Memecoins Wiped Out As 11.6 Million Tokens Fail In Brutal Year: Research

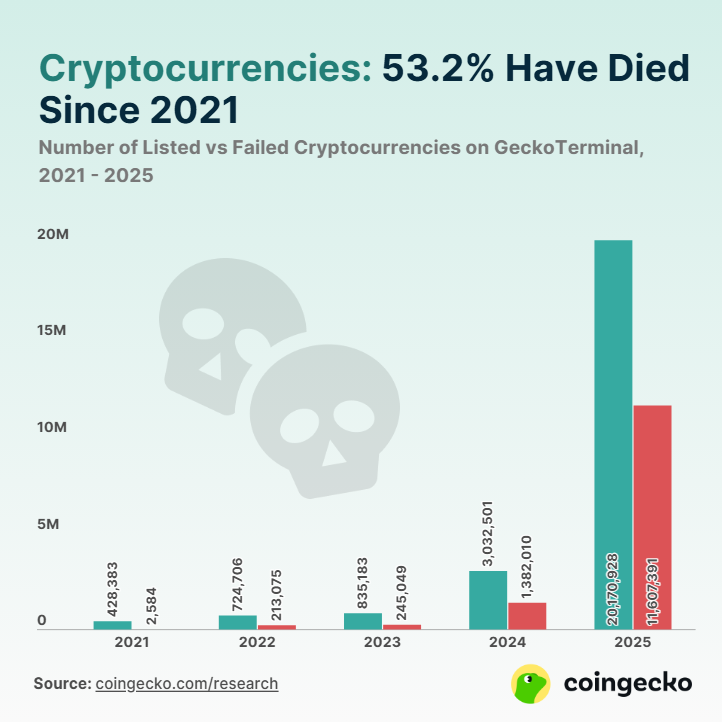

Memecoins were hammered last year, and the fallout was huge. According to CoinGecko research, about 11.6 million tokens stopped trading or became inactive in 2025. That number dwarfs previous years and has left investors and market watchers sorting through losses and broken projects.

Memecoin Failures Spike After Major Sell-Off

Based on reports from CoinGecko, roughly 7.7 million token failures happened in the fourth quarter of 2025. That quarter accounted for most of the total, driven by a sharp market move on October 10, 2025, when reports show more than $19 billion in crypto liquidations occurred in a single day.

Small tokens with little liquidity were hit the hardest. Many of those lists of dead tokens were dominated by memecoins and low-effort projects that rarely had active development or real trading depth.

A Flood Of New Tokens Met Weak Demand

Launch tools made it easy to create tokens, and that contributed to the problem. Reports note that platforms which simplified token creation led to a surge in new, cheaply issued coins. When market conditions turned, many of those coins had no buyers left.

In contrast, mainstream tokens with deeper pools of trading and clearer use cases were more likely to survive the shock. CoinGecko compared the scale: around 1.3 million tokens failed in all of 2024, showing how dramatic last year’s collapse was.

What This Means For Traders And Exchanges

Trading activity fell for countless small tokens. Volume dried up fast for poorly backed projects, and price swings became more extreme. Some exchanges and data sites had to update lists and delist tokens that no longer met minimum activity rules. The memecoin sector’s share of speculative trading fell sharply as risk appetite faded and traders moved into assets with more liquidity.

Image: Altorise

Regulatory And Market Watchers React

Calls for better oversight of token listings grew louder. Some market analysts said exchanges should tighten listing standards and that clearer labels for experimental tokens could help retail buyers avoid traps. Others warned that stricter rules might slow innovation. For now, updates from research platforms are being used to map which tokens vanished and why they failed.

Market Sentiment Remains Fragile

Investors are picking through the wreckage, looking for lessons. A number of small projects were abandoned by teams, and a long list of inactive tokens now serves as a warning to traders chasing hype. Based on CoinGecko’s data, the scale of failures in 2025 is unparalleled in recent years, and it signals that, without buyers and liquidity, newly minted coins can disappear quickly.

Featured image from Phantom, chart from TradingView

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.