Why Is Crypto Up Today? – January 27, 2026

The crypto market is up today – but just barely. The cryptocurrency market capitalisation is up by just 0.1% over the past 24 hours by the time of writing, meaning it’s largely unchanged. It still stands at $3.05 trillion, the same as yesterday. Also, 77 of the top 100 coins posted price increases. Moreover, the total crypto trading volume stands at $113 billion.

TLDR:

Crypto Winners & Losers

On Tuesday morning (UTC), we find 7 of the top 10 coins per market capitalisation up and three down (not taking stablecoins into consideration).

Bitcoin (BTC) fell by 0.1%, currently trading at $87,702. It, too, like the market in general, is unchanged in a day.

Ethereum (ETH) appreciated just 0.3%, changing hands at $2,901.

The highest fall among the top 10 is 0.3% by Tron (TRX), now trading at $0.2942.

At the same time, Solana (SOL)’s 1% is the category’s highest increase. It currently stands at $123.

It’s followed by Binance Coin (BNB)’s 0.6%, now trading at $876.

Furthermore, of the top 100 coins per market cap, 77 have posted price increases today.

Pump.fun (PUMP) leads this list with a 24.7% rise to $0.003134.

Next up is Hyperliquid (HYPE)’s 22.6% to the price od $27.28.

Provenance Blockchain (HASH) is the only other double-digit increase, rising 19.3% to $0.02739.

Of the red coins, River (RIVER)stands at the top, having plunged by 32.6%, reverting nearly all yesterday’s gains. It now stands at $58.14.

The rest are down 5% and less per coin.

Investors across markets await a fresh batch of tech earnings reports coming from the US, as well as the decision by the US Federal Reserve on interest rates. It remains to be seen how – if at all – these will affect the crypto market specifically.

Meanwhile, Fundstrat managing partner Tom Lee argued crypto fundamentals remain intact despite recent underperformance and that BTC and ETH could surge when the gold and silver rally begins to cool.

BTC’s Psychological Battleground

Petr Kozyakov, co-founder and CEO at Mercuryo, commented that BTC “stands precariously” at about $87,000. It currently “continues to teeter in the grip of bearish sentiment.” As the week began, it fell to the $86,100 level in “frenetic Asian trading.”

Moreover, markets are in risk-off mode as gold and silver surge. This shows that investors are “rushing to traditional safe-haven assets amid increasing levels of geopolitical risk.”

Additionally, both retail and institutional crypto investors remain on the defensive, Kozyakov added. Retail-driven sectors and institutional participation have retreated.

Meanwhile, Jimmy Xue, co-founder and COO of Axis, argued that Bitcoin’s $90,000 pause is a “macro repricing, not a demand breakdown.”

More precisely, the current pause is a macro-driven repricing of the discount rate, Xue says, as “the market’s hope for an aggressive 2026 easing cycle has significantly cooled.”

The spot ETF inflows remain a resilient floor, he says. But they are currently acting as a “passive wall” and not an active engine of price discovery.

Per Xue, “the $90,000 level has become a psychological battleground where macro traders are taking profits to hedge against a restrictive Fed, even as long-term institutional accumulators continue to buy the dips.”

He concludes: “A signal of Fed ‘patience’ this week effectively removes the immediate liquidity injection the market was front-running, leading to a period of ‘tense calm.’ In an environment already shaped by geopolitical friction and trade uncertainty, this lack of fresh capital typically triggers ‘volatility by headline,’ where thin order books lead to sharper, news-driven price swings. Without a dovish pivot, expect liquidity to remain defensive and concentrated in the most established assets.”

Levels & Events to Watch Next

At the time of writing on Tuesday morning, BTC was changing hands at $87,702. It’s been a choppy trading day, especially in the first half, with the price falling to the low of $87,180 twice. It very briefly hit the intraday high of $88,763.

BTC fell 3.8% over the past seven days, trading in the $86,319-$91,178 range.

The $90,500-$91,200 zone now acts as resistance, having previously served as a support area. If BTC falls below $86,400, it could move to $84,400. But a move above that level would open doors to $89,500, $90,500, $93,300, and $95,500.

At the same time, Ethereum was trading at $2,901. It surged from the intraday low of $2,879 to the intraday high of $2,948, and it swiftly dropped from that level.

Over the past week, ETH is 6.4% in the red, moving between $2,801 and $3,108.

A move above $2,950 could allow the coin to move back above $3,000, followed by $3,070 and $3,120. Another stable rally would take it to $3,200 and $3,330. Yet, another drop would clear a path to the $2,750-$2,850 area, and subsequently $2,600.

