[ad_1]

Cause to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business consultants and meticulously reviewed

The very best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

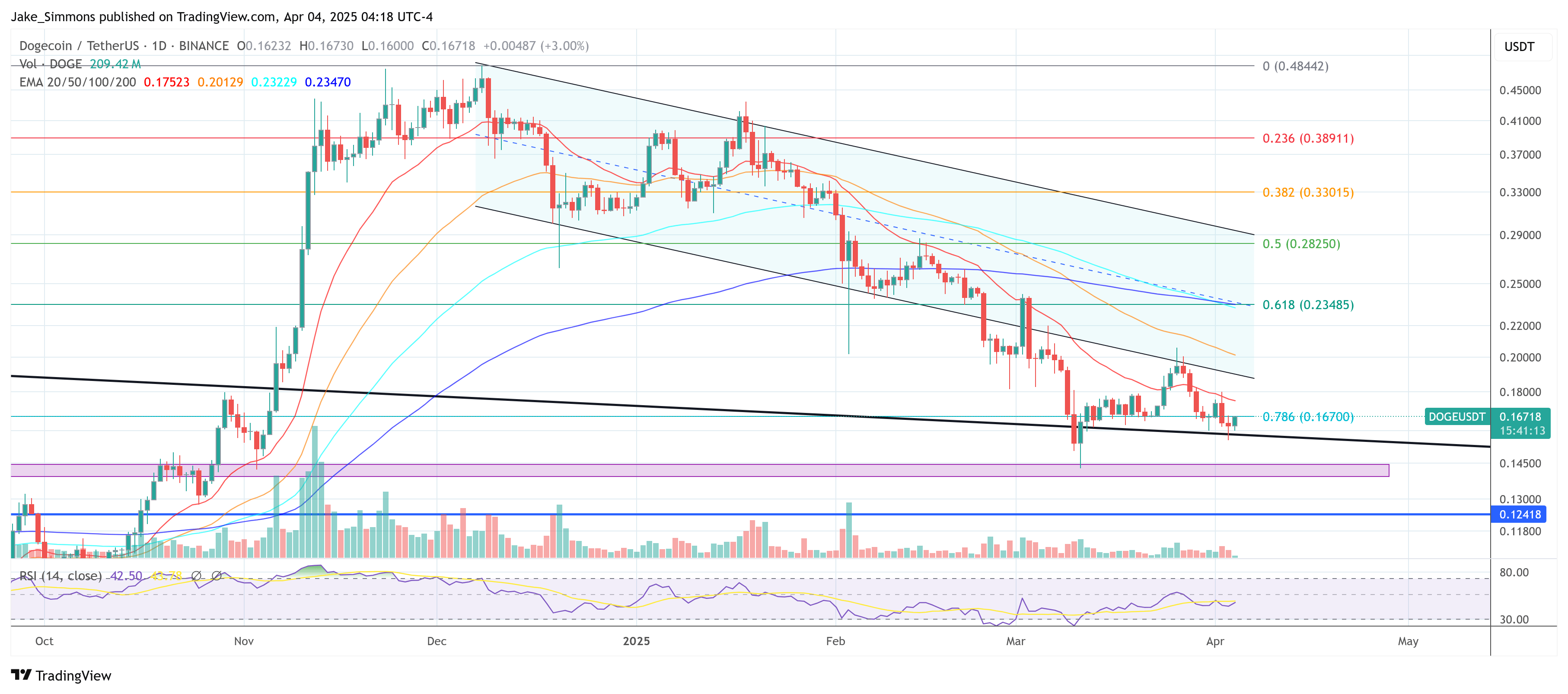

Dogecoin is as soon as once more within the scorching seat because the meme coin exams a multi-year development line that dates again to the heady days of 2021. Each the every day and weekly charts underscore the importance of this zone, with the market hovering dangerously close to a juncture that might decide whether or not the present worth collapses by one other quarter or phases a dramatic rebound.

Dogecoin May Plunge Additional

On the weekly chart, the development line slants downward from the traditionally elevated ranges close to final cycle’s high and converges with the 0.786 Fibonacci retracement at round $0.167. Thus, Dogecoin finds itself on shaky floor because it slipped under the 0.786 Fibonacci stage at $0.167 but nonetheless clings to the multi-year trend line, which at the moment hovers round $0.157.

DOGE’s capacity to remain above the road might determine whether or not the market can keep away from a renewed sell-off that might erase 1 / 4 of its present worth. Notably, DOGE is already down about 66% from its December peak above $0.48 final yr, revealing simply how tightly the bulls want to carry the road to keep away from one other wave of promoting strain.

Associated Studying

Zooming in on the every day time-frame, the story turns into clearer. After Dogecoin dropped out of a downtrend channel on February 24, it made an try to combat its method again inside on March 2 and three, solely to be swiftly pushed under the channel ground once more. Subsequent rejections on March 6 and March 26 alongside the decrease boundary verify that the bears have little intention of giving DOGE a simple path again above. This persistent refusal is accompanied by waning quantity, indicating that consumers have had problem mustering the momentum required to reclaim a foothold contained in the channel.

The weekly EMAs are unfold above the value, notably with key strains sitting properly above $0.16, whereas the every day EMAs have changed into near-term ceilings that Dogecoin has repeatedly didn’t surmount in latest periods.

Associated Studying

Ought to DOGE fall under the multi-year development line, it may take a look at once more the assist zone simply round $0.14 like on March 10 and 11—delineated in crimson on the chart. If DOGE fails to defend the development line and slides under the $0.14 mark, the following main pivot comes at $0.12, symbolized by the distinguished blue line. A retreat that far would quantity to an additional 25% drop from present worth ranges, doubtlessly deepening bearish sentiment properly into the second quarter.

All eyes are actually locked on the interaction between worth and the decades-long slope that has served as each a magnet and buffer throughout a number of market cycles. Ought to consumers step in firmly on the intersection of the multi-year line and the 0.786 Fibonacci stage, the following problem can be to recapture the decrease boundary of the descending channel—one thing Dogecoin has didn’t do regardless of repeated exams. Alternatively, a decisive break under $0.14 would elevate the chances of a capitulation all the way down to $0.12 or doubtlessly decrease.

For now, it seems Dogecoin’s destiny hinges on whether or not this lengthy standing structural assist can climate the storm. If it does, the battered meme coin might but script a comeback. If not, the market might face a freefall that rekindles reminiscences of essentially the most risky chapters in its historical past.

Featured picture created with DALL.E, chart from TradingView.com

[ad_2]

Source link