[ad_1]

Coinspeaker

XRP at Critical Juncture: Will Bulls Take Charge to Hit $2.83?

With Bitcoin

BTC

$95 981

24h volatility:

1.3%

Market cap:

$1.90 T

Vol. 24h:

$40.83 B

and Ethereum

ETH

$2 695

24h volatility:

2.6%

Market cap:

$324.72 B

Vol. 24h:

$30.01 B

progressively stabilizing at decrease ranges for a possible comeback, XRP

XRP

$2.30

24h volatility:

5.2%

Market cap:

$132.58 B

Vol. 24h:

$6.46 B

positions itself at a crucial degree. Buying and selling between the $2.50 cyclical mark, XRP faces a pullback of two.06% over the previous 24 hours.

Moreover, over the previous 7 days, it has dropped practically 22%, declining its market cap to $140 billion. However, it nonetheless stays the fourth largest cryptocurrency available in the market.

Nevertheless, the rising speculations within the derivatives market would possibly lengthen its correction section. The promoting strain stays dominant, limiting any vital bullish breakout.

Rising Funding Price Displays Sentimental Shift

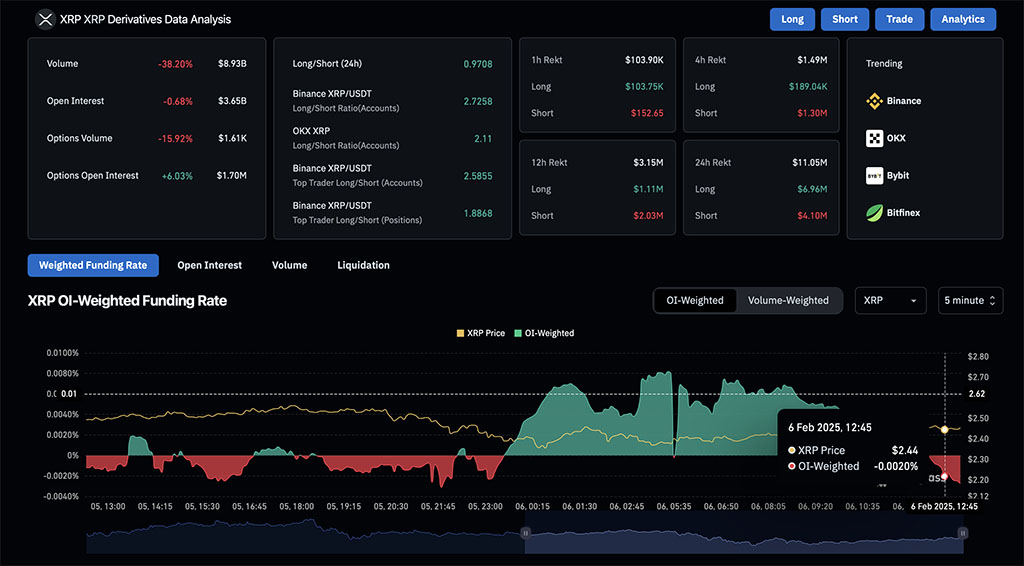

Regardless of an open curiosity of $3.65 billion, XRP witnesses a barely higher variety of promoting positions. It’s because the long-to-short ratio over the previous 24 hours stays at 0.9708, whereas the bulls wrestle to equalize the taking part in subject.

The funding charge is on the verge of coming into constructive territory. Over the previous few hours, the XRP funding charge has considerably improved from the latest dip of minus 0.0077% to reaching 0.0004%.

This shift signifies a rising optimism amongst merchants, suggesting potential worth stabilization. If the funding charge continues to enhance, it might help an uptrend.

Therefore, regardless of the minor drop in open curiosity and unequal long-to-short ratio, favorably on the bearish facet, the bullish speculations are bettering the funding charge. This displays the broader market anticipating XRP to begin a constructive pattern.

Declining Alternate Reserves to Enhance XRP Demand

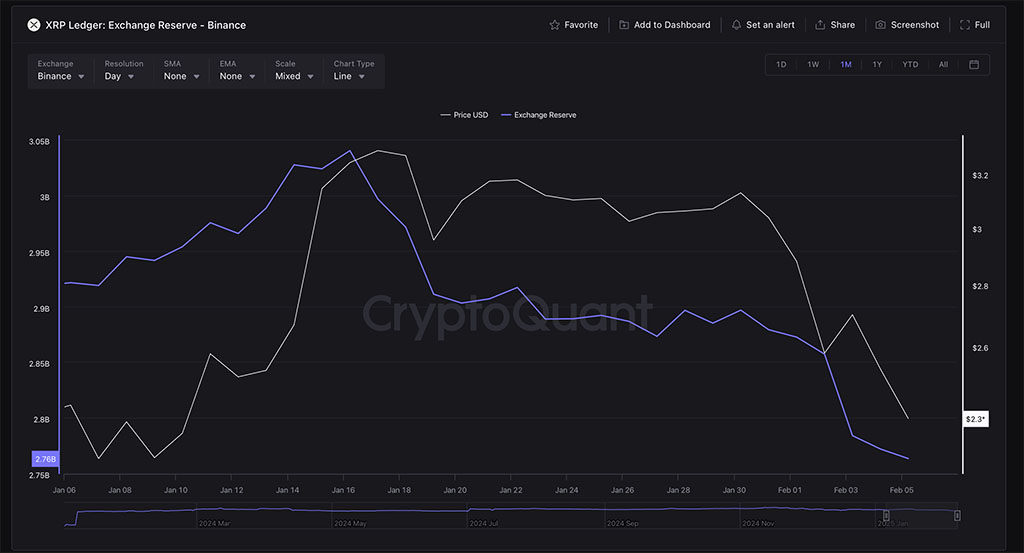

Together with the bullish expectations within the derivatives subject, the XRP ledger Alternate Reserve, which has been in a declining pattern since January 16, has dropped from 3.04 billion XRP to 2.76 billion XRP. This accounts for a large X p.c drop within the Binance Alternate Reserve.

A reducing alternate reserve usually alerts accumulation, hinting at diminished promoting strain. If this pattern continues, a worth rebound may very well be imminent.

Therefore, with the numerous outflow of XRP from the world’s largest centralized cryptocurrency alternate, the discount in provide is more likely to artificially bounce again in XRP costs.

XRP Value Evaluation

Within the every day chart, the XRP worth pattern reveals two consecutive bearish candles, prolonging the downfall to $2.38. Nevertheless, with the intraday restoration of two.70%, XRP is again at a market worth of $2.44, because it sustains a dominance above the S1 help pivot degree at $2.27.

The possibilities of a bullish continuation stay vital. Moreover, the altcoin takes help from the 100-day EMA, regardless of breaking beneath the 50-day EMA line.

Because the speculations within the derivatives market and the recovering and potential demand surge from the exchanges, XRP is more likely to problem the S1 pivot degree at $2.83. On the flip facet, closing beneath $2.2781 will seemingly take a look at the $2 psychological mark.

XRP at Critical Juncture: Will Bulls Take Charge to Hit $2.83?

[ad_2]

Source link