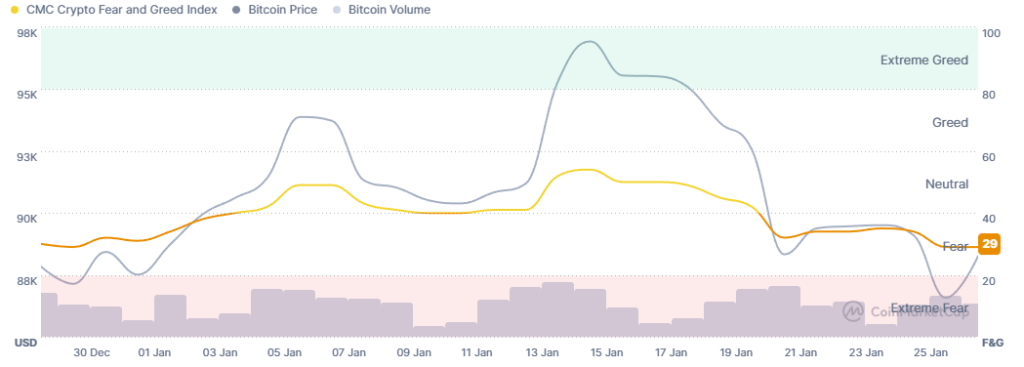

Meanwhile, the crypto market sentiment remained unmoved over the past day, holding firmly within the fear zone.

The crypto fear and greed index stands at 29 at the time of writing, the same level as yesterday.

While the level may continue dropping in the short-term, it – like the market in general – awaits further signals, be they internal or external.

ETFs Break The Red Streak

The US BTC spot exchange-traded funds (ETFs) started the week in green, breaking a five-day outflow streak. They added $6.84 million, with the total net inflow now standing at $56.5 billion.

Of the twelve ETFs, three saw inflows, and three posted outflows. BlackRock took in $15.93 million, followed by Grayscale’s $7.75 million and WisdomTree’s $2.79 million.

On the red side, Bitwise recorded $10.79 million in outflows, followed by Fidelity’s $5.83 million and Ark & 21Shares’ $2.91 million.

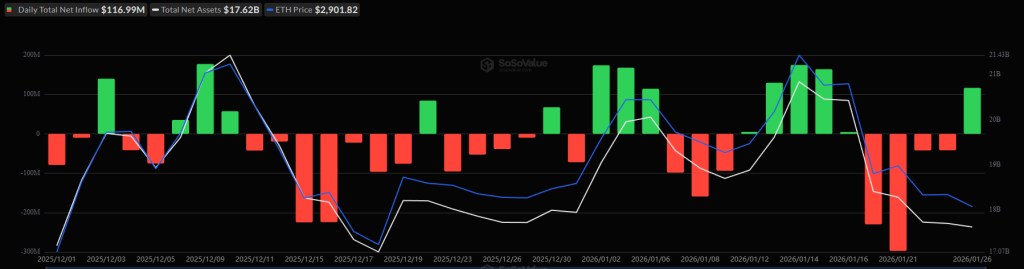

Moreover, the US ETH ETFs outperformed their BTC counterparts on Monday, posting inflows of $116.99 million. With this, they also broke a four-day red streak. The total net inflow climbed slightly to $12.42 billion.

Of the nine ETH ETFs, one saw outflows, and one saw inflows. BlackRock recorded $20.25 million in outflows.

However, at the same time, Fidelity took in $137.24 million, turning the day’s tides green.

Meanwhile, Michael Saylor’s Strategy reported another addition to its Bitcoin treasury. The company bought 2,932 BTC for approximately $264.1 million between 20 January and 25 January.

With the latest acquisition, Strategy now holds a total of 712,647 BTC, spending roughly $54.19 billion.

Moreover, BlackRock applied to the US Securities and Exchange Commission (SEC) to launch the iShares Bitcoin Premium Income ETF.

Unlike products that track Bitcoin’s price, this type of ETF combines price exposure with a covered call strategy to generate regular income.

Quick FAQ

- Did crypto move with stocks today?

After several red days, the crypto market has posted a minor increase over the past 24 hours. Meanwhile, the US stock market started the week green. By the closing time on Monday, 26 January, the S&P 500 was up 0.5%, the Nasdaq-100 increased by 0.42%, and the Dow Jones Industrial Average rose by 0.64%. This comes ahead of a fresh batch of tech earnings reports, as well as the US Federal Reserve’s interest rate decision.

- Is this rally sustainable?

Minor shifts in prices are normal and expected. However, the basis for the current increase is shaky and may not hold for long. We are likely to see additional pullbacks in the near-term. That said, incoming macro movements could push the prices higher.

Trending News

RecommendedPopular Crypto TopicsPrice Predictions