting financial panorama. Not like equities, cryptocurrencies confirmed resilience.

Bitcoin dominance noticed a 0.30% uptick following the announcement, reflecting a shift in investor sentiment and a flight to “digital belongings” in its place retailer of worth.

Crypto market optimism amid regulatory shift

The U.S. Senate Banking Committee has accredited Paul Atkins as the following SEC Chair in a 13-11 vote, setting the stage for a significant shift in crypto regulation.

Known for his pro-market approach, Atkins is anticipated to steer the SEC away from strict enforcement and towards clearer, industry-friendly insurance policies. This shift has strengthened long-term investor confidence in crypto markets.

Bitcoin stays above $80k, main altcoins are holding vital help ranges, and the excessive chance of Federal Reserve quantitative easing — mixed with a regulatory shift on the SEC — has allowed crypto markets to soak up latest macro volatility.

Ought to these situations persist, threat urge for food might enhance, setting the stage for stronger institutional inflows and a possible market-wide rally within the coming quarters.

[ad_2]

Source link