[ad_1]

Bitcoin has extended its consolidation below $100,000 for the reason that starting of February. This worth lag has been compounded by a slowdown in bullish sentiment amongst buyers and a slowing euphoria relating to the crypto-positive influences of Trump’s new administration within the US.

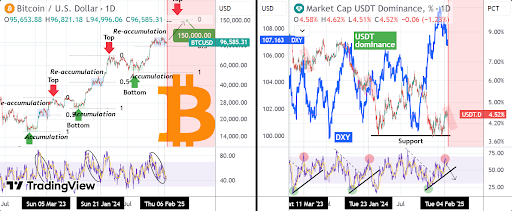

Regardless of this rally slowdown, technical evaluation continues to help a bullish long-term outlook for Bitcoin. The present stagnation seems to be a re-accumulation part for bullish buyers; a sample noticed a number of instances earlier than main upward strikes this cycle. Moreover, evaluation exhibits that the USDT dominance goes to play an important position in triggering the subsequent Bitcoin rally towards $150,000.

Bitcoin’s Re-Accumulation Section And The Position Of USDT Dominance

In accordance with a technical analyst (TradingShot) on the TradingView platform, Bitcoin is at present exhibiting an fascinating accumulation development alongside the USDT dominance. The USDT dominance displays the proportion of the full crypto market capitalization in USDT, indicating whether or not merchants favor stablecoins over riskier crypto belongings. A excessive USDT dominance usually indicators low shopping for stress in cryptocurrencies. Conversely, a declining USDT dominance usually means that merchants are rotating funds again into Bitcoin and different cryptocurrencies.

Associated Studying

Curiously, the USDT dominance has had an important simultaneous prevalence with Bitcoin’s preparations for rallies this cycle. Two notable re-accumulation durations have occurred after Bitcoin bottomed in November 2022, with every resulting in important worth rallies. The primary accumulation interval spanned from January 2023 to March 2023, whereas the second occurred between November 2023 and February 2024. Each of those re-accumulation phases came about on the 0.5 Fibonacci extension degree from an earlier accumulation part. Moreover, these phases shared frequent traits, together with a peaking 1-day RSI construction within the USDT dominance chart and a pullback within the Greenback Index (DXY).

Now, Bitcoin seems to be mirroring the same conditions once more, with USDT dominance and the DXY pulling again with the present re-accumulation part, which has been enjoying out since December 2024. If the sample continues to unfold as expected, this might point out that Bitcoin is on the verge of its subsequent main rally.

USDT To Ship BTC To $150,000

If Bitcoin follows the sample noticed in earlier rallies this cycle with the USDT dominance to the core, the re-accumulation part might finish within the next one or two weeks and finally trigger one other rally to new all-time highs.

Associated Studying

When it comes to a goal, the analyst famous a possible $150,000 goal for the Bitcoin worth, a minimum of earlier than one other main correction and a subsequent accumulation part. Nevertheless, Bitcoin should overcome key resistance levels, notably the psychological $100,000 mark, which has served as a significant hurdle in latest weeks.

On the time of writing, Bitcoin is buying and selling at $97,175, up by 1.6% prior to now 24 hours. A transfer to $150,000 will symbolize a 54% improve from the present worth.

Featured picture from Pexels, chart from Tradingview.com

[ad_2]

Source link